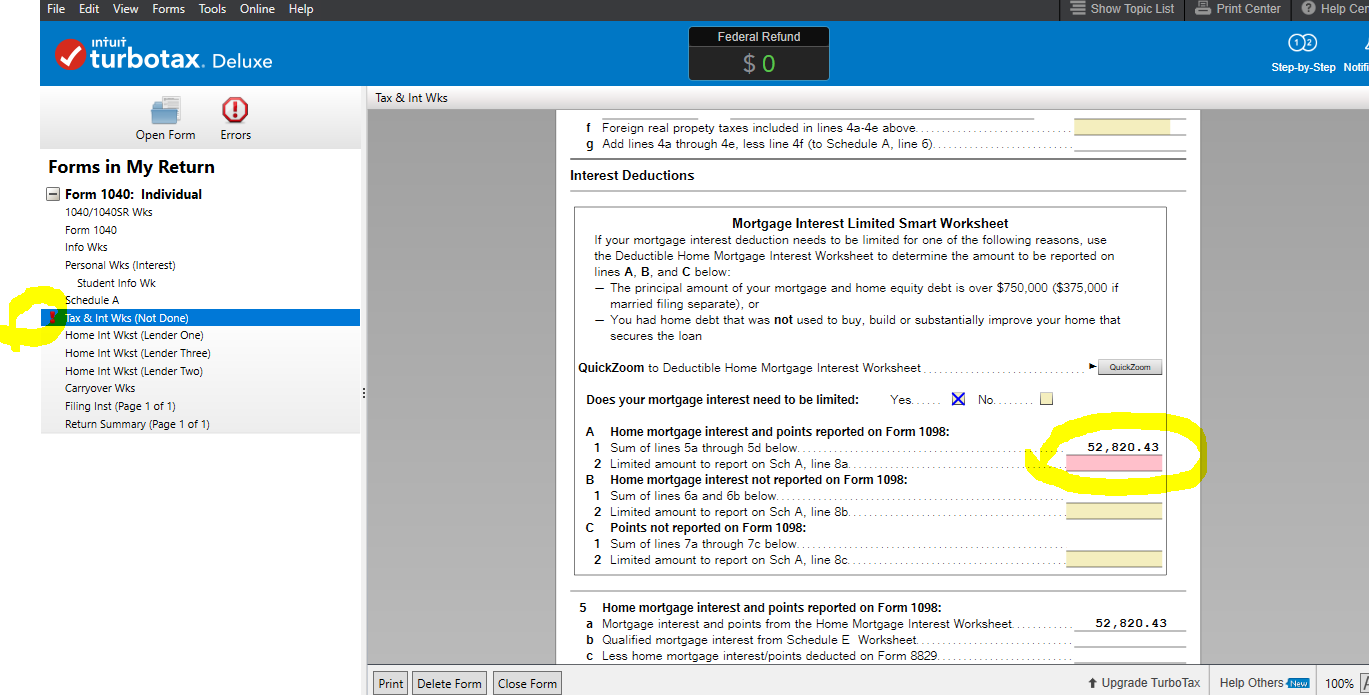

Mortgage Interest Limited Smart Worksheet This tax worksheet computes the taxpayer s qualified mortgage loan limit and the deductible home mortgage interest Example

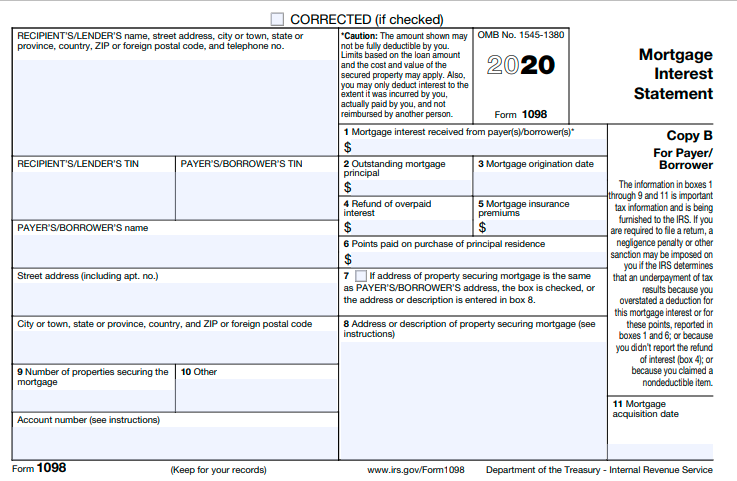

Instructions Complete a worksheet tab for all home secured mortgages to determine the amount of interest paid that is deductible on Deductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16 2017 and 750 000

Mortgage Interest Limited Smart Worksheet

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/2c01c580-64fd-433f-aa61-04afcd910edb.default.PNG

It s true you can deduct the interest you pay each tax year on your individual tax return Learn more about the mortgage interest tax deduction here Who

Templates are pre-designed documents or files that can be used for numerous purposes. They can save time and effort by supplying a ready-made format and design for producing various kinds of material. Templates can be used for individual or professional tasks, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

Mortgage Interest Limited Smart Worksheet

Edit 'Deductible Home Mortgage Interest Worksheet' for CA 540 return

Mortgage Interest Worksheet to determine the amount to be reported on lines A B | Course Hero

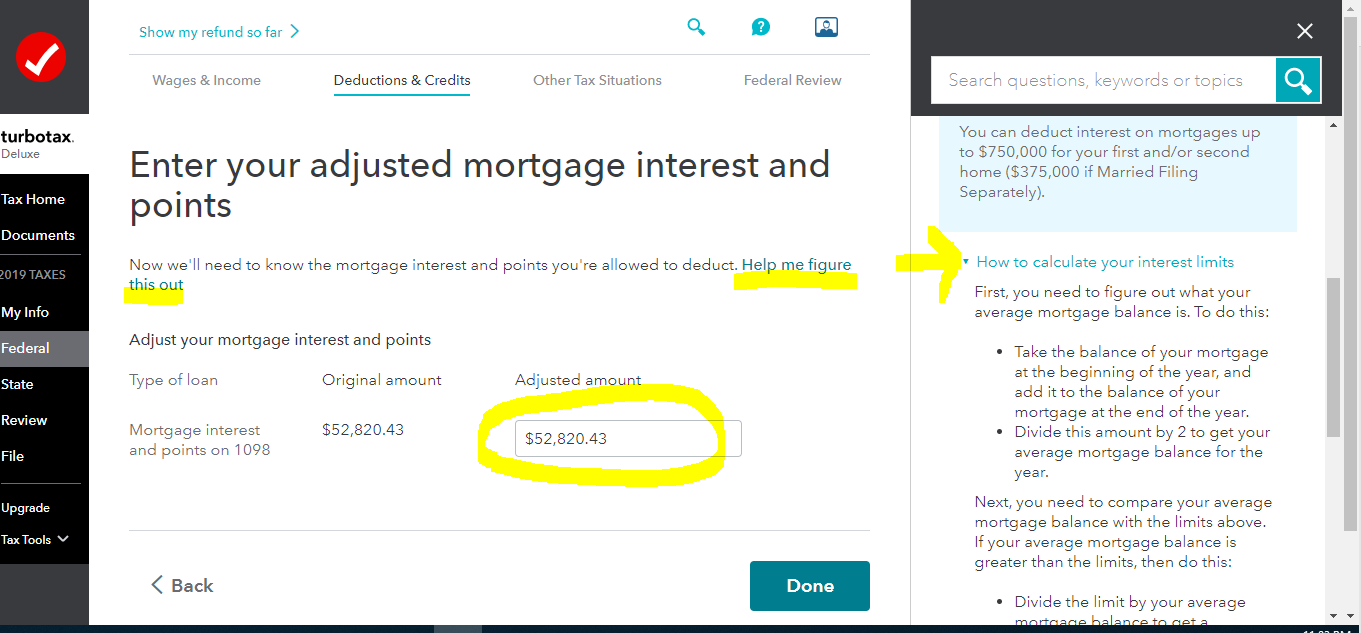

Question about how TurboTax is handling my mortgage interest : r/TurboTax

Publication 936, Home Mortgage Interest Deduction; Part II. Limits on Home Mortgage Interest Deduction

Tax Loss Harvesting with Vanguard: A Step by Step Guide - Physician on FIRE

Publication 936 (2022), Home Mortgage Interest Deduction | Internal Revenue Service

https://ttlc.intuit.com/community/tax-credits-deductions/discussion/home-mortgage-interest-limited-smart-worksheet-why-can-t-i-enter-beginning-balance-it-s-highlighted/00/2151949

Home Mortgage Interest Limited Smart Worksheet why can t I enter Beginning Balance it s highlighted but won t allow me to enter the dollar

https://www.irs.gov/publications/p936

Part II explains how your deduction for home mortgage interest may be limited It contains Table 1 which is a worksheet you can use to figure the limit on

https://proconnect.intuit.com/support/en-us/help-article/form-1098/understanding-deductible-home-mortgage-interest/L18S60lyN_US_en_US

The Deductible Home Mortgage Interest Worksheet is designed to help you calculate your deductible home mortgage interest if that debt is

https://www.adftaxes.com/files/Mortgage_Deduction_Limit_Worksheet.pdf

Mortgage Deduction Limit Worksheet Part I Qualified Loan Limit 1 Enter the average balance of all This is not home mortgage interest 16

https://www.thebalancemoney.com/home-mortgage-interest-tax-deduction-3192984

Key Takeaways Mortgage interest is tax deductible on mortgages of up to 750 000 unless the mortgage was taken out before Dec 16 2017

Smart Charts Practice Aids Client Letters CPE Courses Curated by Tralawney Worksheet Qualified Loan Limit and Deductible Home Mortgage Interest Client That s because the 2017 Tax Cuts and Jobs Act limited the deduction to the interest on the first 750 000 of a mortgage There s an

limited You will need to complete this IRS Qualified Loan Limit Worksheet before reporting the mortgage interest deduction in the 1098 program entry What