Rounding To The Nearest Hundred Worksheet With Answers STI sidewall profile taper STI TOP Bottom corner rounding

Excel round ROUND Excel Excel 4 6 5 4 quot quot 6 quot quot 5 5 5 1 5

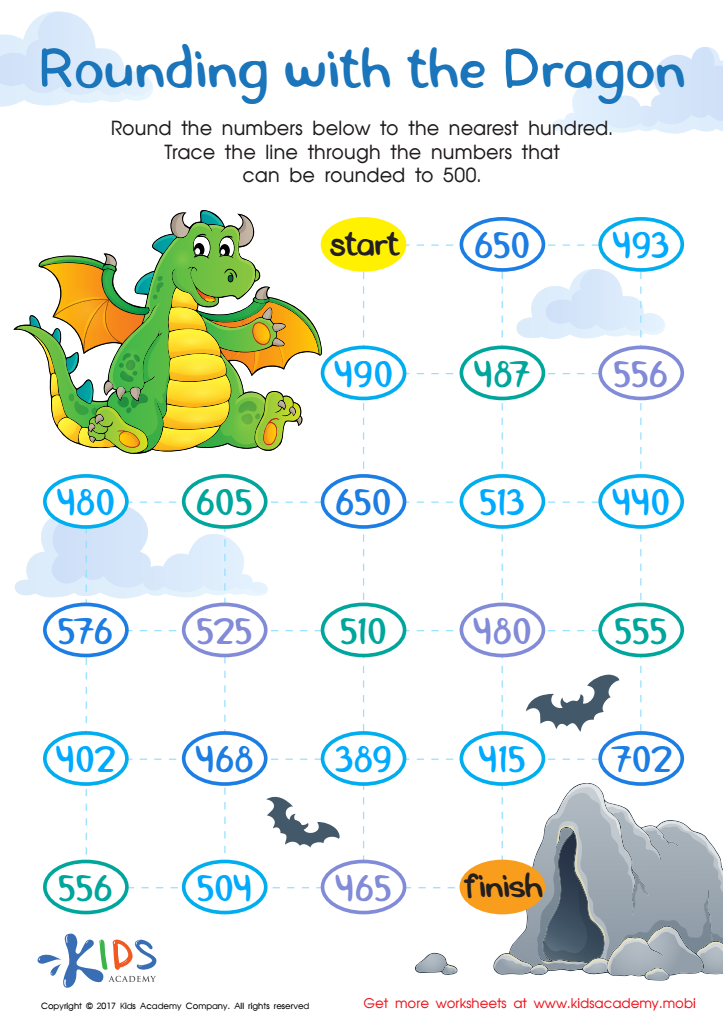

Rounding To The Nearest Hundred Worksheet With Answers

Rounding To The Nearest Hundred Worksheet With Answers

Rounding To The Nearest Hundred Worksheet With Answers

https://teachsimplecom.s3.us-east-2.amazonaws.com/images/rounding-to-the-nearest-ten-thousand-worksheet/rounding-worksheet-nearest-ten-thousand.jpg

rounding off question IELTS International English Language Testing System IDP

Pre-crafted templates provide a time-saving service for producing a diverse series of documents and files. These pre-designed formats and designs can be utilized for different individual and professional tasks, consisting of resumes, invitations, flyers, newsletters, reports, discussions, and more, streamlining the material production process.

Rounding To The Nearest Hundred Worksheet With Answers

Rounding Worksheet To The Nearest 1000

Rounding Numbers Worksheets To The Nearest 100

Rounding Worksheet To The Nearest 1000

Rounding To Hundred Thousands Worksheet Have Fun Teaching

Rounding Decimals To The Nearest Whole

Rounding Worksheets To The Nearest 10

https://community.ato.gov.au › question

Sep 8 2024 0183 32 On a Paper Company Tax Return what are the rounding rules loose the cents OR round up from 50 cents to less than a dollar after the decimal point for 7 Reconciliation to

https://www.zhihu.com › question

lip rounding rounded spread neutral o

https://community.ato.gov.au › question

Feb 15 2021 0183 32 I noticed that pre fill data from previous years always rounds the decimal place to the lowest dollar rather than the next highest dollar I was wondering if these amounts require

https://community.ato.gov.au › question

Jul 13 2021 0183 32 Hi there We have received a tax invoice from a supplier for a total of 156 52 with 14 27 GST included This supplier obviously uses the Taxable Supply Rule As our

https://community.ato.gov.au › question

Jul 19 2024 0183 32 I m trying to make sure GST is correctly calculated and detailed on a receipt when there can be rounding issues Consider an example of a 27 00 item that has 10 GST

[desc-11] [desc-12]

[desc-13]