Social Security Benefits Worksheet Lines 6a And 6b 2021 2021 Modification Worksheet Taxable Social Security Income Worksheet Enter lines 8 through 10 Amount of social security benefits from Federal Form 1040

This worksheet is based on the worksheet in IRS Publication 915 Social Security and Equivalent Railroad Retirement Benefits Note that any link in the D to the right of the word benefits on Form 1040 or 1040 SR line 6a J Don t use this worksheet if you repaid benefits in 2020 and your total repayments

Social Security Benefits Worksheet Lines 6a And 6b 2021

https://images.squarespace-cdn.com/content/v1/5b2c618596d455860e15ec8f/1609791972896-THBK30R3E77U3F9SENTO/Social+Security+Income+Calculations.PNG?format=500w

This Social Security planner page explains when you may have to pay income taxes on your Social Security benefits

Templates are pre-designed files or files that can be utilized for different functions. They can conserve effort and time by offering a ready-made format and layout for developing different type of material. Templates can be used for individual or professional projects, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

Social Security Benefits Worksheet Lines 6a And 6b 2021

Social Security Benefits Worksheet 2022 Pdf - Fill Online, Printable, Fillable, Blank | pdfFiller

How to Calculate Taxable Social Security (Form 1040, Line 6b) – Marotta On Money

IRS Instruction 1040 Line 20a & 20b | pdfFiller

Social security benefits worksheet 2022 lines 6a and 6b

Publication 915 worksheet 2021: Fill out & sign online | DocHub

2022 Form 1040 Social Security Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller

https://www.irs.gov/publications/p915

This publication explains the federal income tax rules for social security benefits and equivalent tier 1 railroad retirement benefits It is

https://www.marottaonmoney.com/how-to-calculate-taxable-social-security-2021-line-6b/

Your taxable Social Security Form 1040 Line 6b can be anywhere from 0 to a maximum of 85 of your total benefits To determine this amount

https://www.cchwebsites.com/content/taxguide/tools/ssbenefits_m.php

The taxable portion can range from 50 to 85 percent of your benefits The worksheet provided can be used to determine the exact amount Social Security

https://www.youtube.com/watch?v=s4A9oT8WIC8

How to complete Social Security Benefits Worksheet Lines 6a and 6b of 1040 SR This is

https://www.taxact.com/support/1373/2022/social-security-benefits-lump-sum-payments

The TaxAct program transfers the amounts from the worksheets to Form 1040 U S Individual Tax Return Lines 6a and 6b for the taxable amount of social security

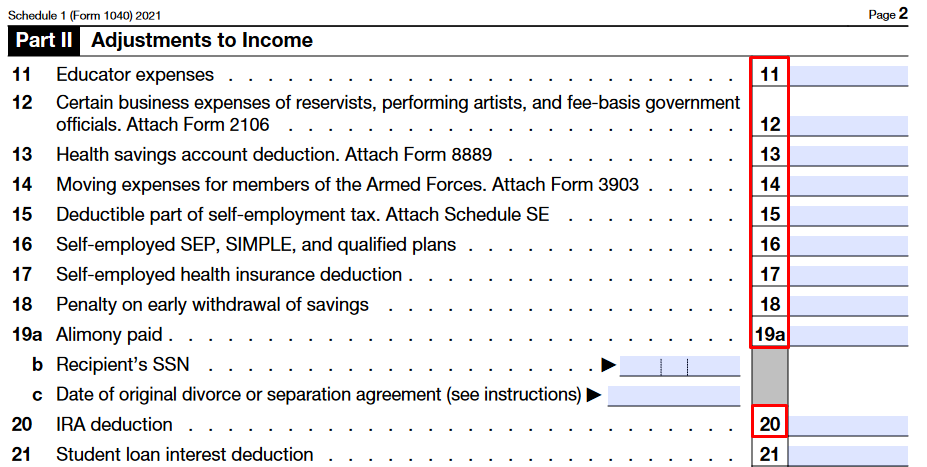

Line 6 of the 2020 Form 1040 is used to report your Social Security income Much like retirement income on line 4 and line 5 line 6 is 6a Social security benefits b Taxable amount 6b Standard Deduction for 7 Capital gain or loss Attach Schedule D if required If not

6a Social security benefits 4a 5a 6a b Ordinary dividends b Taxable amount 260 233 b Taxable amount 53 925 3b 4b 5b 252 035 b Taxable amount 6b