Personal Use Of Company Vehicle Worksheet 2022 Your employee s commute between home and work if it is on a regular basis Trips unrelated to your organization s purpose work trade etc

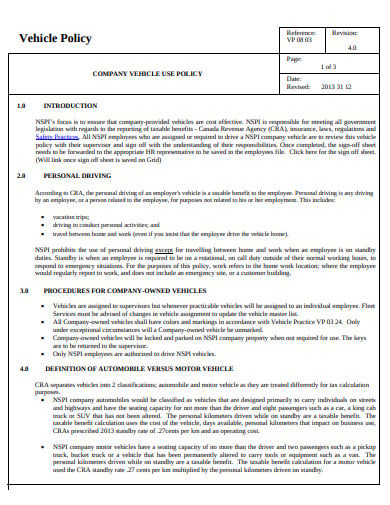

This guide includes information about employer policies regarding the use of company vehicles It contains sample polices and calculation Worksheet to calculate income from personal use of company vehicle continued Method II Cents per mile rule Generally to qualify to use the cents per

Personal Use Of Company Vehicle Worksheet 2022

Personal Use Of Company Vehicle Worksheet 2022

Personal Use Of Company Vehicle Worksheet 2022

https://s3.studylib.net/store/data/008438590_1-320468c8d627110ac62d7e4c2ba7e31e.png

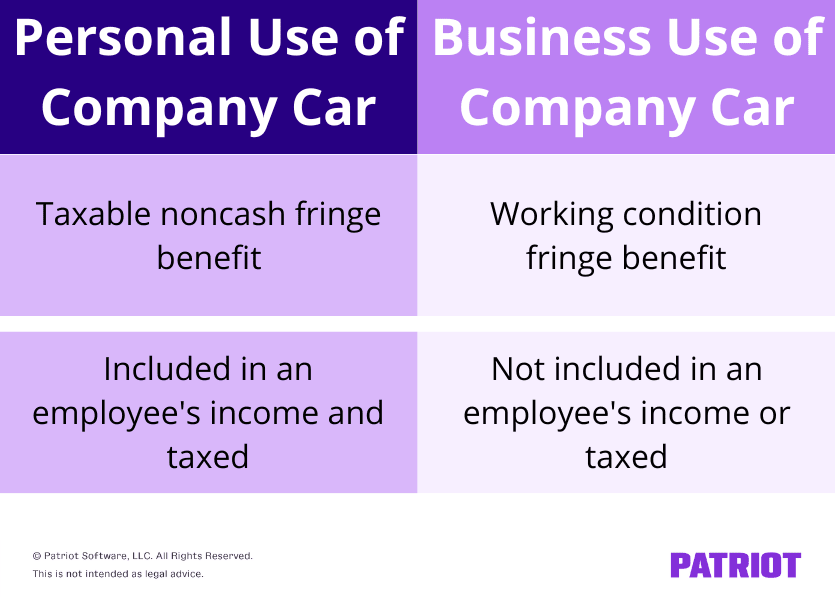

Personal use of a company vehicle generally results in taxable wages for the employee But sorting out the amount to tax can be confusing The

Pre-crafted templates offer a time-saving service for creating a diverse variety of files and files. These pre-designed formats and layouts can be used for various individual and expert tasks, including resumes, invites, leaflets, newsletters, reports, discussions, and more, simplifying the content creation procedure.

Personal Use Of Company Vehicle Worksheet 2022

Urke & Stoller, LLP

2022 Reporting of Personal Use of Automobiles - Rudler, PSC

FREE 21+ Company Vehicle Policy Templates in PDF | MS Word | Google Docs | Pages

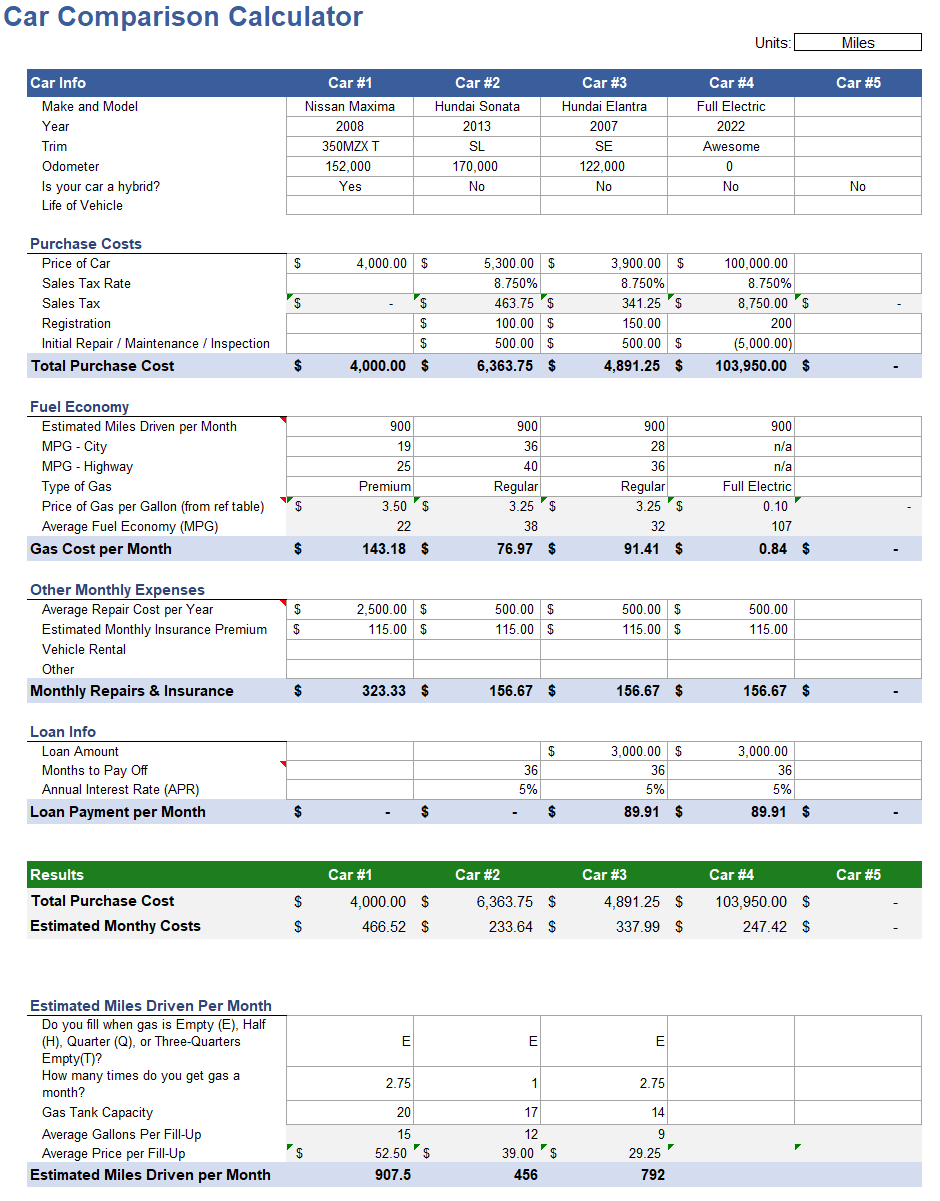

Car Comparison Calculator for Excel

The Ultimate Small Business Tax Deductions Worksheet for 2022

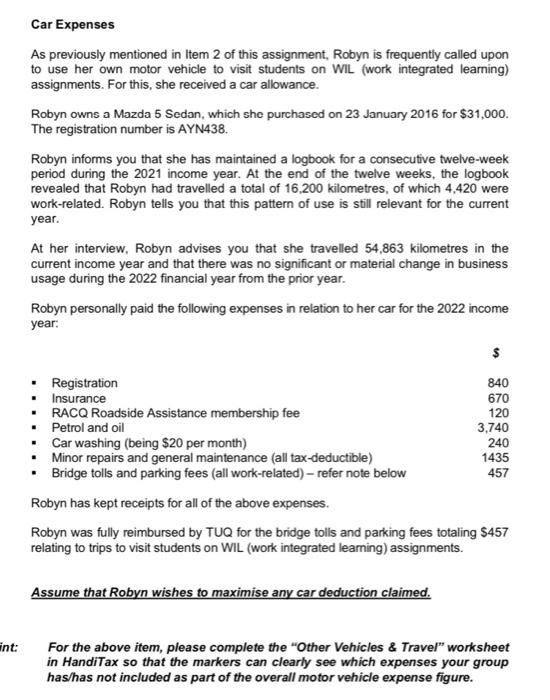

Car Expenses As previously mentioned in Item 2 of | Chegg.com

https://rudler.cpa/2022-reporting-of-personal-use-of-automobiles/

This rule includes the value of an employee s personal use of an employer provided vehicle The value of the benefit is included on the

https://www.patriotsoftware.com/blog/payroll/personal-use-company-vehicle-car-tax-pucc/

Driving a company vehicle for personal use is a taxable noncash fringe benefit aka benefit you provide in addition to wages As a result you

https://www.irsvideos.gov/Business/FilingPayingTaxes/EmployerProvidedVehicles

An employee s personal use of an employer owned automobile is considered a part of an employee s taxable income and it s vital to to document business use If

https://www.irs.gov/publications/p15b

The business mileage rate for 2023 is 65 5 cents per mile You may use this rate to reimburse an employee for business use of a personal vehicle

https://www.thetaxadviser.com/issues/2022/nov/employer-provided-company-owned-vehicles.html

Valuation of the personal use of an automobile is based on availability not actual use Thus if the automobile was available for personal use

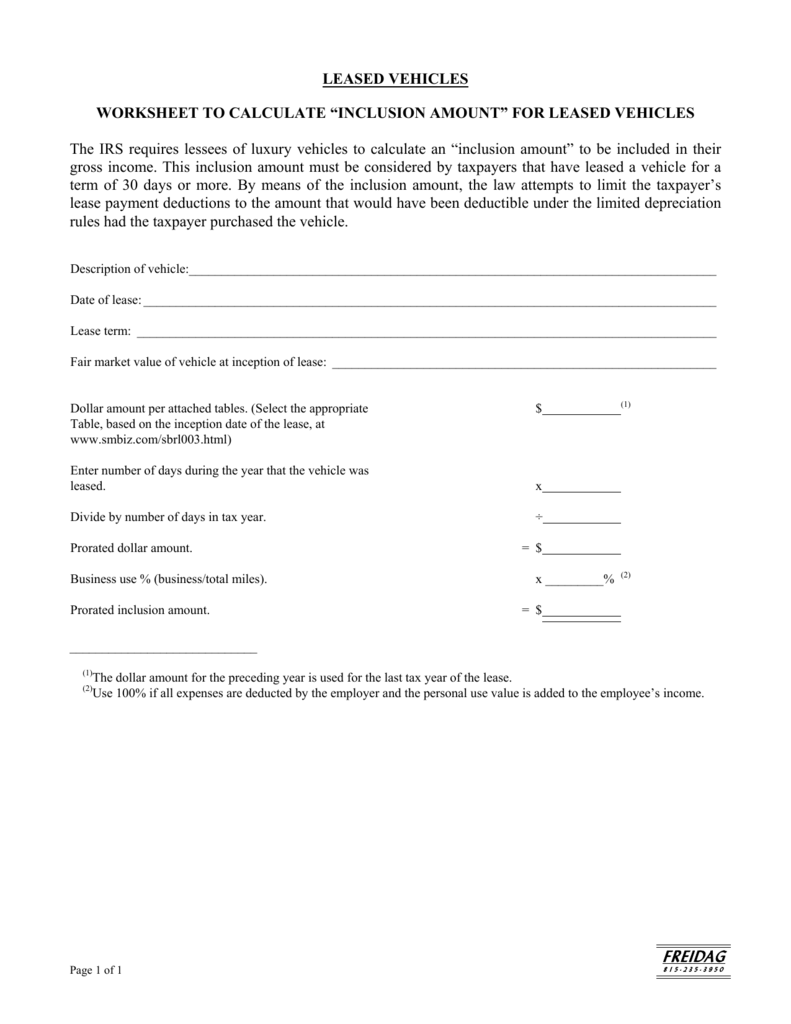

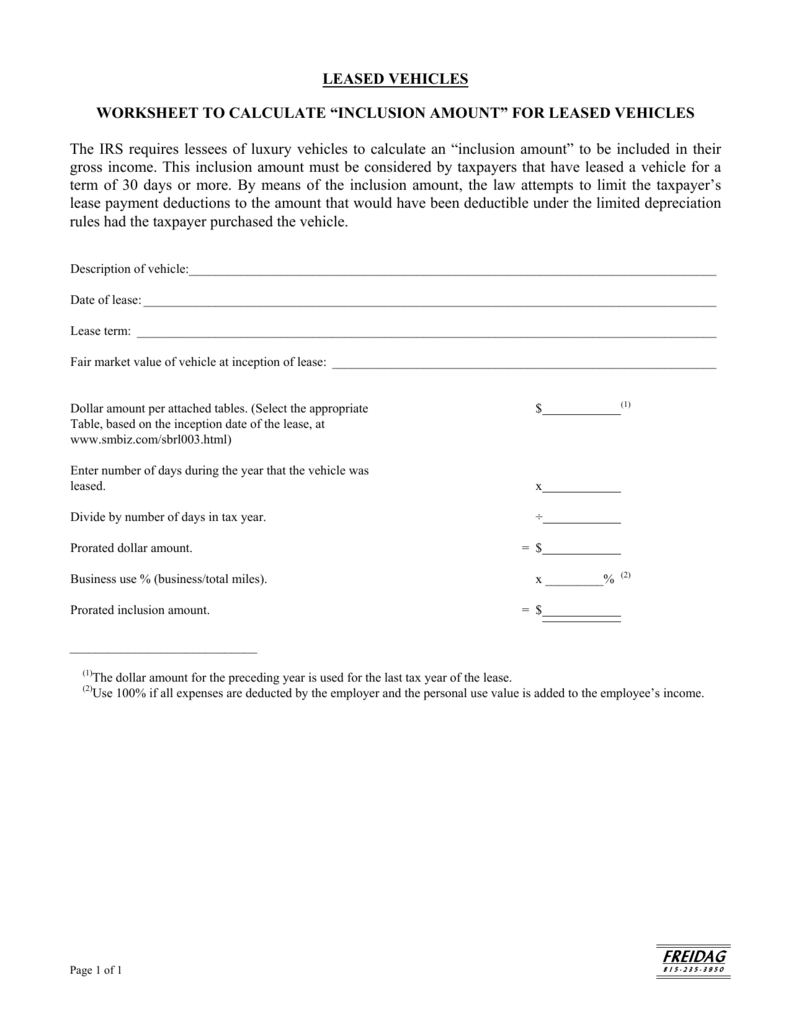

One method of calculating the business use of your car is to total your actual expenses gas oil insurance vehicle depreciation etc and EMPLOYER S WORKSHEET TO CALCULATE EMPLOYEE S TAXABLE INCOME RESULTING FROM EMPLOYER PROVIDED VEHICLE 2021 Employee Description of Vehicle Date Vehicle

Personal use of company automobile airplane or other employer owned or leased property These amounts are not taxable fringe benefits for Pennsylvania