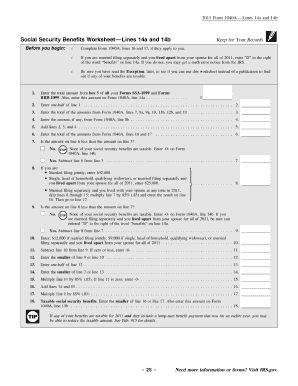

Taxability Of Social Security Worksheet income for purposes of computing the alternate tax on line 39 NOTE This also affects you if you are single and use the Tax Reduction Worksheet The

Financial advisors know the importance of social security Use this calculator to explain to this growing clientele how their benefits are taxed worksheet to calculate Social Security tax liability How to File Social Security Income on Your Federal Taxes Once you calculate the amount

Taxability Of Social Security Worksheet

Taxability Of Social Security Worksheet

Taxability Of Social Security Worksheet

https://www.pdffiller.com/preview/6/963/6963800/large.png

None of the benefits are taxable for 2019 3 Use the worksheet in IRS Pub 915 if any of the following apply Form 2555 Foreign Earned Income is

Pre-crafted templates offer a time-saving solution for developing a varied range of documents and files. These pre-designed formats and layouts can be used for different personal and professional tasks, including resumes, invitations, flyers, newsletters, reports, discussions, and more, improving the material development procedure.

Taxability Of Social Security Worksheet

How to Calculate Taxable Social Security (Form 1040, Line 6b) – Marotta On Money

2021-2023 Form IRS Publication 915Fill Online, Printable, Fillable, Blank - pdfFiller

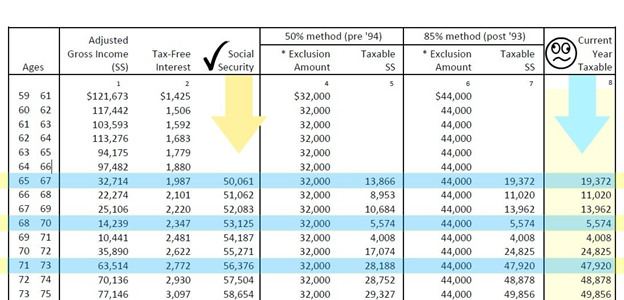

Calculating Taxable Social Security Benefits - Not as Easy as 0%, 50%, 85% | Moneytree Software

Social Security Benefits Worksheet 2022 Pdf - Fill Online, Printable, Fillable, Blank | pdfFiller

Social Security Benefits Worksheet 2022 Pdf - Fill Online, Printable, Fillable, Blank | pdfFiller

Social Security Benefits Worksheet

https://www.irs.gov/pub/irs-pdf/n703.pdf

Read This To See if Your Social Security Benefits May Be Taxable If your Do not use the worksheet below if any of the following apply to you instead go

https://www.ssa.gov/benefits/retirement/planner/taxes.html

More than 44 000 up to 85 percent of your benefits may be taxable are married and file a separate tax return you probably will pay taxes on your benefits

https://www.cchwebsites.com/content/taxguide/tools/ssbenefits_m.php

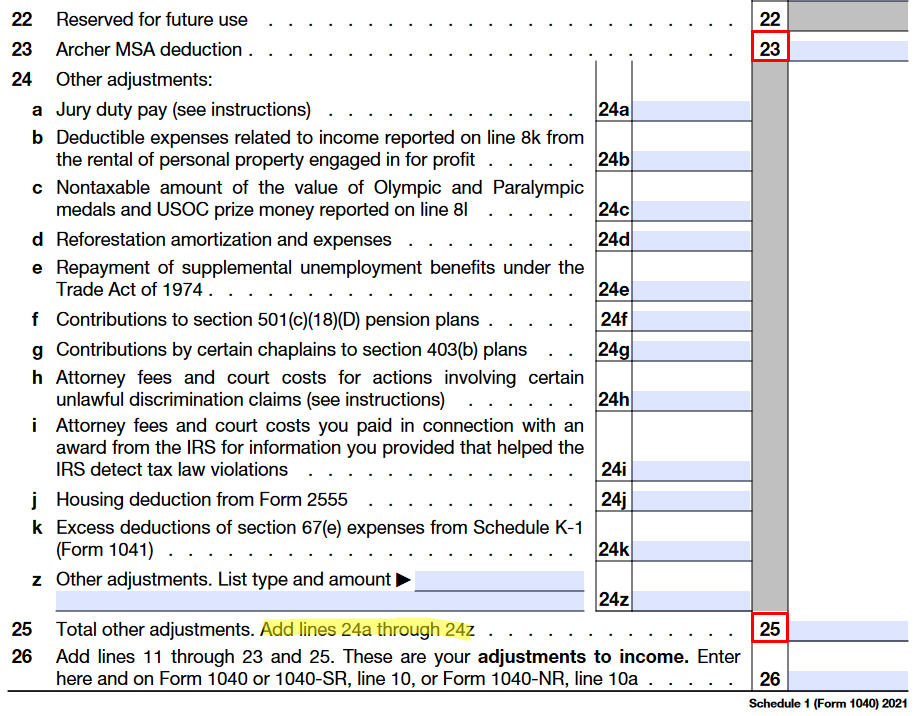

Worksheet to Figure Taxable Social Security Benefits Many of those who receive Social Security retirement benefits will have to pay income tax on some or

https://www.taxact.com/support/1375/2022/social-security-benefits-worksheet-taxable-amount

If your income is modest it is likely that none of your Social Security benefits are taxable As your gross income increases a higher percentage of your

https://tax.ri.gov/sites/g/files/xkgbur541/files/2022-12/Social%20Security%20Worksheet_w.pdf

Taxable Social Security Income Worksheet Enter your spouse s date of birth if MODIFICATION FOR TAXABLE SOCIAL SECURITY INCOME WORKSHEET STEP 1

A person cannot file Form 1040EZ if they have taxable social security benefits The person must file Form 1040 or Form 1040A If you have social security Free social security taxable benefits Calculator Use this calculator to estimate how much of your Social Security benefit is subject to income taxes

Create your account and manage tax forms online See more social security worksheet versions We ve got more versions of the social security worksheet form