Lihtc Income Calculation Worksheet Use the Household Income Qualification Worksheet section 4 of this workbook to calculate and certify household income 3 Fill out the

INCOME AND ASSET INCOME CALCULATION WORKSHEET Property Name Unit if assigned Applicant Tenant Income Asset Source s Calculation Math Formula Complete a separate worksheet for each income earning household member 18 years of age or older Income must be documented per DPP AHP income calculation

Lihtc Income Calculation Worksheet

Lihtc Income Calculation Worksheet

Lihtc Income Calculation Worksheet

https://www.adventuresincre.com/wp-content/uploads/2020/02/Capture2.jpg

Low Income Housing Tax Credits LIHTC Multifamily Supportive Income Calculation Worksheet October 20 2022 News Notices Partner

Templates are pre-designed files or files that can be used for different functions. They can save effort and time by providing a ready-made format and layout for developing various type of material. Templates can be utilized for personal or professional projects, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

Lihtc Income Calculation Worksheet

Determining Income Eligibility and Rent

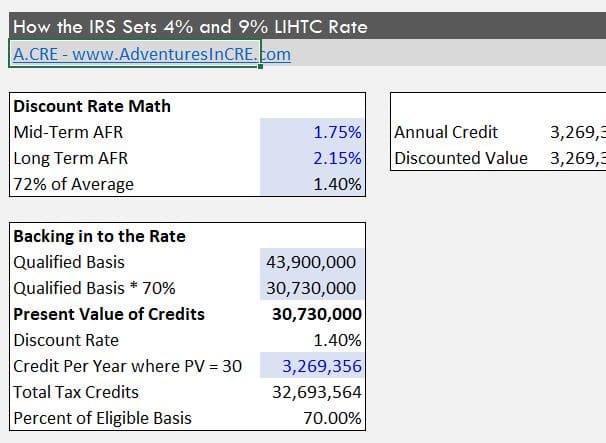

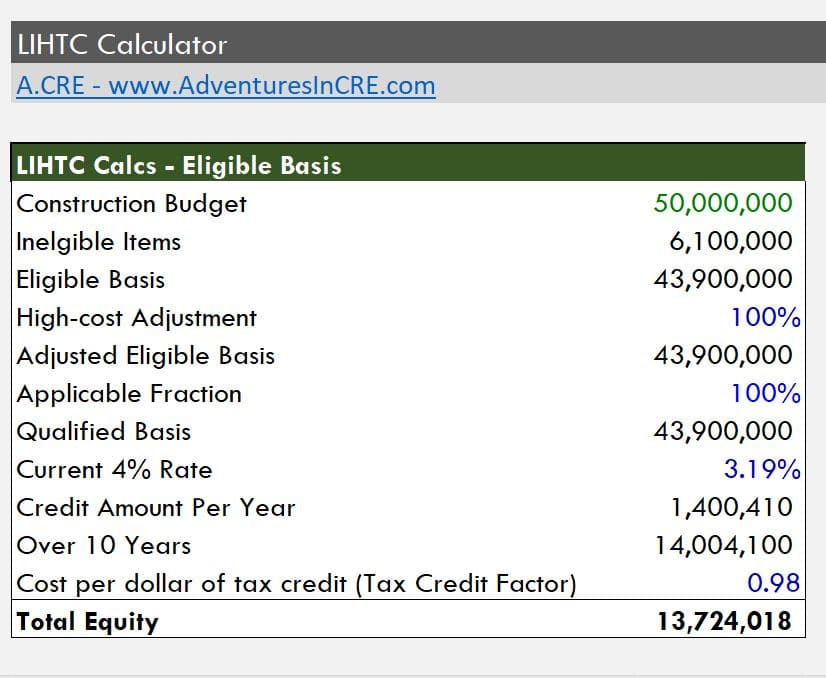

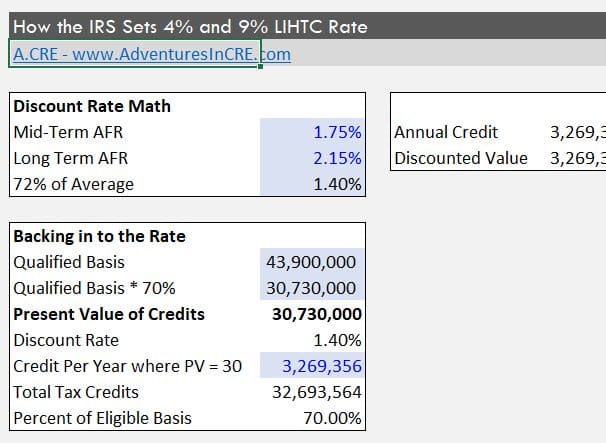

LIHTC Calculator - Adventures in CRE

CPD Income Eligibility Calculator User Manual

LIHTC Compliance Manual

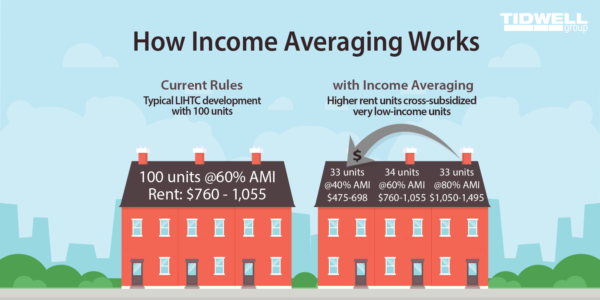

Income Averaging: Handling a Double-edged Sword | Tidwell Group

Implementation of LIHTC Income Averaging

https://www.bostonplans.org/getattachment/ef43933c-f41f-4e65-8575-8a79cac1ef78

Income calculation worksheet is intended for information purposes only Calculation results do not constitute approval for affordable housing

https://files.hudexchange.info/resources/documents/IncomeResidentRentCalc.pdf

For full time students 18 and older only 480 of annual earned income should be included here Periodic payments from Social Security annuities insurance

https://www.youtube.com/watch?v=L1eJj-rhLGY

This is a recording of the LIHTC Income Asset Verifications and Calculations webinar Below

https://www.novoco.com/resource-centers/affordable-housing-tax-credits/rent-income-limit-calculator

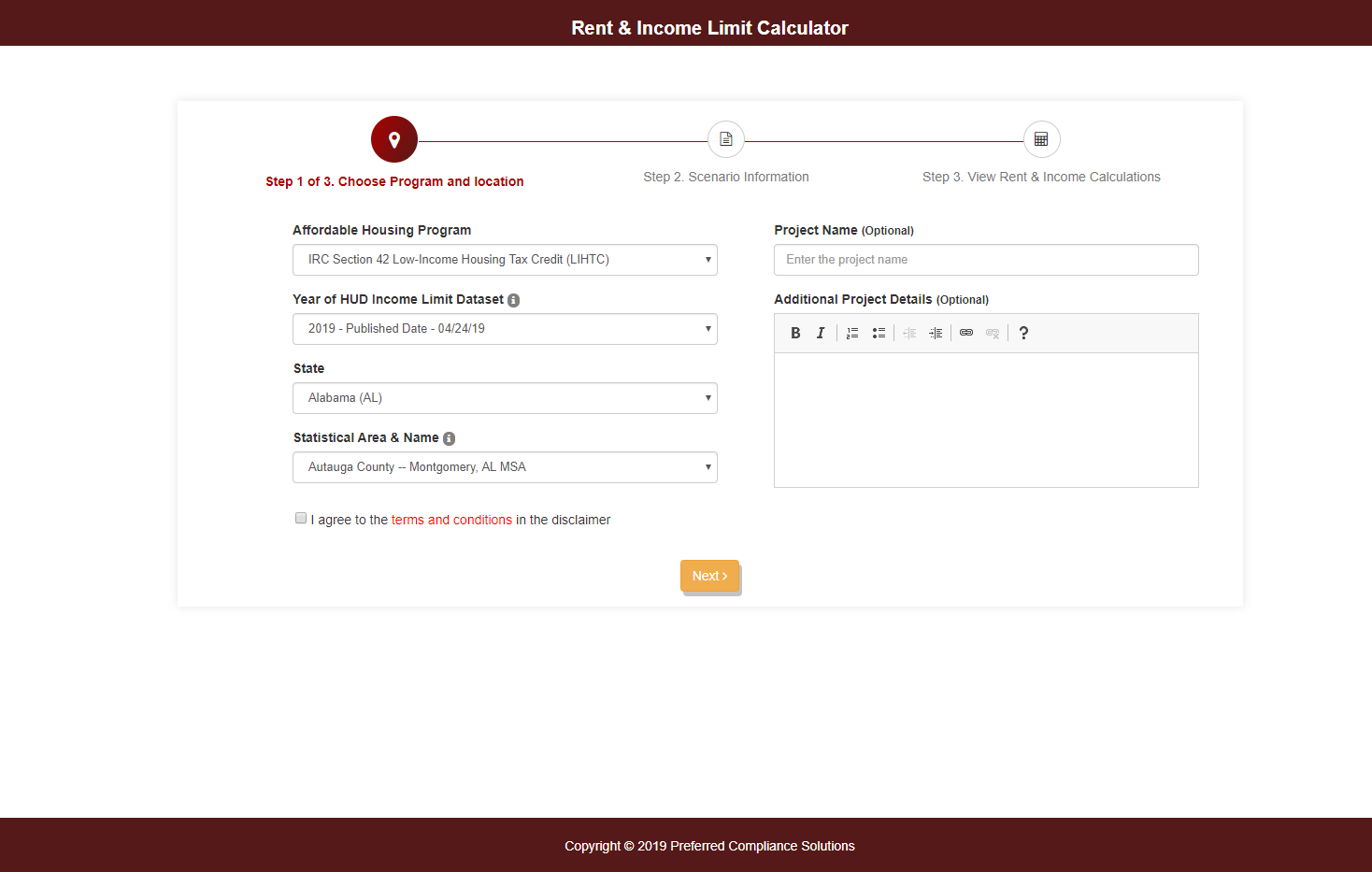

An online tool to calculate IRS Section 42 i 3 A LIHTC rent and income limits for every county and Metropolitan Statistical Area MSA in the United

https://www.hud.gov/sites/documents/DOC_35649.PDF

The amount of assistance paid on behalf of the family is calculated using the family s annual income less allowable deductions HUD program regulations specify

Appendix G Eligibility Determination Worksheets Income Calculation and Certification WorksheetExcel download XLS Tenant Income Calculation and Management Entity must submit the following information 1 Current list of LIHTC properties managed by the agent including type of property

Under the 20 50 test at least 20 of the units in a LIHTC project must be both rent restricted and occupied by tenants whose gross income is 50