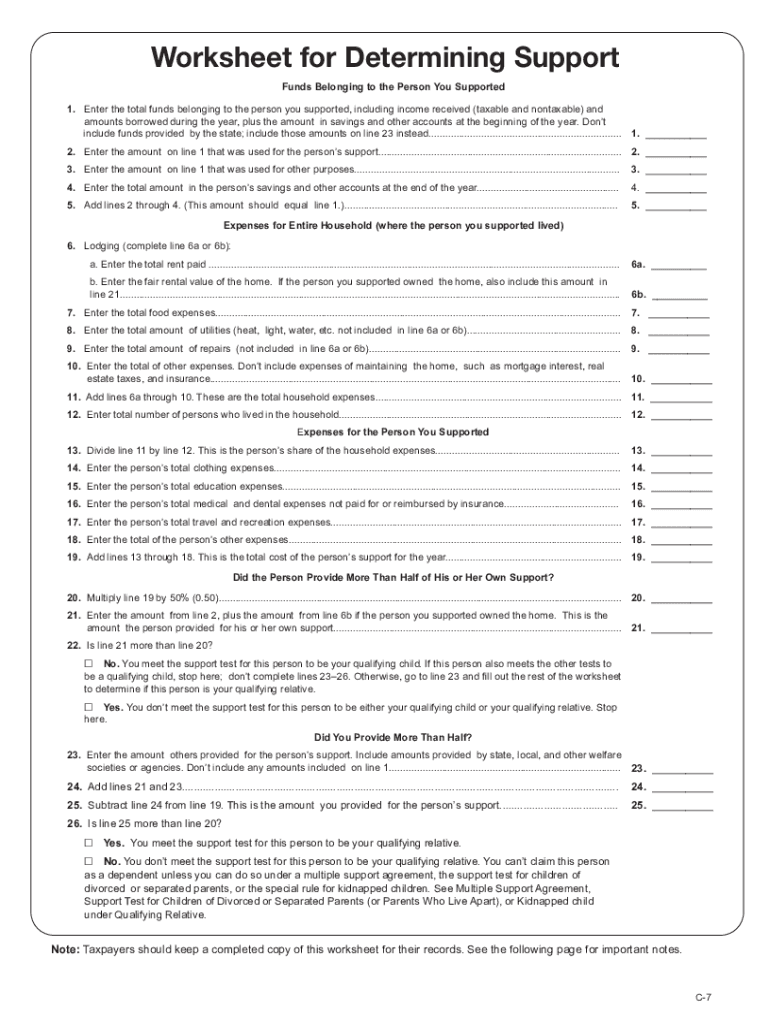

Irs Worksheet For Determining Support Enter the total funds belonging to the person you supported including income received taxable and nontaxable and amounts borrowed during

Use the support test with four other tests to see whether you can claim another person as your dependent on your Form 1040 or Form 1040A U S Individual This brochure contains general information for taxpayers and should not be relied upon as the only source of authority Taxpayers should seek professional tax

Irs Worksheet For Determining Support

Irs Worksheet For Determining Support

x-raw-image:///a515a6f825a3d809a6d226ef989d78252e4db3250cfe7ca3560f2e0de6655979

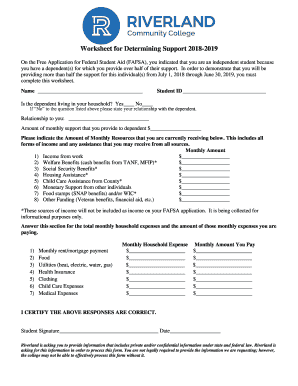

Sheet1 A B C D E 1 2 Name 3 4 Worksheet for Determining Support 5 6 1 Enter the total funds belonging to the person you supported including

Pre-crafted templates use a time-saving option for creating a varied variety of documents and files. These pre-designed formats and layouts can be utilized for various individual and professional projects, consisting of resumes, invitations, leaflets, newsletters, reports, discussions, and more, enhancing the material production process.

Irs Worksheet For Determining Support

Worksheet for determining support excel: Fill out & sign online | DocHub

TaxprepSmart: Example – Using Worksheet for Determining Support

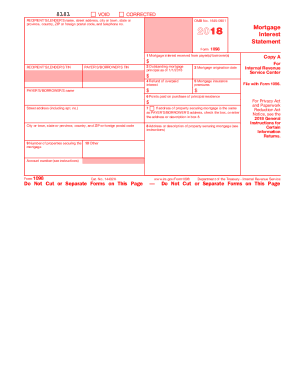

1040 (2022) | Internal Revenue Service

1040 (2022) | Internal Revenue Service

8.17.5 Special Computation Formats, Forms and Worksheets | Internal Revenue Service

Worksheet for determining support excel: Fill out & sign online | DocHub

https://www.ctcresources.com/uploads/3/1/6/2/31622795/worksheet_for_determining_support.pdf

Step 1 of the worksheet identifies the dependent s income used for support as a subtotal of their total income Not all of their income is to be counted for

https://dbm.maryland.gov/benefits/Documents/HBForms/irs_worksheet_to_determine_support.pdf

Enter the total funds belonging to the person you supported including income received taxable and nontaxable and amounts borrowed during the year plus the

https://www.irs.gov/publications/p501

Exception Worksheet 2 Worksheet for Determining Support Qualifying Child of More Than One Person Tiebreaker rules Applying the tiebreaker rules to

https://apps.irs.gov/app/vita/content/globalmedia/teacher/06_dependencyexemptions_lesplan.pdf

Worksheet for Determining Support Internet Form 2120 Multiple Support Declaration Page 4 Dependents page 4 Discuss a multiple support situation and

http://www.a-ccpa.com/content/taxguide/tools/support_m.php

The worksheet provided may be used to determine whether you meet the support test with respect to a particular individual Generally this requires that you

Calculate Child Support CA Child Support Services Calculating Debt Payoff Personal Exemptions and Dependents IRS gov The child must not have provided Attach a signed copy of your 2015 federal tax return Income from work Interest income Unemployment benefits Gifts provide source of gift

Do not include unearned income for calculating the Earned Income Tax Credit 1e imputed income enter the gross amount of income the parent could earn if