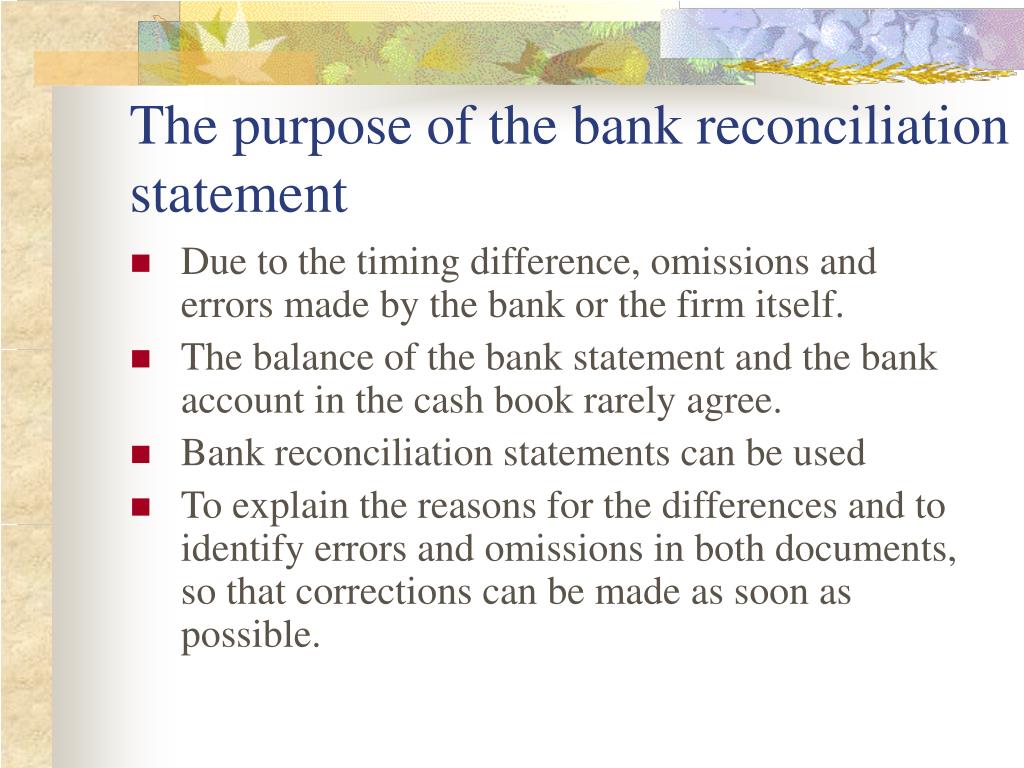

What Are The Purpose Of Bank Reconciliation WEB The bank reconciliation is the internal financial report that explains and documents any differences that may exist between the balance of a checking account as reflected by the bank s records bank balance for a company and the company s accounting records company balance

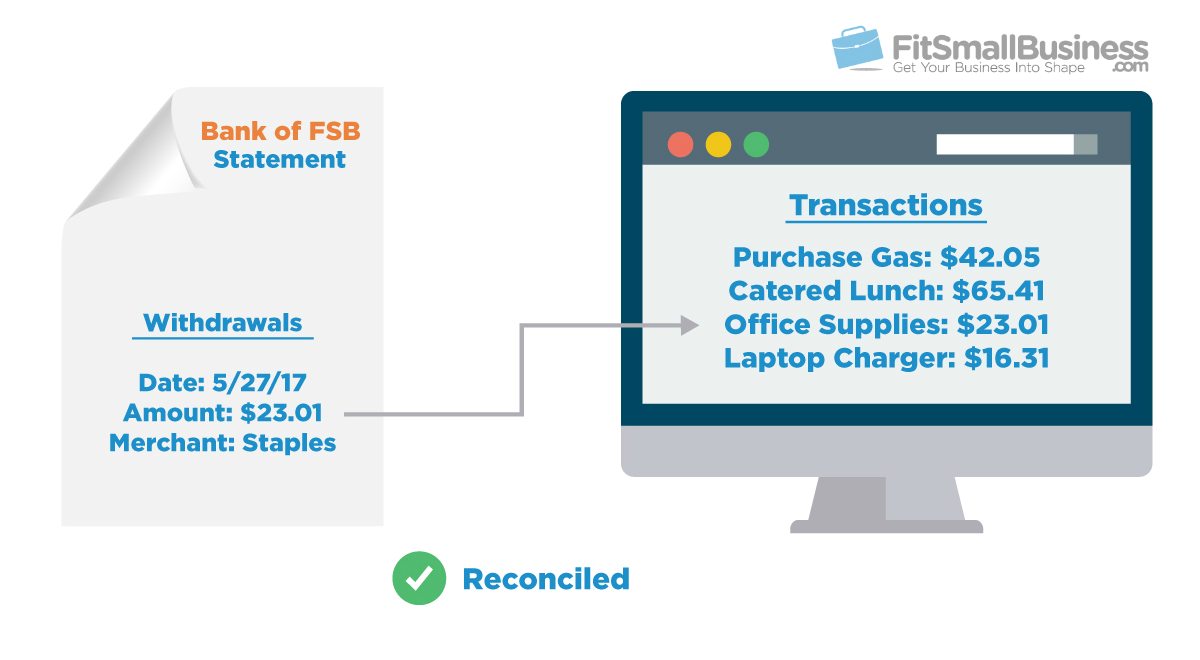

WEB A bank reconciliation is matching information regarding cash accounts from accounting records to the corresponding information on bank statements Simply put a reconciliation is how a business makes sure it has the cash it thinks it has While financial statements like the general ledger indicate how much money a business should have WEB Jun 11 2021 0183 32 Reconciliation is an accounting process that ensures that the actual amount of money spent matches the amount shown leaving an account at the end of a fiscal

What Are The Purpose Of Bank Reconciliation

What Are The Purpose Of Bank Reconciliation

What Are The Purpose Of Bank Reconciliation

https://www.freshbooks.com/wp-content/uploads/2022/02/do-bank-reconciliation.jpg

WEB Jun 21 2023 0183 32 Bank reconciliation is the process of comparing your company s bank statements to your own records ensuring all transactions are accounted for An effective bank reconciliation process can identify any discrepancies in your company s records and help prevent fraud and theft from your bank account If you weren t to

Pre-crafted templates provide a time-saving service for creating a varied variety of files and files. These pre-designed formats and layouts can be used for different individual and professional tasks, consisting of resumes, invites, flyers, newsletters, reports, discussions, and more, improving the material production process.

What Are The Purpose Of Bank Reconciliation

Bank Reconciliation Statement Bartleby

Bank Reconciliation Template Excel Templates Excel Templates

What Is The Bank Reconciliation Purpose

A Guide To BANK RECONCILIATION STATEMENT Read This Notes With PDF

Bank Reconciliation What It Is How It Works Examples

Example Bank Reconciliation YouTube

https://quickbooks.intuit.com/global/resources/

WEB Jul 25 2022 0183 32 Bank reconciliation is the process of comparing the balance as per the cash book with the balance as per the passbook bank statement The very purpose of reconciling the bank statement with your business books of accounts is to identify any differences between the balance of the two accounts

https://www.investopedia.com/terms/b/bankreconciliation.asp

WEB Aug 19 2023 0183 32 Key Takeaways A bank reconciliation statement summarizes banking and business activity comparing the bank s account balance with internal financial records Bank

https://www.accountsiq.com/accounting-glossary/why

WEB The main purpose of a bank reconciliation statement BRS is to help companies identify errors that can affect their tax and financial reporting Bank reconciliations are also an essential way to prevent and detect fraud

https://corporatefinanceinstitute.com/resources/

WEB Written by CFI Team What is a Bank Reconciliation A bank reconciliation statement is a document that compares the cash balance on a company s balance sheet to the corresponding amount on its bank statement Reconciling the two accounts helps identify whether accounting changes are needed

https://www.moderntreasury.com/questions/what-is

WEB The main purpose of bank reconciliation is to ensure that a company s finances are correctly documented Especially for companies that move money this process helps guarantee product accuracy and correct internal bookkeeping

WEB Aug 29 2022 0183 32 Bank reconciliation is used to identify justify and align these mismatches and provide the most accurate possible picture of cash flow The reconciliation process requires business owners to understand some key accounting concepts such as NSF checks and deposits in transit WEB Nov 21 2023 0183 32 A bank reconciliation is a tool for balancing the differences between a company s check register cash account and its bank account It is important because it

WEB In summary the purpose of a bank reconciliation is quite simple it ensures accurate tracking of all financial transactions detects errors or frauds early enough before they cause significant damage aids proper bookkeeping practices and guarantees efficient budget management How to reconcile your bank statements