Ss Benefits Worksheet 2022 The worksheet is created as a refund if social security benefits that are partially or fully taxed are entered on the SSA screen If the benefits are not taxed

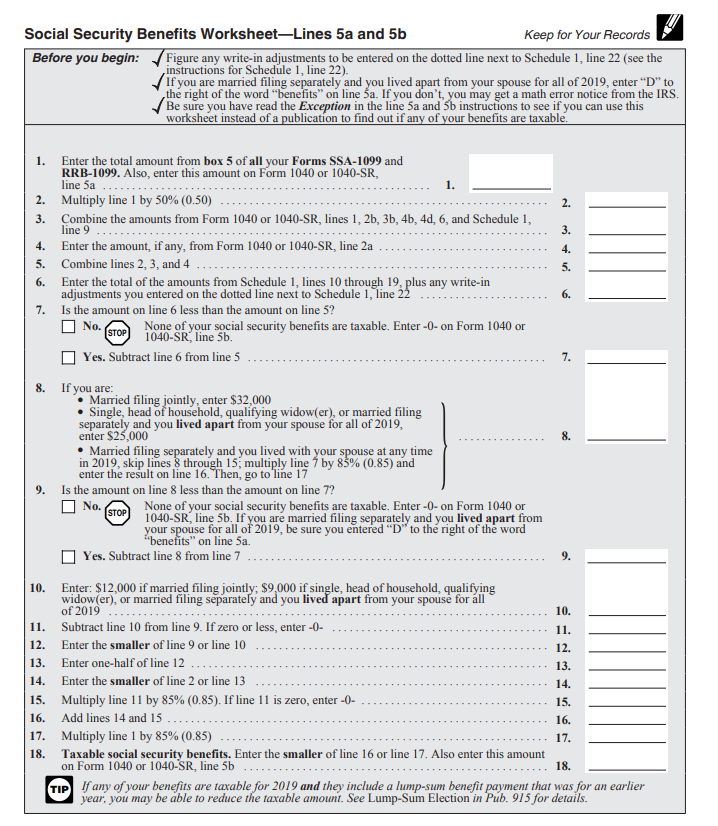

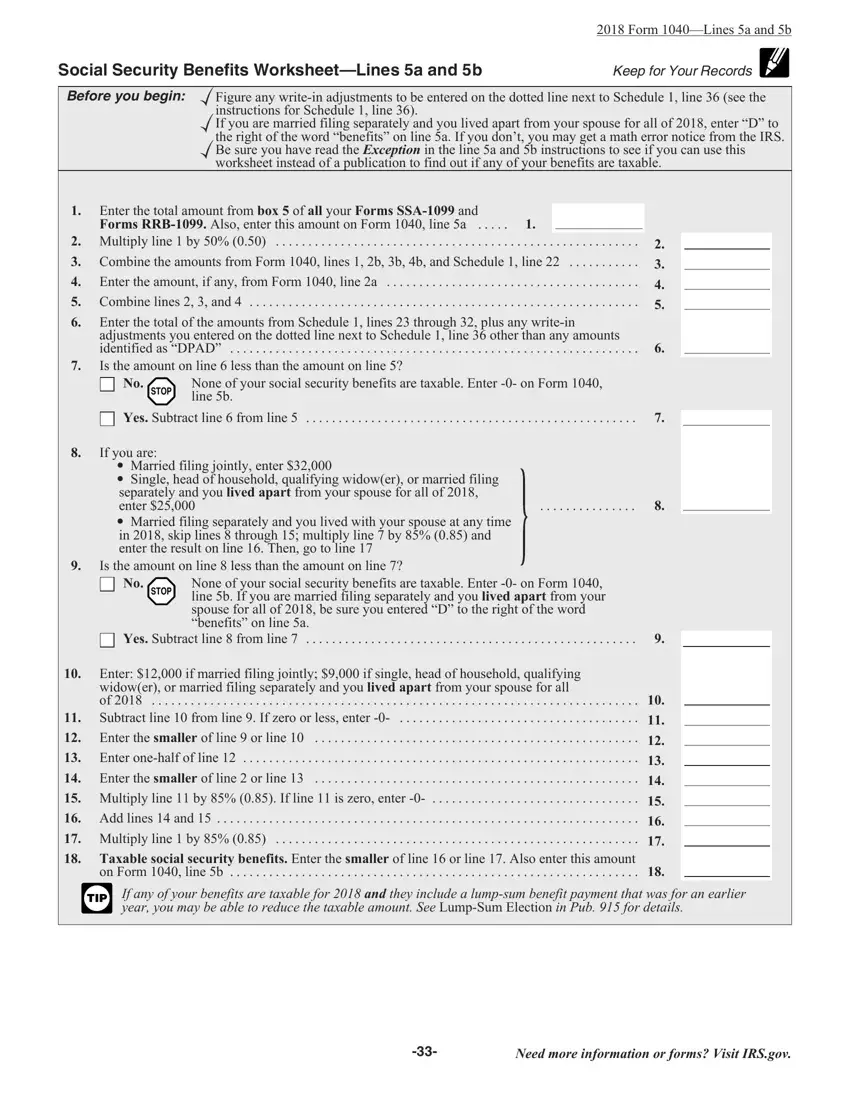

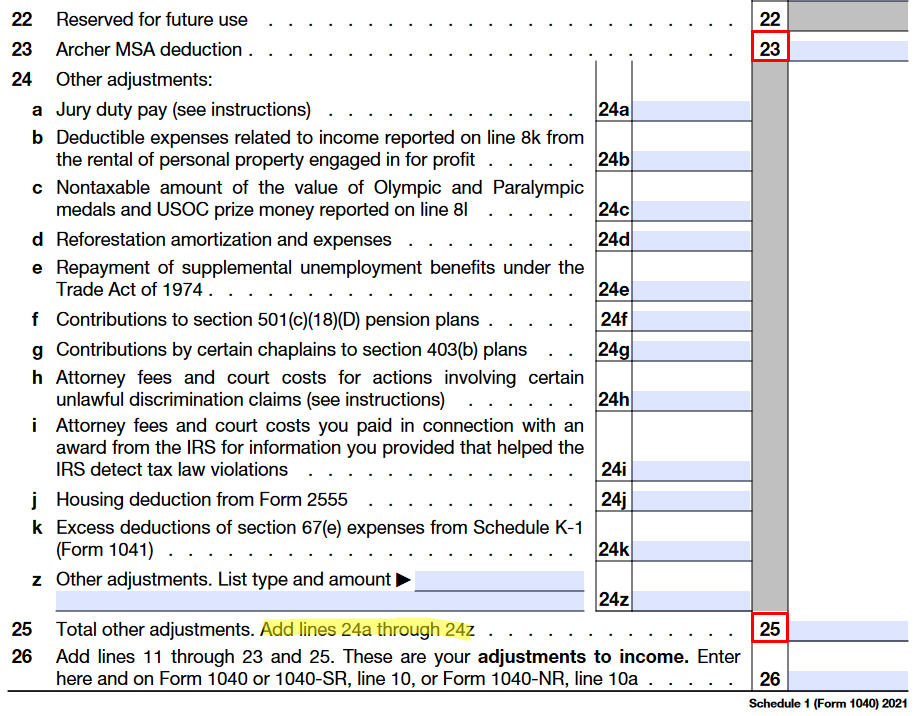

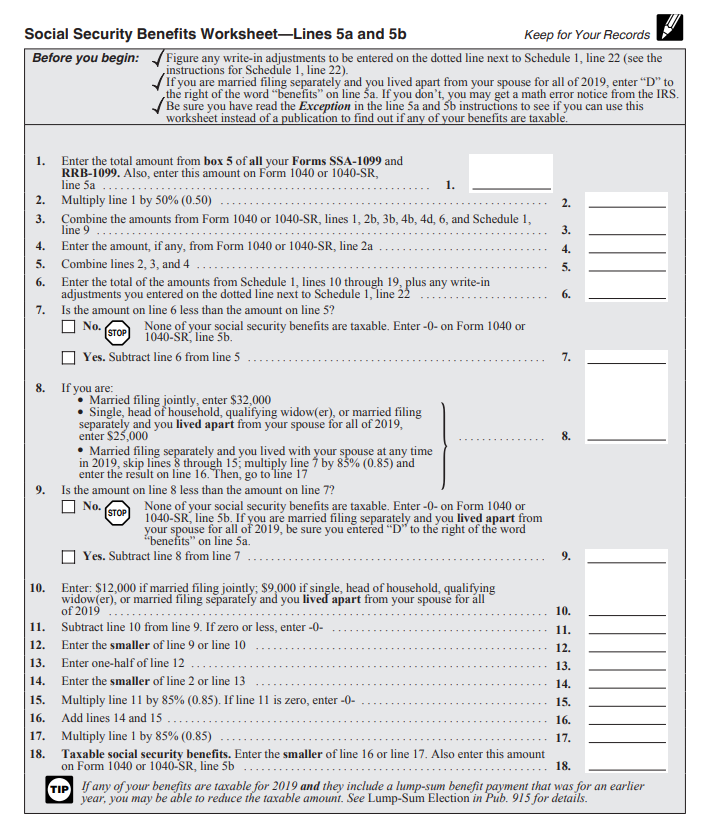

The IRS will not have Social Security worksheets available for tax year 2022 to calculate the amount of benefits that are taxable until late SOCIAL SECURITY WORKSHEET 1 Enter the amount from Box 5 of form s SSA 1099 2 Enter one half of line 1 amount 3 Add amounts from the federal form 1040 on

Ss Benefits Worksheet 2022

https://images.squarespace-cdn.com/content/v1/5b2c618596d455860e15ec8f/1609791972896-THBK30R3E77U3F9SENTO/Social+Security+Income+Calculations.PNG

This taxable benefit calculator makes it simple for you to show clients how much of their benefit is taxable Note that not everyone pays taxes on benefits

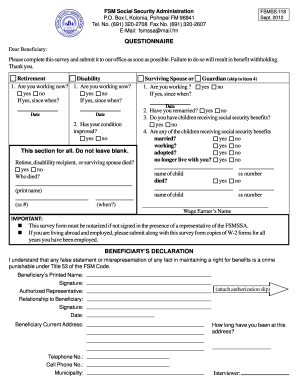

Templates are pre-designed files or files that can be utilized for numerous functions. They can save effort and time by offering a ready-made format and design for producing various type of material. Templates can be used for personal or expert tasks, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

Ss Benefits Worksheet 2022

Form 1040 Line 6: Social Security Benefits — The Law Offices of O'Connor & Lyon

Social Security Benefits Worksheet - Lines 20a and 20b

Social Security Benefits Worksheet 2022 Pdf - Fill Out and Sign Printable PDF Template | signNow

Lines 20A 20B ≡ Fill Out Printable PDF Forms Online

How to Calculate Taxable Social Security (Form 1040, Line 6b) – Marotta On Money

Publication 915 (2022), Social Security and Equivalent Railroad Retirement Benefits | Internal Revenue Service

https://www.irs.gov/pub/irs-pdf/n703.pdf

Enter the total amount from box 5 of ALL your 2022 Forms SSA 1099 Include the full amount of any lump sum benefit payments received in 2022 for 2022 and

https://www.taxact.com/support/1375/2022/social-security-benefits-worksheet-taxable-amount

This worksheet is based on the worksheet in IRS Publication 915 Social Security and Equivalent Railroad Retirement Benefits Note that any link in the

https://www.ssa.gov/benefits/retirement/planner/taxes.html

This Social Security planner page explains when you may have to pay income taxes on your Social Security benefits

https://www.cchwebsites.com/content/taxguide/tools/ssbenefits_m.php

The taxable portion can range from 50 to 85 percent of your benefits The worksheet provided can be used to determine the exact amount Social Security

https://tax.ri.gov/sites/g/files/xkgbur541/files/2022-12/Social%20Security%20Worksheet_w.pdf

2022 Modification Worksheet Taxable Social Security Income Worksheet Enter Eligible percentage of social security benefits Divide line 9 by line 8

What is the Social Security benefits worksheet used to determine Things get more complex if you re paying taxes on 85 of your benefits However the IRS helps taxpayers by offering software and a worksheet to

Taxable Social Security Worksheet 2023 Get a fillable Social Security Benefits Worksheet 2022 PDF template online Complete and sign it in seconds from