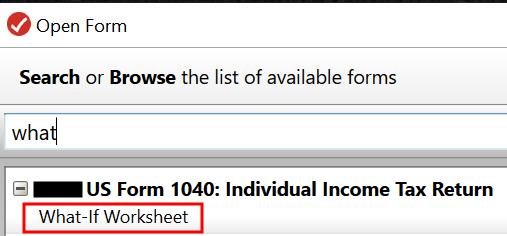

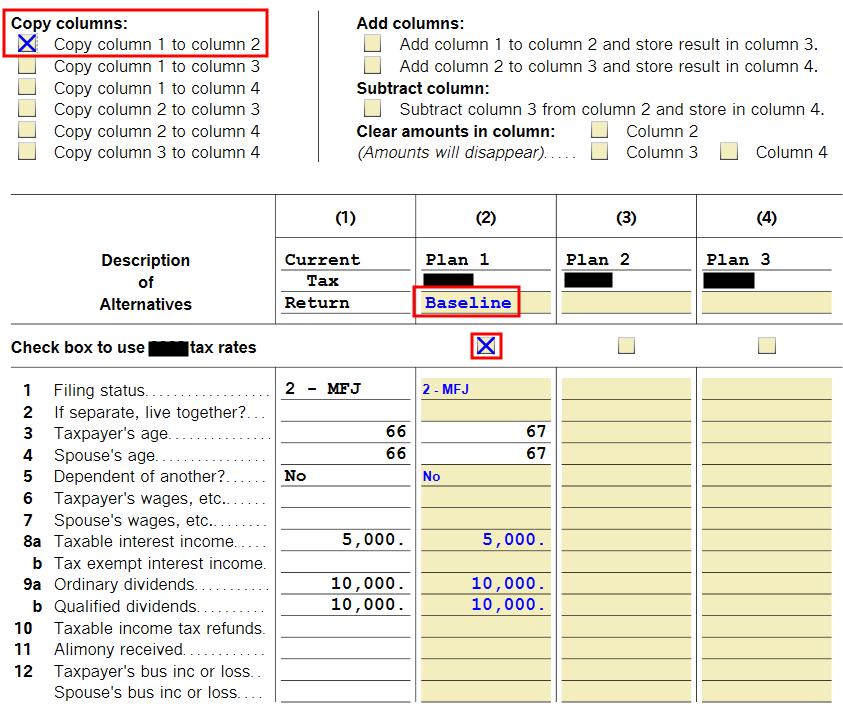

What If Worksheet Turbotax This is where TT looks at all the possible ways to deal with your college expenses It uses the numbers from this worksheet to pick the best tax strategy for

Interactive eBooks incorporate multimedia elements quizzes and activities enhancing the reader engagement and providing a more immersive learning experience TurboTax Desktop you can first put in a Married Filing Joint return then switch to Forms open

What If Worksheet Turbotax

What If Worksheet Turbotax

What If Worksheet Turbotax

https://thefinancebuff.com/wordpress/wp-content/uploads/2023/05/tt-what-if-05-total-tax.jpg

The one or two page W2 Worksheet gives you background information and the documents for your fictional user You will be filing taxes for that person

Pre-crafted templates offer a time-saving solution for developing a diverse range of files and files. These pre-designed formats and designs can be used for various personal and professional tasks, including resumes, invitations, flyers, newsletters, reports, presentations, and more, enhancing the material creation process.

What If Worksheet Turbotax

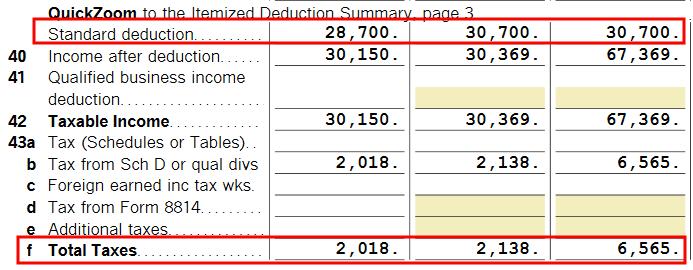

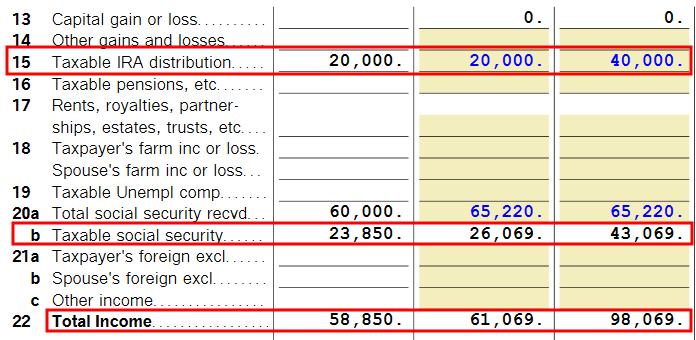

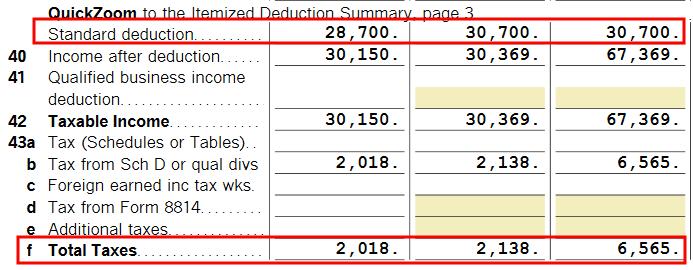

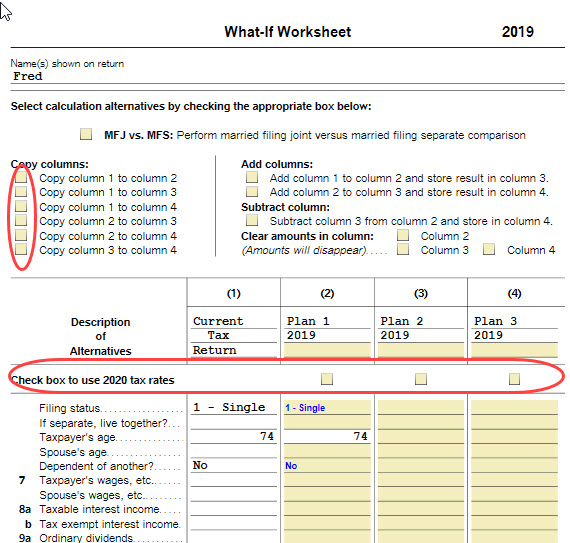

Tax Planning with TurboTax What-If Worksheet: Roth Conversion

For a new LLC in service this year, where my property has been depreciated for 17 years already, How do I override the 27.5 years to get the proper depreciation amount?

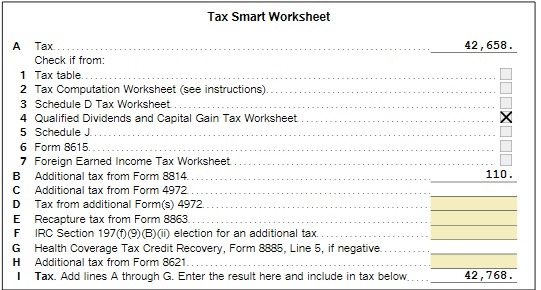

total of payments and withholdings

Tax Planning with TurboTax What-If Worksheet: Roth Conversion

How do I display the Tax Computation Worksheet?

Solved: The tax reported on 1040 Ln 16 does not with IRS Pub 17 Tax Tables.

https://groups.google.com/g/alt.comp.software.financial.quicken/c/jMFm9vzoD00

I have been using Turbotax for several years and have never been able to access the What if worksheet from the Tools menu It would be

https://www.bogleheads.org/forum/viewtopic.php?t=308170

I use the What If Worksheet mentioned above It consolidates everything into one form which makes it easy to see what s going on and have

https://thefinancebuff.com/turbotax-what-if-planning-roth-conversion.html

The What If Worksheet in TurboTax doesn t show the marginal tax rate directly You have to calculate it yourself by dividing the difference in

https://anniversary.mnu.edu/worksheet/turbotax-what-if-worksheet.html

what if worksheet what is the what if worksheet and how do i get around it when filing my taxes in online turbotax there is no forms function and the

https://pxdj.startapps.org/what-if-worksheet-turbotax/82233114

What if worksheet turbotax Web5 giu 2019 TurboTax login Compare TurboTax products All online tax preparation software Free Edition tax filing

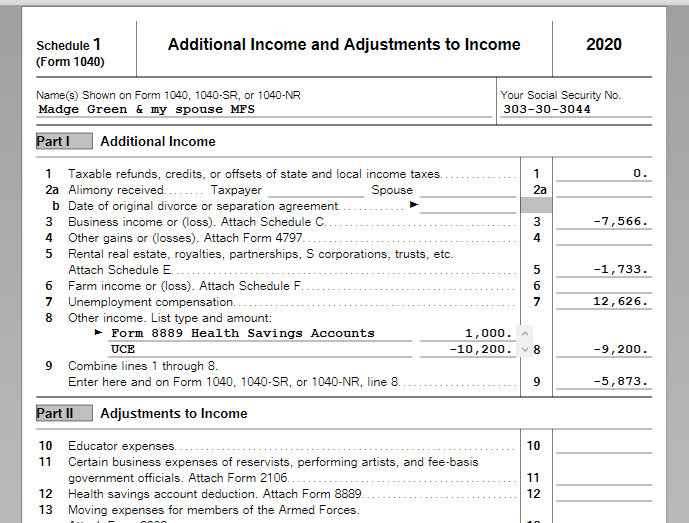

Enter the amount from line 3 of the Foreign Earned Income Tax Worksheet as the parent s taxable income on line 6 of Form 8615 Line 7 If the tax return Complete Credit Limit Worksheet B only if you meet all of the following You are claiming one or more of the following credits a Mortgage

Think this depends on the complexity of your return If youre a plain vanilla individual tax filer with employment income and investments then