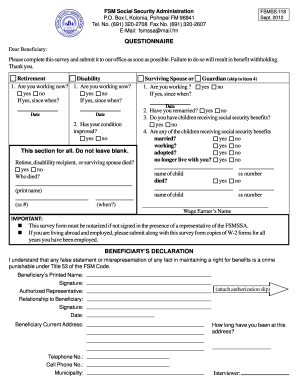

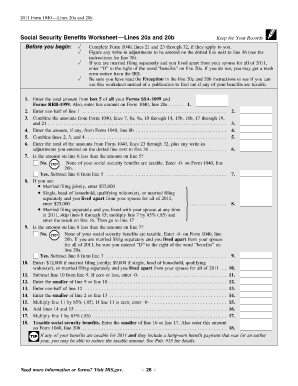

Social Security Benefit Worksheet 2021 The worksheet is created as a refund if social security benefits that are partially or fully taxed are entered on the SSA screen If the benefits are not taxed

2021 Modification Worksheet Taxable Social Security Income Worksheet Enter Taxable amount of social security from Federal Form 1040 or 1040 SR line 6b 2021 Social Security Benefits Worksheet is available in our book collection an online access to it is set as public so you can download it

Social Security Benefit Worksheet 2021

Social Security Benefit Worksheet 2021

Social Security Benefit Worksheet 2021

https://www.pdffiller.com/preview/6/963/6963800/large.png

The reportable Social Security benefit is calculated using the worksheet below and entered on Step 4 of the IA 1040

Templates are pre-designed files or files that can be used for different functions. They can conserve effort and time by offering a ready-made format and layout for developing different kinds of content. Templates can be used for individual or expert projects, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Social Security Benefit Worksheet 2021

2021-2023 Form IRS Publication 915Fill Online, Printable, Fillable, Blank - pdfFiller

15 Printable social security benefits application form Templates - Fillable Samples in PDF, Word to Download | pdfFiller

How to Calculate Taxable Social Security (Form 1040, Line 6b) – Marotta On Money

Social Security Benefits Worksheet 2022 Pdf - Fill Online, Printable, Fillable, Blank | pdfFiller

Social Security Benefits Worksheet 2022 Pdf - Fill Out and Sign Printable PDF Template | signNow

Publication 915 (2022), Social Security and Equivalent Railroad Retirement Benefits | Internal Revenue Service

https://www.irs.gov/publications/p915

In March 2022 the SSA notified you that you should have received only 2 500 in benefits in 2021 Form SSA 1099 Social Security Benefit

https://www.ssa.gov/benefits/retirement/planner/taxes.html

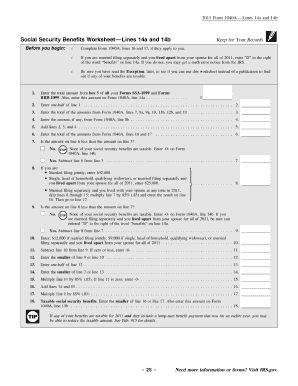

This Social Security planner page explains when you may have to pay income taxes on your Social Security benefits

https://www.taxact.com/support/1375/2022/social-security-benefits-worksheet-taxable-amount

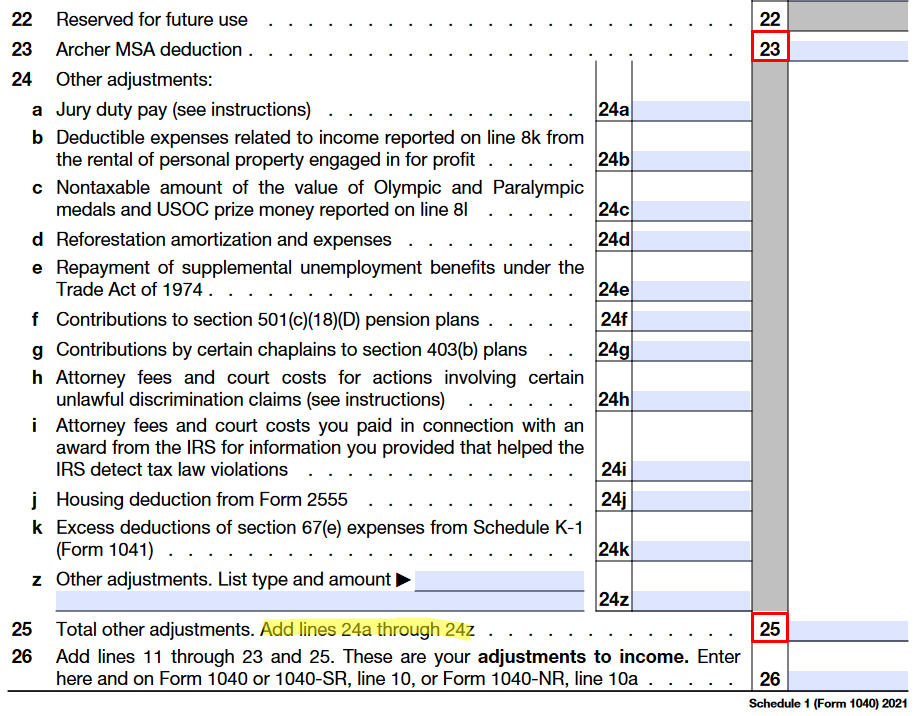

This worksheet is based on the worksheet in IRS Publication 915 Social Security and Equivalent Railroad Retirement Benefits Note that any link in the

https://www.cchwebsites.com/content/taxguide/tools/ssbenefits_m.php

The taxable portion can range from 50 to 85 percent of your benefits The worksheet provided can be used to determine the exact amount

https://www.dir.ct.gov/drs/Calculators/SSA/2021-SSBA-Worksheet.htm

Enter below the amounts reported on your 2021 federal Social Security Benefits Worksheet Press the Calculate Your Social Security Adjustment button when

Using the 2022 SSI monthly benefit you can compute the monthly benefit received in 2021 6 Social Security benefits received in FFY22 cannot be calculated Social Security retirement disability or survivor benefits Complete the Social Security Credit Worksheet below to calculate this credit You may only

Enter total annual Social Security SS benefit amount box 5 of any SSA 1099 and RRB 1099 Enter taxable income excluding SS benefits IRS Form 1040 lines