Self Employment Income Calculation Worksheet Go to bit ly btbtool for a worksheet that will help you calculate self employment income Unemployment Benefits Any unemployment benefits you receive Note

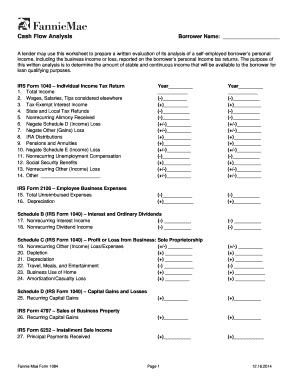

This worksheet must be used to prepare a written evaluation of the analysis of income related to Partnership and or S Corporation Income and be made part of the This form is a tool to help the Seller calculate the income for a self employed Borrower the Seller s calculations must be based on the

Self Employment Income Calculation Worksheet

Self Employment Income Calculation Worksheet

Self Employment Income Calculation Worksheet

https://www.pdffiller.com/preview/36/897/36897717.png

FHA Self Employment Income Calculation Worksheet Previous post USDA REO Net Rental Income Loss worksheet Next post FHA Refinance Worksheets Recent Posts

Templates are pre-designed files or files that can be utilized for numerous functions. They can save time and effort by supplying a ready-made format and layout for creating various type of content. Templates can be used for personal or professional tasks, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

Self Employment Income Calculation Worksheet

Self Employed Income Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller

Self Employed Income Worksheet - Fill and Sign Printable Template Online

Fannie Mae Income Worksheet ≡ Fill Out Printable PDF Forms Online

Self employment income expense tracking worksheet: Fill out & sign online | DocHub

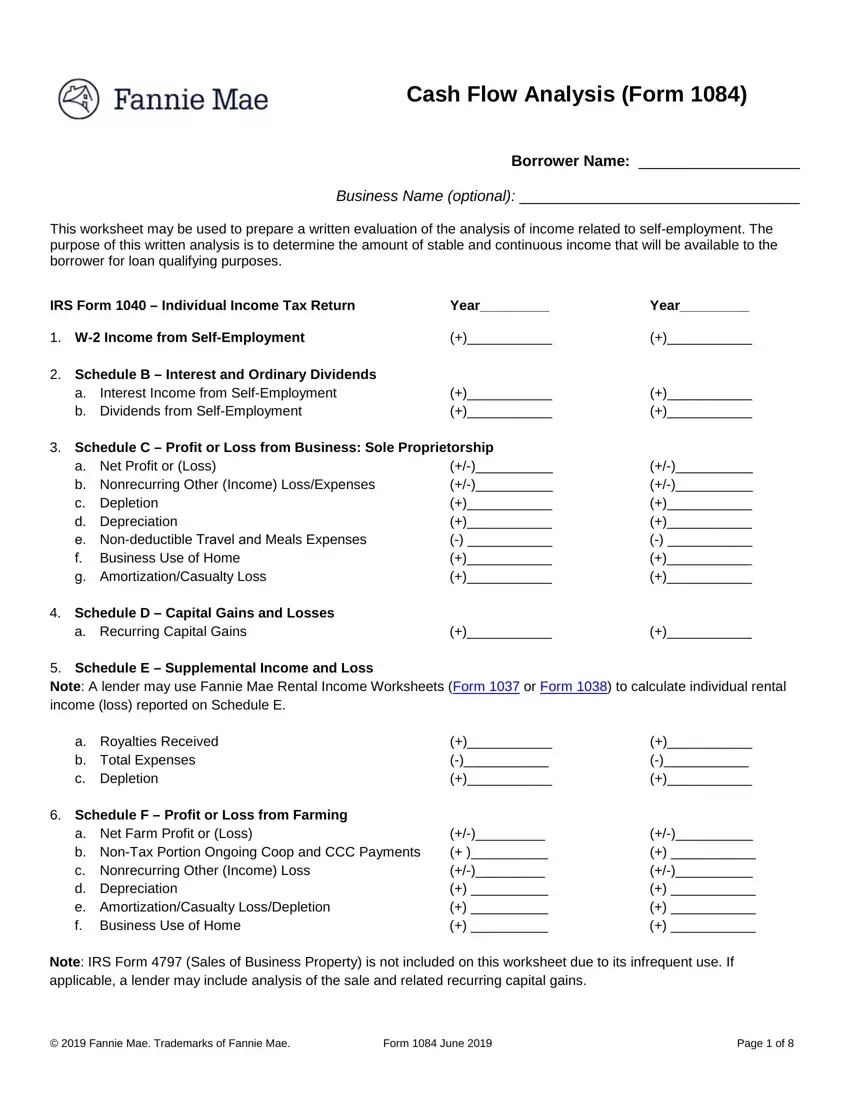

Self-Employed Borrower: Form 1084 Part 1 - Personal Tax Returns

Mortgage News Digest: "I Need Income Computation Training" means I don't understand self-employment

https://www.mgic.com/underwriting/seb

MGIC s self employed borrower and income analysis calculators are editable and auto calculating worksheets for cash flow analysis and updated for the 2022

https://www.essent.us/training/essentials-training/income-analysis-tools

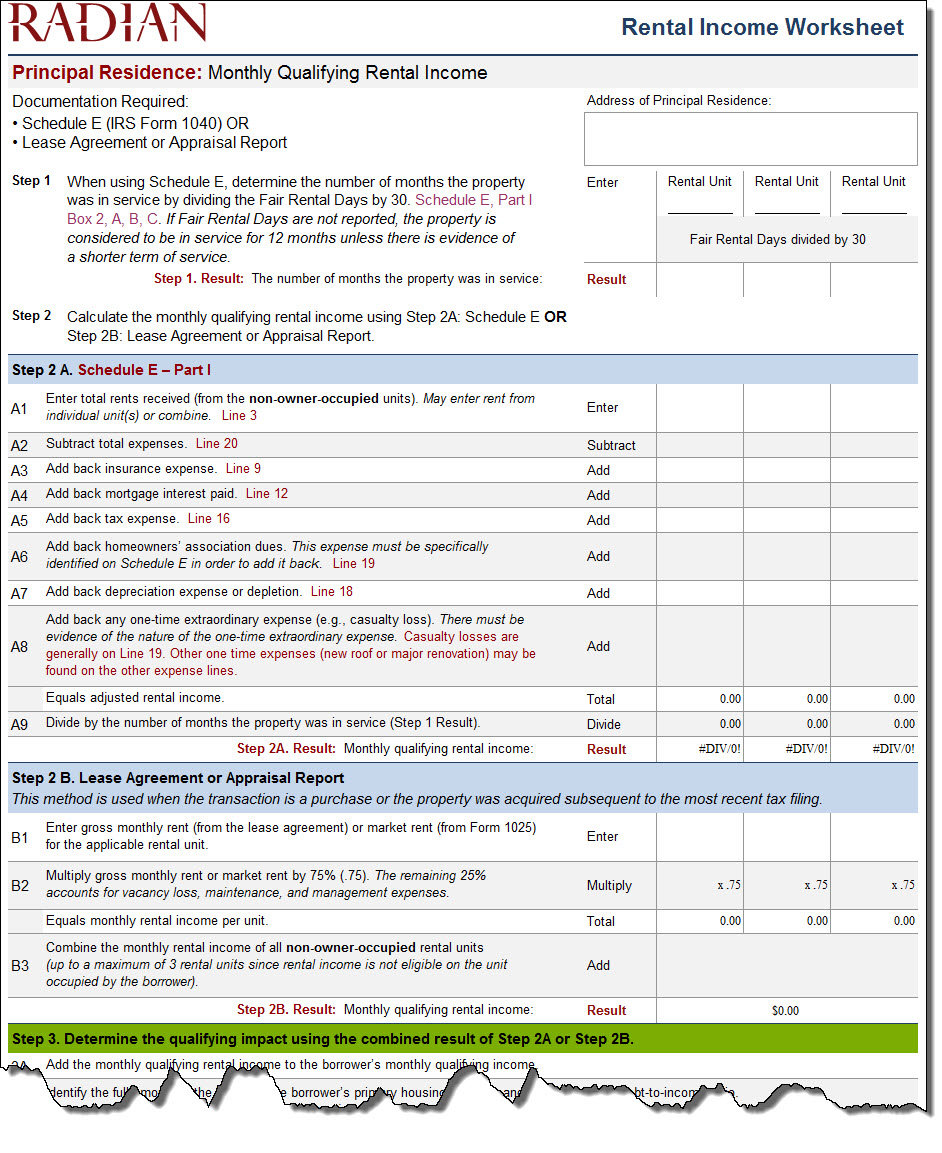

Our income analysis tools and job aids are designed to help you evaluate qualifying income quickly and easily Use our PDF worksheets to total numbers by hand

https://singlefamily.fanniemae.com/media/7746/display

This worksheet may be used to prepare a written evaluation of the analysis of income related to self employment The purpose of this written analysis is to

https://www.houseloan.com/corr/Forms/Copy%20of%20Self%20Employed%20Income%20Calculation%20Worksheet.xlsm

Complete all White colored fields For additional documentation and calculation information hold your cursor over the red triangle located in the uper right

https://www.radian.com/tools-and-technologies/tools/self-employed-cash-flow-calculator

This self employed income analysis and the included descriptions generally apply to individuals Who have 25 or greater interest in a business

SELF EMPLOYMENT INCOME WORKSHEET S CORPORATION SCHEDULE K 1 FORM 1120S AND FORM 1120S INSTRUCTIONS Complete all the fields on this worksheet If a Self Employment Income Tax Calculation Worksheet Case Name Case Number Tax

Net earnings from self employment 10 Taxable interest 11 Dividends 12 Taxable refunds credits or offsets of State and local income taxes See IRS Form