Section 163 J Computation Worksheet The Tax Cuts and Jobs Act of 2017 revised Section 163 j by imposing a limitation on the deduction for business interest expense for years

Go to the Income Deductions 8990 Interest Expense Limitation worksheet Select Section 2 Election for Section 163 j 9 In the grid Old Rule Business interest expense was generally fully deductible and potentially limited in cases involving related or foreign parties

Section 163 J Computation Worksheet

Section 163 J Computation Worksheet

Section 163 J Computation Worksheet

https://www.irs.gov/pub/xml_bc/71420e04.gif

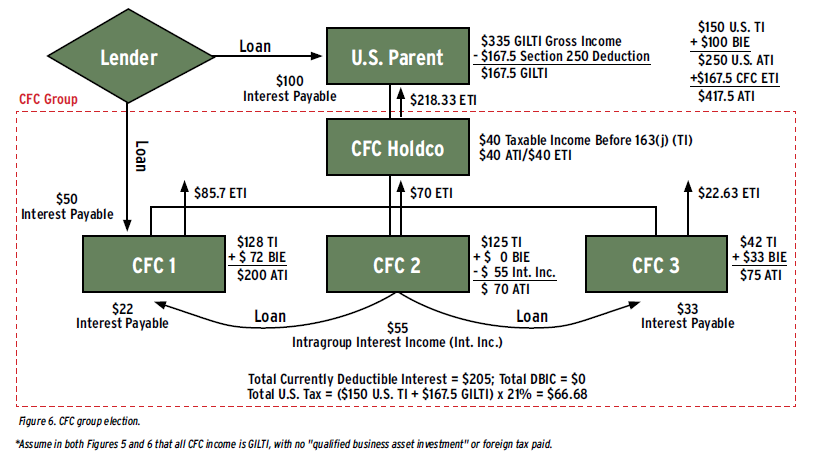

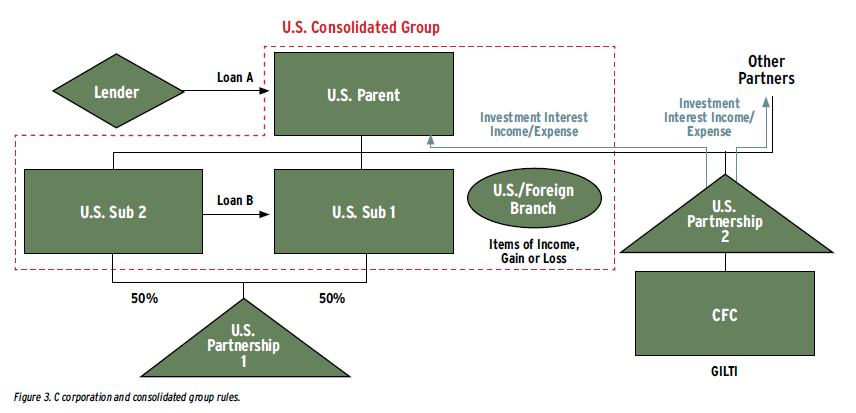

A specified group calculates a single Section 163 j limitation for a specified period of a CFC group based on the sum of the current year

Templates are pre-designed files or files that can be utilized for numerous functions. They can save effort and time by offering a ready-made format and design for producing different sort of material. Templates can be utilized for individual or expert tasks, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

Section 163 J Computation Worksheet

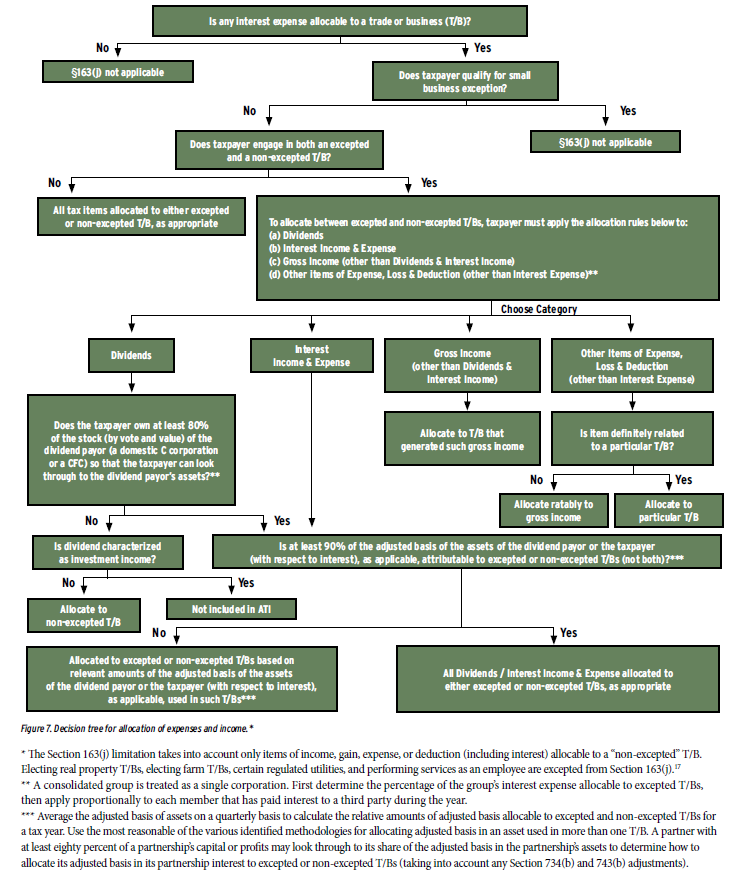

Part I: The Graphic Guide to Section 163(j) | Tax Executive

Interest Expense Limitation Under Section 163(j) for Businesses | SC&H Group

Part I: The Graphic Guide to Section 163(j) | Tax Executive

Part I: The Graphic Guide to Section 163(j) | Tax Executive

Final Business Interest Limitation Rules Present Opportunities : 2020 : Articles : Resources : CLA (CliftonLarsonAllen)

LB&I Training Tax Cuts & Jobs Act (TCJA) 1

https://www.irs.gov/newsroom/basic-questions-and-answers-about-the-limitation-on-the-deduction-for-business-interest-expense

FAQs about the limitation on the deduction for business interest expense also known as the section 163 j limitation

https://www.thetaxadviser.com/issues/2022/dec/sec-163j-business-interest-limitation-new-rules-2022.html

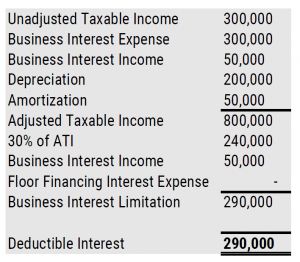

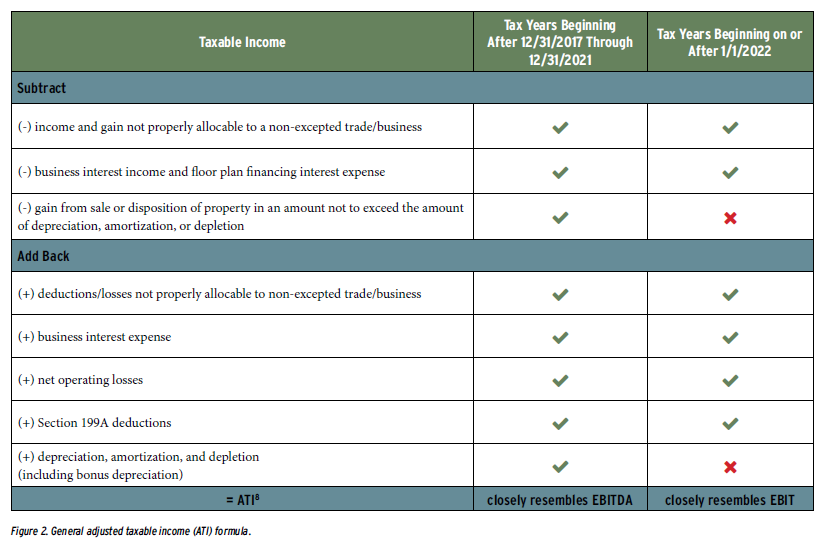

This item discusses how the rules for calculating ATI have changed for 2022 and beyond and how this affects the deductibility limit

https://answerconnect.cch.com/topic/4cbb44087d331000b14b90b11c18cbab09/section-163-j-business-interest-deduction-limit

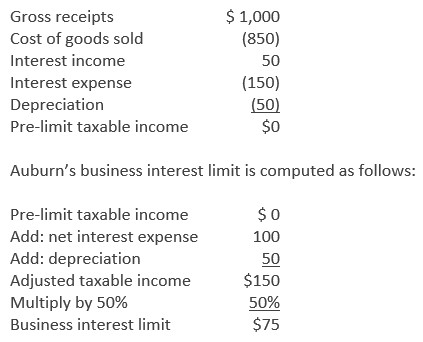

Diana s section 163 j limit is 12 000 30 percent of ATI 0 business interest income 0 floor plan financing Thus 3 000 of her business interest

https://kpmg.com/us/en/home/insights/2020/08/tnf-section-163j-passthrough-entities.html

Section 163 j is applied to partnership business indebtedness at the partnership level To the extent a partnership s business interest deduction is limited

https://cs.thomsonreuters.com/ua/ut/cs_us_en/cus/shr/form_8990_overview.htm

UltraTax CS 1120 transfers the amount entered in this field to Form 8990 line 1 Calculating adjusted taxable income Perform the following steps to force the

Interest expense subject to the section 163 j limitation and modify the computation of an applicable CFC s ATI respectively Thus under the proposed Any business interest expense that is non deductible during a tax year due to the Code Section 163 j interest expense limitation is carried

Initially included as part of the Tax Cuts and Jobs Act of 2017 TCJA the current iteration of IRC section 163 j 163 j limits the