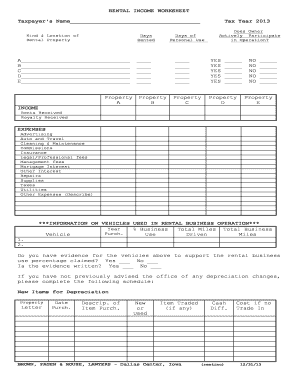

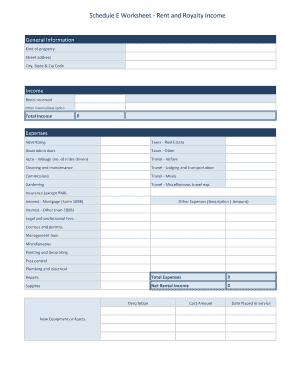

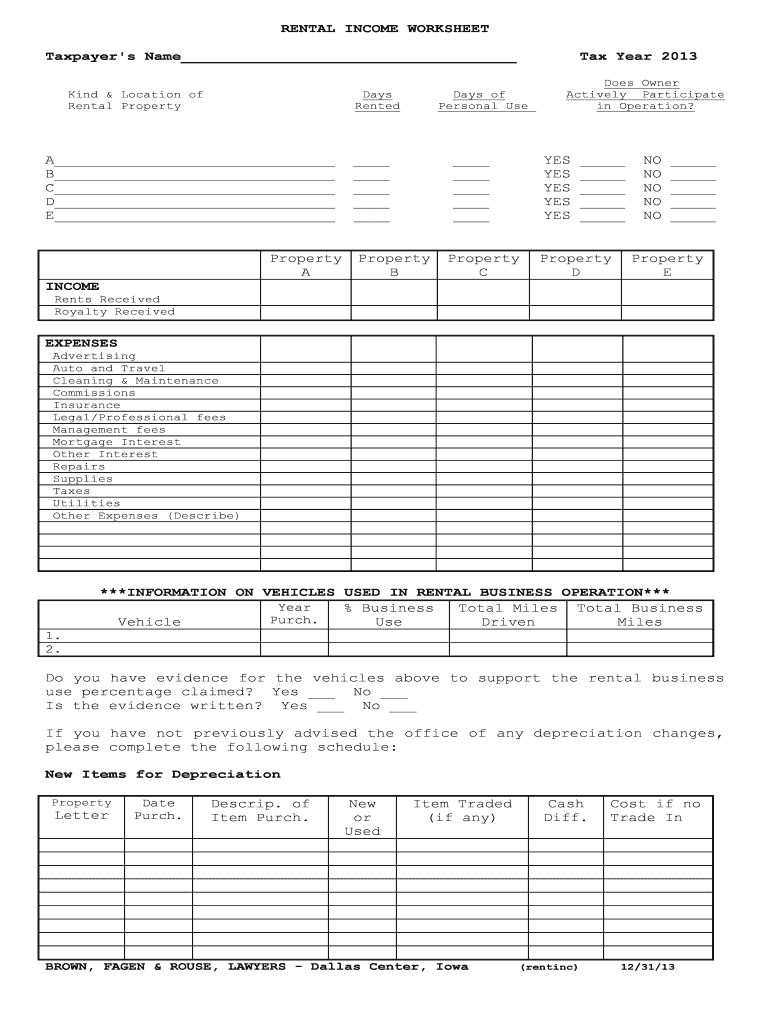

Schedule E Worksheet For Rental Property spreadsheet to help them maintain financial records year round The Schedule E includes income and expenses categories common to owning rental

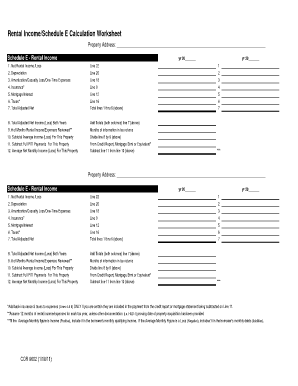

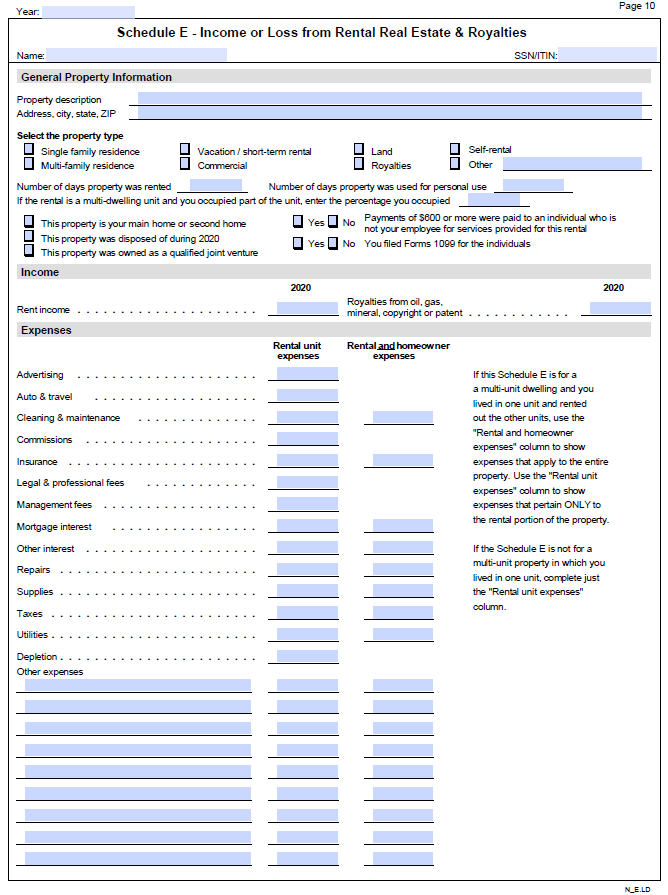

If you earn rental income on a home or building you own receive royalties or have income reported on a Schedule K 1 from a partnership or S Calculate monthly qualifying rental income loss using Step 2A Schedule E OR Step 2B Lease Agreement or Fannie Mae Form 1007 or Form 1025 Step 2 A

Schedule E Worksheet For Rental Property

Schedule E Worksheet For Rental Property

Schedule E Worksheet For Rental Property

https://www.pdffiller.com/preview/100/98/100098772/large.png

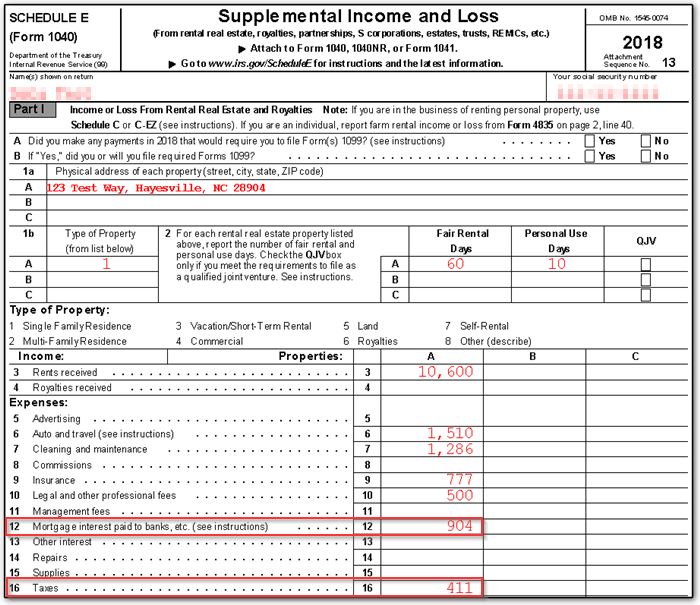

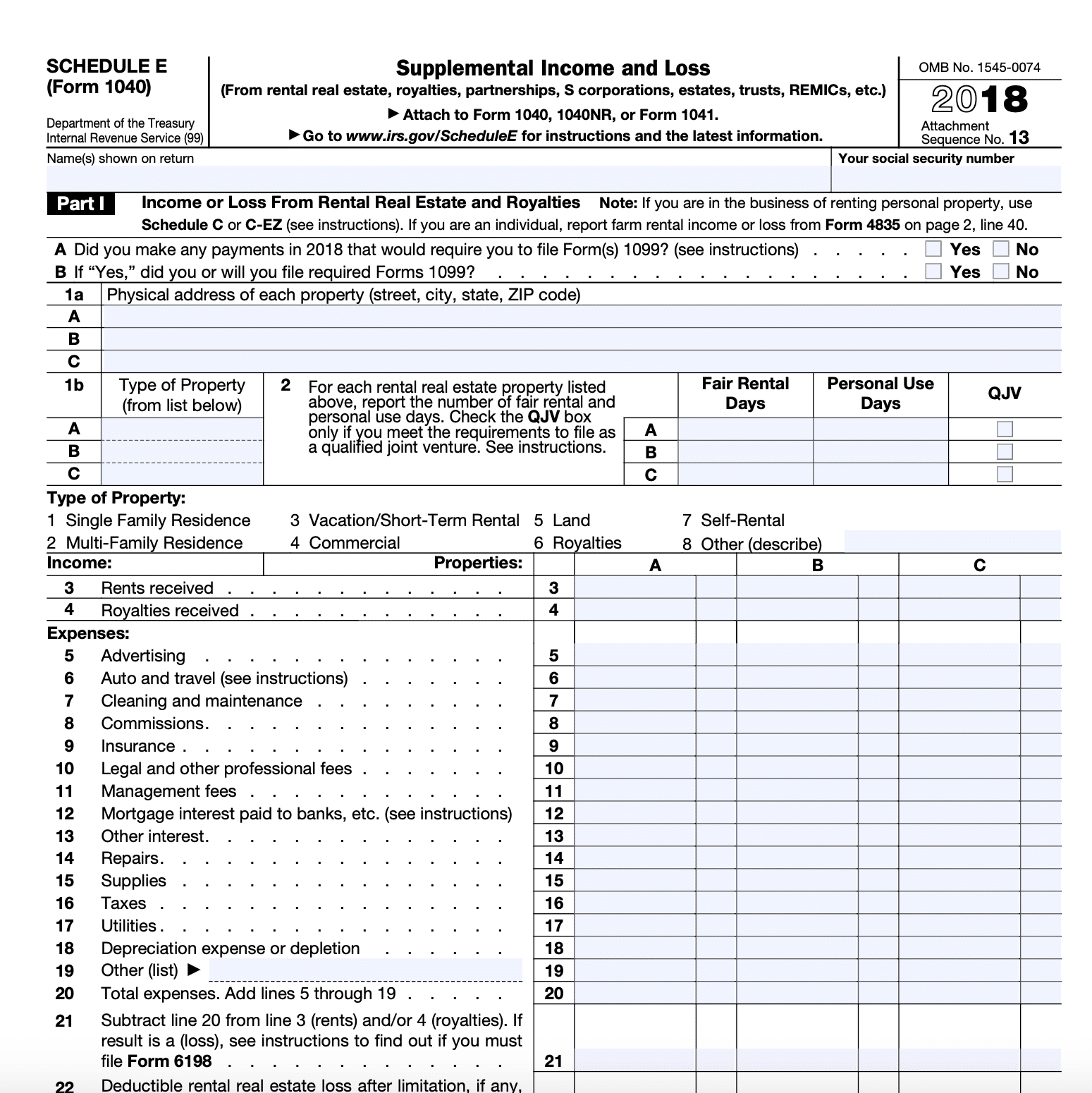

Use Schedule E Form 1040 to report income or loss from rental real estate royalties partnerships S corporations estates trusts and residual interests in

Pre-crafted templates offer a time-saving option for creating a diverse variety of documents and files. These pre-designed formats and layouts can be utilized for different individual and expert jobs, consisting of resumes, invites, leaflets, newsletters, reports, discussions, and more, improving the content production process.

Schedule E Worksheet For Rental Property

Schedule E Worksheet Turbotax - Fill Out and Sign Printable PDF Template | signNow

Schedule E Worksheet - Fill and Sign Printable Template Online

Rental Property Income & Expenses Spreadsheet

Schedule E Calculator - Fill Online, Printable, Fillable, Blank | pdfFiller

2018 Schedule E Rental Income Example. See a sample of how to fill out rental income into the 2018 Schedule E tax form.: Fill out & sign online | DocHub

1040 - Schedule E - Tax Court Method Election

https://www.irs.gov/pub/irs-pdf/f1040se.pdf

Income or Loss From Rental Real Estate and Royalties Note If you are in the business of renting personal property use Schedule C See instructions If you

https://www.irs.gov/forms-pubs/about-schedule-e-form-1040

Schedule E is used to report income from rental properties royalties partnerships S corporations estates trusts and residual interests

https://static.twentyoverten.com/605f3c1f00c22d3d76f6981a/64UvfO_7MJe/TY-2022-Schedule-E-Summary-Worksheet.pdf

Please complete this form and include it with your other tax documents Property Type residential commercial vacant land Property Address Who owns the

https://www.costalawgrouppc.com/schedule-e-rental-property/

Use Schedule E Form 1040 or 1040 SR to report income or loss from rental real estate royalties partnerships S corporations estates trusts

![Schedule-E Tax Form Survival Guide for Rental Properties [2021 Tax Year Update] Schedule-E Tax Form Survival Guide for Rental Properties [2021 Tax Year Update]](https://resources.hemlane.com/content/images/2021/12/Schedule-E-Property-Management-2022-IRS-pg.1.png?w=186)

https://spinellicpa.com/wp-content/uploads/2020/02/Schedule-E-Rental-Property-Worksheet-1.pdf

Please use this worksheet to gather information on rental property owned during the year Address Date Purchased if 2018 Rental Property 1 Rental Property

schedule A or E If the rental property produces a loss the Vacation Home Limitation Worksheet may limit the amount of rental expenses that were entered Sheet1 A B C D E F G H I J K L M N O 1 Rental Income Worksheet 2 Individual Schedule E Part I For each property complete ONLY 2A or 2B

This form is a tool to help the Seller calculate the net rental income from Schedule E the Seller s calculations must be based on the