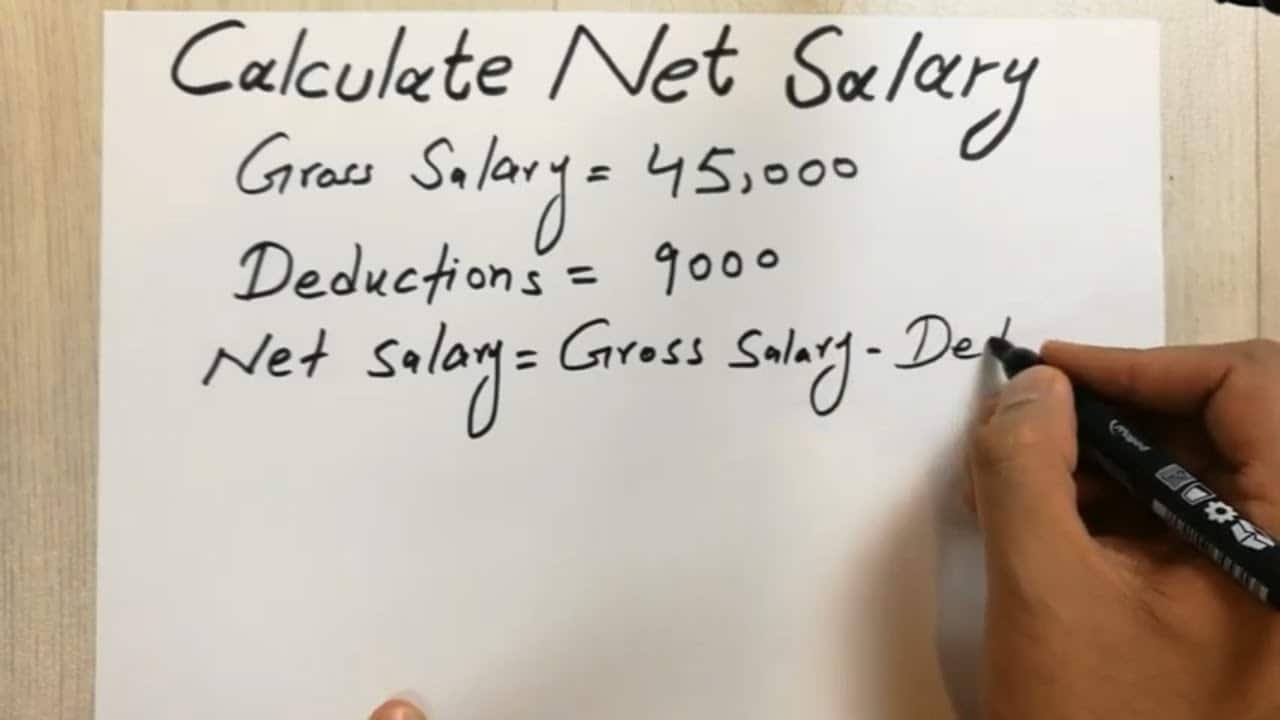

Net Pay Formula In Excel Oct 5 2021 0183 32 To find net pay subtract what is in the cell for total deductions from the cell with gross pay For example A1 B4 3 Paid time off If your employees are entitled to paid time off then you likely have a system for accruing vacation time for

Oct 28 2014 0183 32 How To Calculate Your Net Income Using Microsoft Excel Tutorials Net Income Calculation using MS Excel How to calculate the Net and Gross Salary of an In Step 1 Gathering the necessary information Step 2 Calculating taxable income Step 3 Determining tax deductions Step 4 Subtracting taxes from gross pay to find net pay Key Takeaways Calculating net pay after taxes is crucial

Net Pay Formula In Excel

Net Pay Formula In Excel

Net Pay Formula In Excel

https://i.ytimg.com/vi/jX50lBGsJQw/maxresdefault.jpg

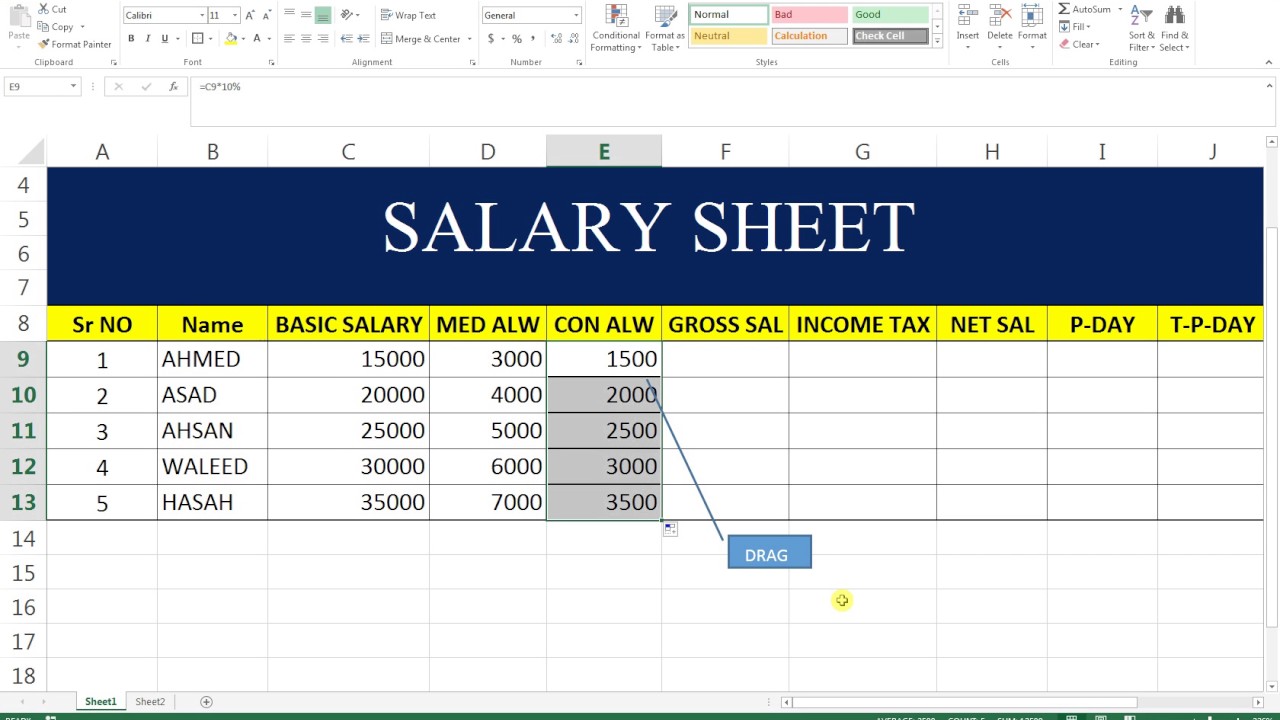

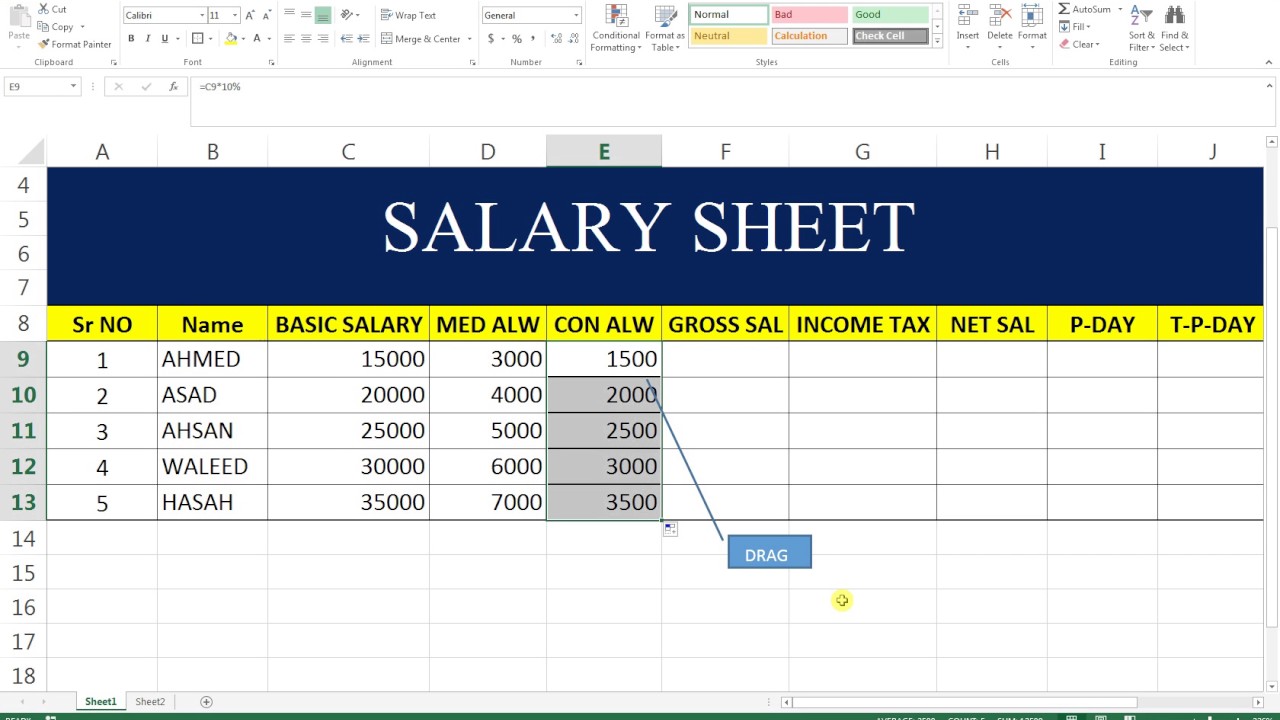

Dec 24 2023 0183 32 The formula to calculate the Net salary is given below Net Salary Gross Pay Total Allowances Step 1 Make a List of Employees with Supporting Data First we collect the name and positions of the employee in the dataset We also set the format of the salary sheet Now we add another sheet of supporting information in the Excel file

Pre-crafted templates use a time-saving service for producing a diverse variety of documents and files. These pre-designed formats and designs can be made use of for various personal and expert jobs, including resumes, invitations, leaflets, newsletters, reports, discussions, and more, streamlining the content creation process.

Net Pay Formula In Excel

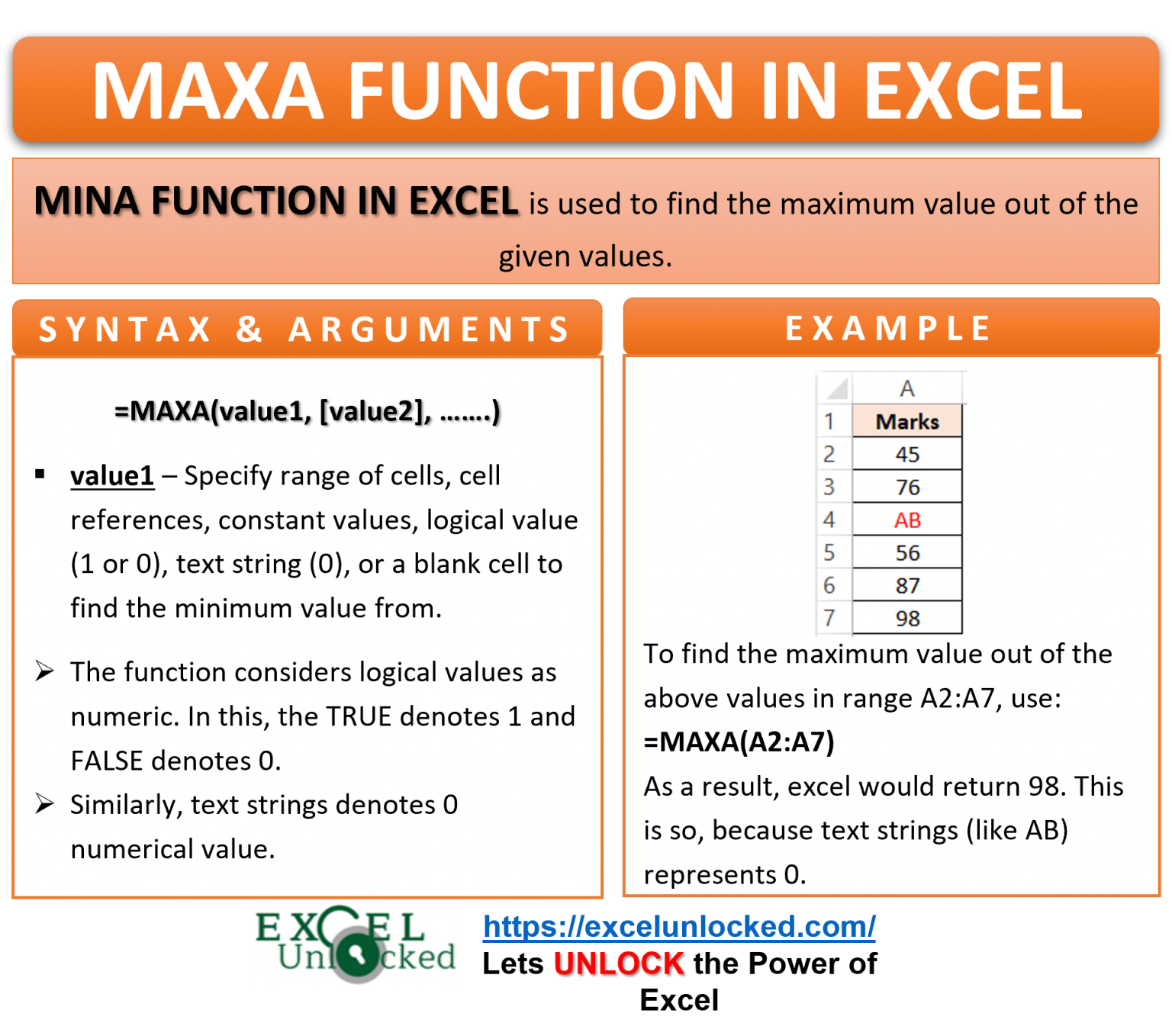

MAXA Function In Excel Finding Maximum Value From Range

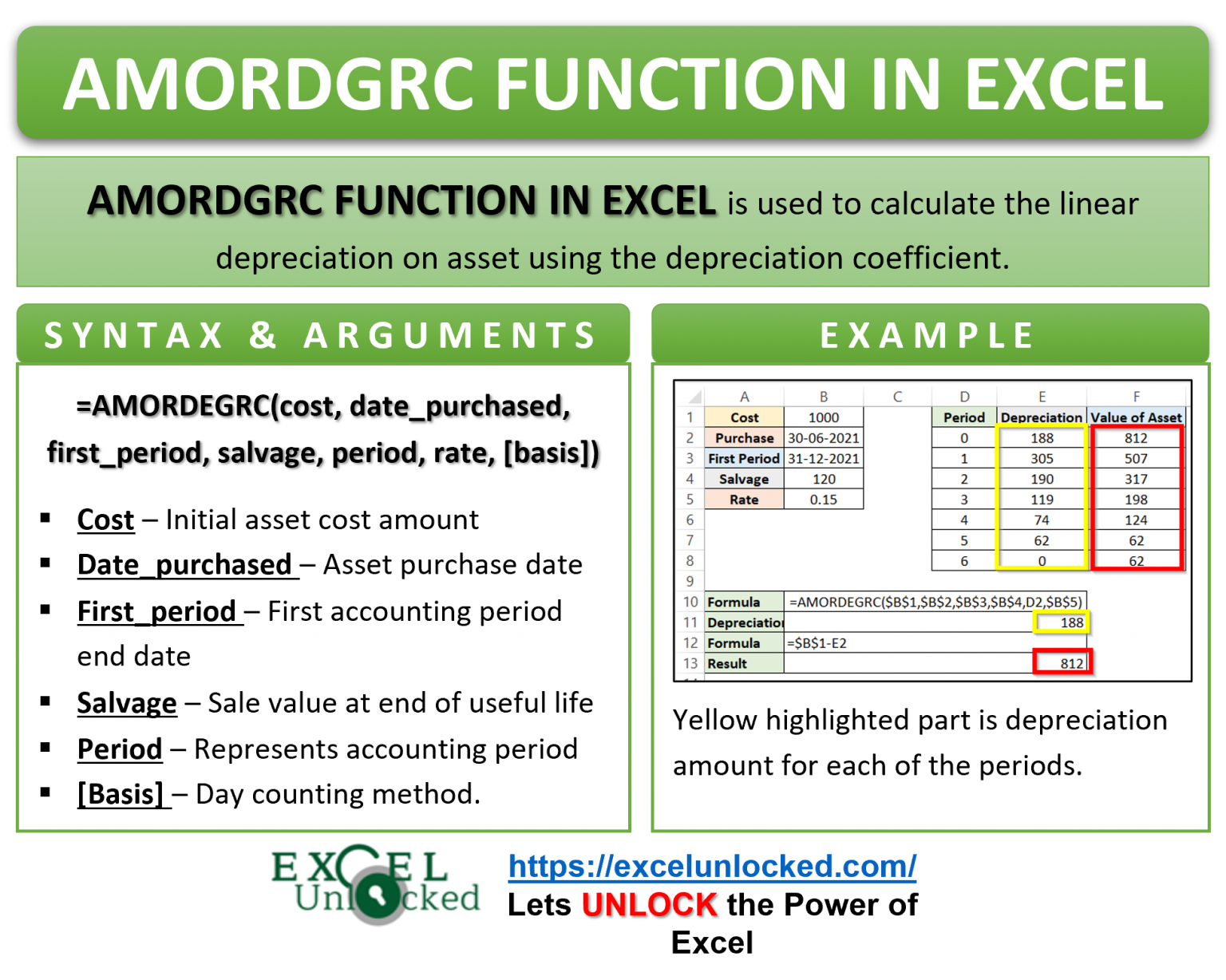

AMORDEGRC Function Of Excel Depreciation Of Asset Excel Unlocked

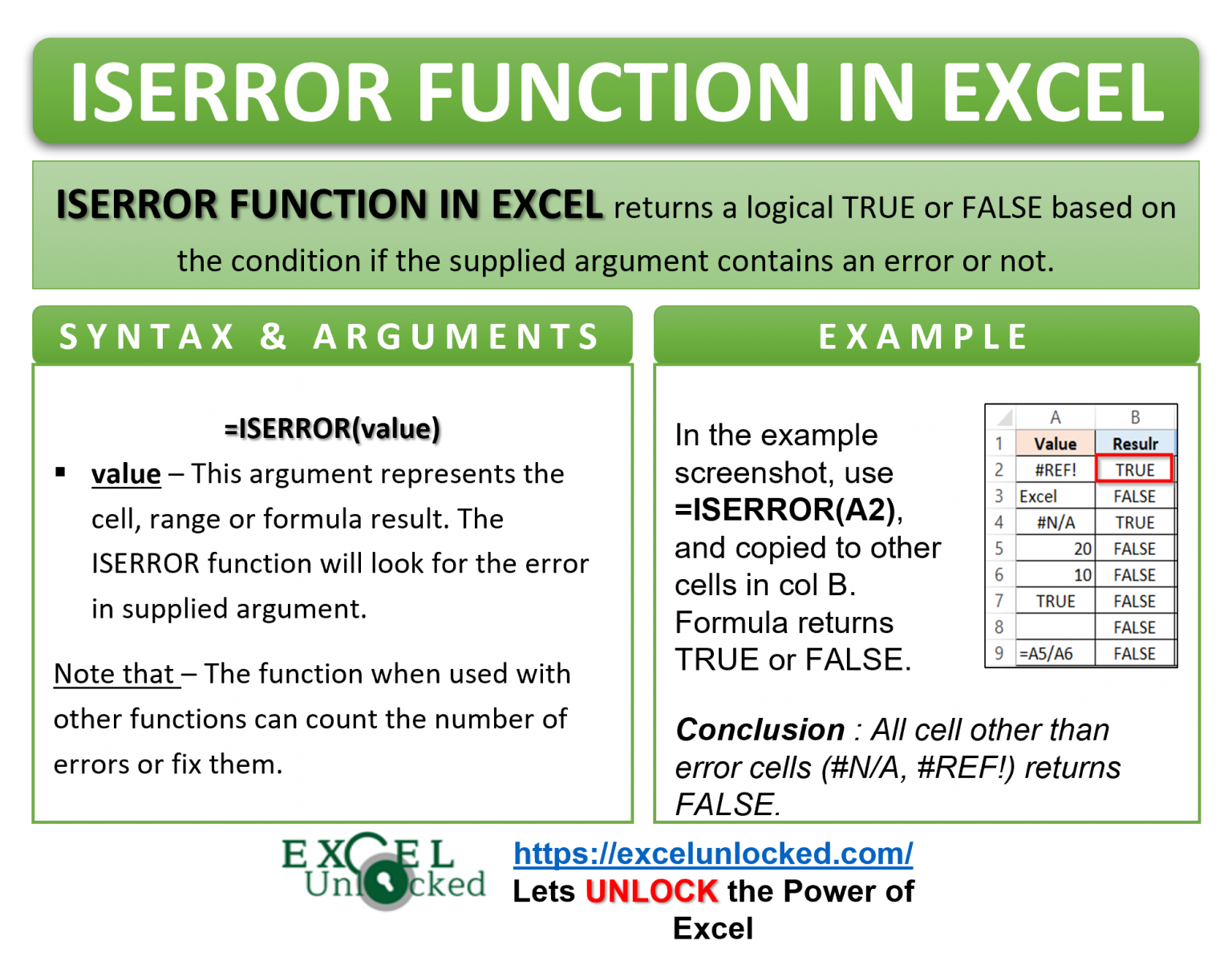

ISERROR Function In Excel Checking For Errors Excel Unlocked

How To Use Fixed Formula In Excel Microsoft Excel Tutorial Excel

How To Calculate Net Take Home Salary Haiper

How To Delete A Formula In Excel SpreadCheaters

https://www.lifewire.com/calculate-net-salary

Sep 11 2020 0183 32 Use the following formulas to calculate your net salary and other financial metrics Net Salary Hours worked x Hourly Rate Positive Adjustments Negative Adjustments Pre tax Adjustments and Pre tax Retirement Contributions All taxes Local State Federal and Medicare Post tax deductions

https://excel-dashboards.com/blogs/blog/excel

To calculate gross pay in Excel you can use the following formula hourly rate hours worked overtime pay bonuses commissions Alternatively if the employee is salaried you can use the formula annual salary number of pay periods in a year Examples of different scenarios for calculating gross pay

https://www.exceldemy.com/make-salary-sheet-in-excel-with-formula

Dec 31 2023 0183 32 A salary sheet is a report where the net payable amount as salary to an employee is recorded The basic wage of an employee extra allowances and deductions are recorded here Upon these calculations gross salary and net payable salary are calculated and recorded

https://www.educba.com/salary-formula

Aug 3 2023 0183 32 Salary Formula Basic Salary Gross Salary Total Allowances DA HRA Medical Insurance Other Allowances or Basic salary CTC x Percentage Gross salary Basic Salary HRA Other Allowances Net salary Gross Salary Income Tax Professional Tax TDS EPF ESIC Components

https://excel-dashboards.com/blogs/blog/excel

For example if an employee worked 40 hours at 15 per hour the formula would be hours worked hourly rate If the employee s salary is 3 000 per month the formula would be monthly salary number of pay periods in a month Deductions and Taxes

[desc-11] [desc-12]

[desc-13]