Turbotax Carryover Worksheet Total Withheld Pmts Must Be Entered For each line enter a total in the boxes to the right and complete the calculation The number of exemptions you are claiming must be entered in the boxes

If Maryland tax was withheld from your income in error you must file to obtain a refund Complete all of the information at the top of the Form 505 including Complete the Part year resident income allocation worksheet below to determine your New York State source income Part year resident income

Turbotax Carryover Worksheet Total Withheld Pmts Must Be Entered

Turbotax Carryover Worksheet Total Withheld Pmts Must Be Entered

Turbotax Carryover Worksheet Total Withheld Pmts Must Be Entered

http://files.cchsfs.com/doc/atx/2016/Help/Content/Resources/Images/Forms_TaxSumCarry_650x198.png

Enter your total 2022 estimated payments Include your spouse s 2022 agreement state and your employer is not withholding PA tax you must make PA estimated

Templates are pre-designed documents or files that can be utilized for various purposes. They can conserve effort and time by offering a ready-made format and layout for creating various kinds of content. Templates can be used for personal or expert tasks, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

Turbotax Carryover Worksheet Total Withheld Pmts Must Be Entered

Carryover Worksheet Automatic Entry

Federal carryover worksheet total withheld pmts

Tax Year Prior to 2020: Total Refund Received in 2018 & Total of all your payments and withholding & 1099G

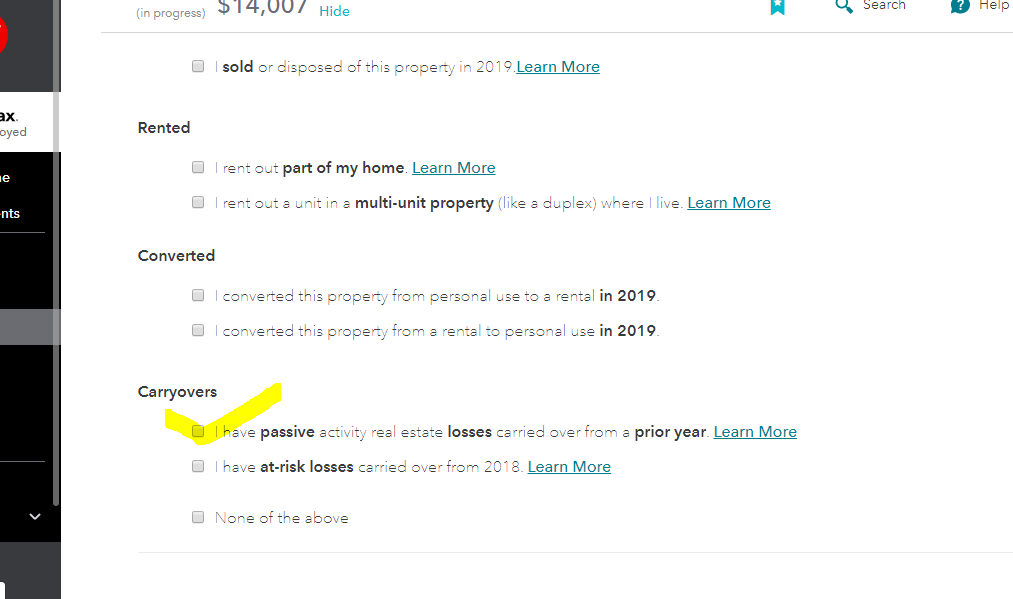

Solved: Passive loss carryover form boxes

2013RossettiLForm1040IndividualTaxReturn Records - Electronic Filing Instructions for your 2013 Federal Tax Return Important: Your taxes are not | Course Hero

Using 2019 carry over foreign tax credit

https://www.reddit.com/r/IRS/comments/10mb40o/total_withheldpmts/

Carryover Worksheet Total withheld pmts must be entered from what I can tell it with forum help it s zero

https://groups.google.com/g/misc.taxes.moderated/c/IaCmKp_fCnI

In 2010 I had an 1076 overpayment and column f Total Overpayment shows this amount However column e Paid With Return shows an 1 278 amount I don t

http://files.cchsfs.com/doc/atx/2016/Help/Content/Both-SSource/Tax%20Summary%20Carryover%20Worksheet.htm

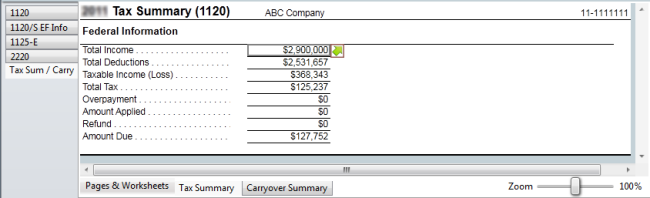

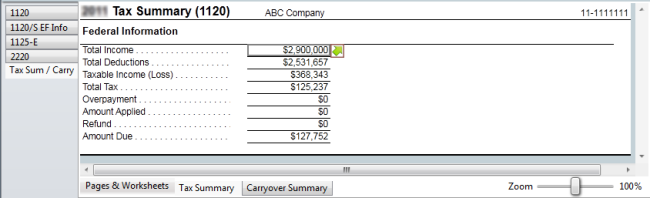

The Tax Summary Carryover worksheet is a two part worksheet that can be added to a return via the Forms menu The Tax Summary gives you an at a glance view of

https://www.irs.gov/instructions/i1040sd

Enter on Schedule D line 13 the total capital gain distributions paid to you during the year regardless of how long you held your investment

https://www.irs.gov/pub/irs-pdf/p536.pdf

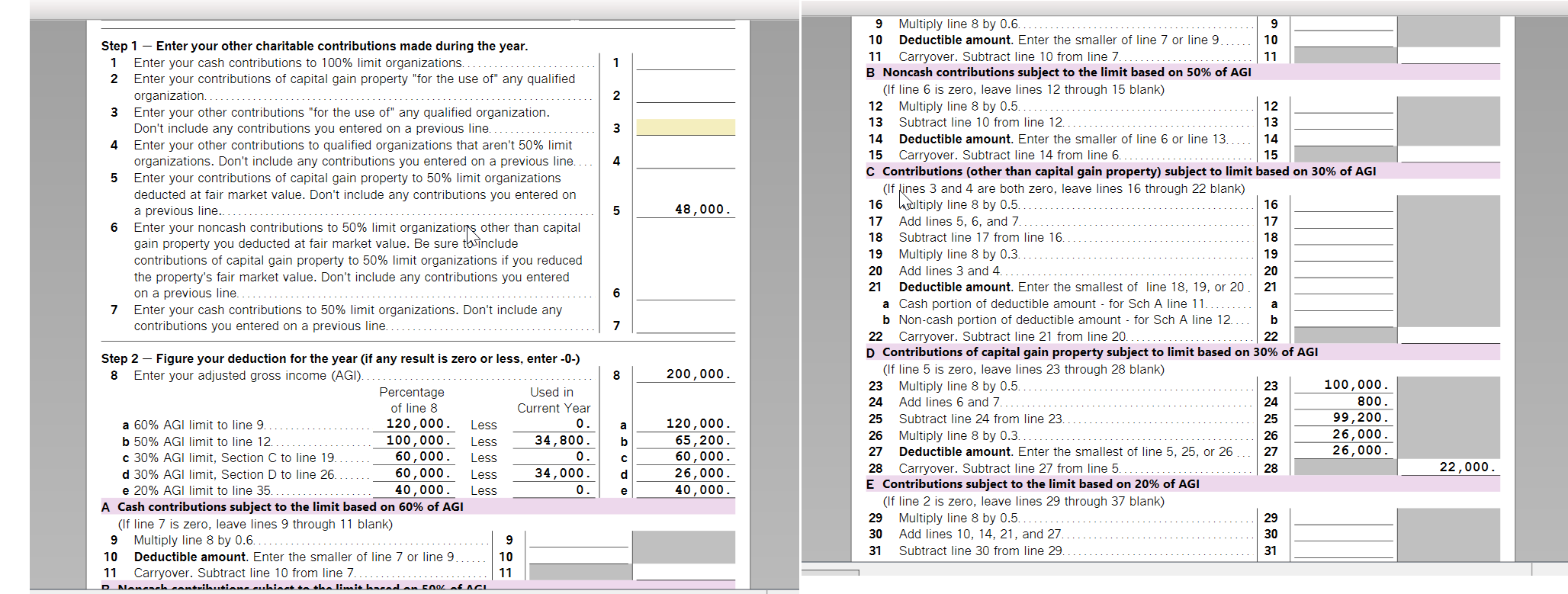

You cannot deduct any NOL carryovers or carrybacks from other years Enter the total amount of your NOL deduction for losses from other years Worksheet 1

Also you do not have to make estimated tax payments if you will pay enough through withholding to keep the amount you owe with your tax return under 500 250 The total taxable income of the PTE must be greater than or equal to 0 and Enter the total amount withheld for all nonresident owners from Line e of

State and local income taxes withheld Form MW508CR must be submitted with To claim the total credit you must complete a second Part H I at the time