What Is Included In Clergy Housing Allowance WEB The clergy housing allowance sometimes called a parsonage allowance or a rental allowance is an allowance paid to ordained ministers and rabbis in Canada and the United States

WEB Jun 12 2024 0183 32 Housing allowance A licensed commissioned or ordained minister who performs ministerial services as an employee may be able to exclude from gross income the fair rental value of a home provided as part of compensation a parsonage or a housing allowance provided as compensation if it is used to rent or otherwise provide a home WEB Dec 9 2021 0183 32 Housing Allowance for Interim Clergy Interim position for an indefinite period or lasts for more than one year even one day longer and requires relocation Interim residence considered primary residence for tax purposes from the first day in position

What Is Included In Clergy Housing Allowance

What Is Included In Clergy Housing Allowance

What Is Included In Clergy Housing Allowance

https://imageio.forbes.com/specials-images/imageserve/566994817/0x0.jpg?format=jpg&width=1200

WEB Oct 23 2019 0183 32 Many churches provide housing a parsonage or a housing allowance for their clergy members as part of their overall compensation package The tax treatment of such housing whether provided directly or as a stipend is an important benefit for ministers

Pre-crafted templates use a time-saving service for creating a varied variety of files and files. These pre-designed formats and layouts can be made use of for different individual and professional projects, including resumes, invites, leaflets, newsletters, reports, presentations, and more, improving the material creation process.

What Is Included In Clergy Housing Allowance

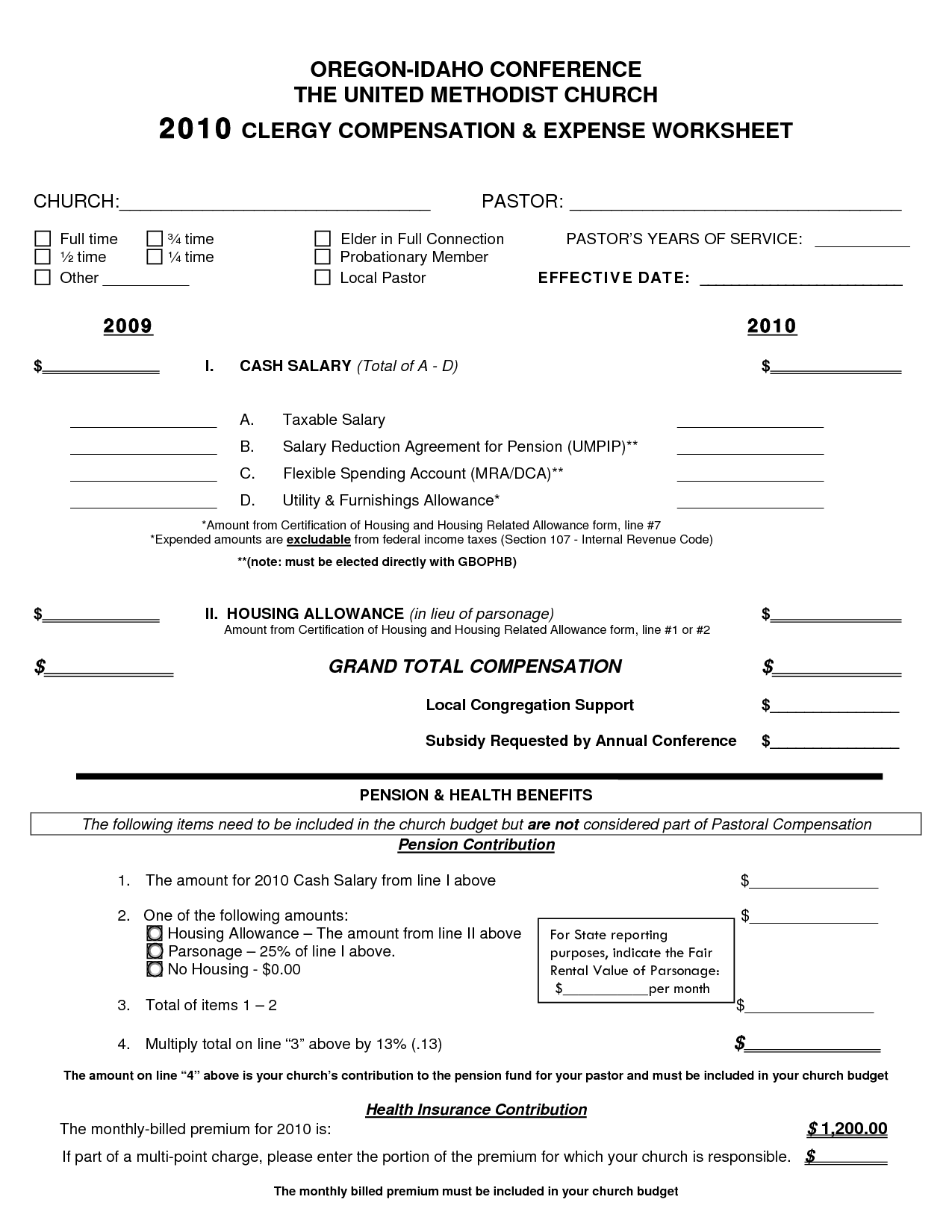

Housing Allowance For Pastors Worksheet Label E Journal Art Gallery

What Is Included In A Standard Cleaning Philadelphia House Cleaning

20 Church Monthly Budget Worksheet Worksheeto

Atheist Watchdog Drops Fight To Halt Clergy Housing Allowance United

Clergy Housing Allowance Is Constitutional Appeals Court Rules

Housing Allowance For Pastors The Ultimate Guide 2023 Edition

https://www.ascensioncpa.com/clergy/everything

WEB What Can Be Included in a Housing Allowance A housing allowance may include expenses related to renting purchasing which may consist of down payments or mortgage payments and or maintaining a clergy member s current home It may not encompass expenses incurred as the result of commercial properties or vacation homes

https://www.irs.gov//ministers-compensation-housing-allowance

WEB Apr 29 2024 0183 32 For more information on a minister s housing allowance refer to Publication 517 Social Security and Other Information for Members of the Clergy and Religious Workers For information on earnings for clergy and reporting of self employment tax refer to Tax Topic 417 Earnings for Clergy

.jpg?w=186)

https://churchbenefits.org/wp-content/uploads/2022/

WEB A housing allowance is a portion of clergy income that may be excluded from income for federal income tax purposes W 2 quot Box 1 quot wages under Section 107 of the Internal Revenue Code

https://pastorswallet.com/housing-allowance-questions-answered

WEB Mar 6 2023 0183 32 If you have not opted out of Social Security you need to include the housing allowance amount as income when calculating your self employment taxes What expenses can be included in the housing allowance A housing allowance can cover Down payment on a home purchase Mortgage principal and interest payments Property taxes

https://reachrightstudios.com/guide-housing-allowance-for-pastors

WEB Here are some frequently asked questions about the housing allowance for pastors with some helpful answers What is the Clergy Housing Allowance Clarification Act of 2002 The Clergy Housing Allowance Clarification Act of 2002 amended the 1986 parsonage allowance exclusion and clarified a few points Section 107 of the IRC reads

WEB The housing allowance is sometimes called a parsonage allowance for clergy who are provided with a parsonage and a rental allowance for clergy who rent their home Example A church pays its pastor an annual salary of 35 000 In addition she is provided the rent free use of a furnished home owned by the church WEB The Clergy Housing Allowance is a portion of a Minister s pay that has been designated to pay housing expenses It is considered one of the best tax benefits currently available to Clergy because this portion of income can potentially be exempt from income taxes

WEB In retirement clergy may still be eligible to claim the clergy housing allowance Your pension distributions from The Church Pension Fund Clergy Pension Plan e g pension benefit 13th check and resettlement benefit are designated as eligible for the clergy housing allowance exclusion by the Board of Trustees of The Church Pension Fund