2022 Social Security Benefits Worksheet The worksheet is created as a refund if social security benefits that are partially or fully taxed are entered on the SSA screen If the benefits are not taxed

Social Security Retirement Supplemental Security Income SSI recipients received a cost of living increase of 1 3 for Calendar Year 2021 The standard 2021 The IRS will not have Social Security worksheets available for tax year 2022 to calculate the amount of benefits that are taxable until late

2022 Social Security Benefits Worksheet

https://images.squarespace-cdn.com/content/v1/5b2c618596d455860e15ec8f/1609791972896-THBK30R3E77U3F9SENTO/Social+Security+Income+Calculations.PNG

Within the pages of Social Security Benefits Worksheet For 2022 a mesmerizing literary creation penned by way of a celebrated wordsmith readers embark on an

Templates are pre-designed documents or files that can be utilized for various purposes. They can save time and effort by providing a ready-made format and layout for producing different type of material. Templates can be utilized for personal or expert projects, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

2022 Social Security Benefits Worksheet

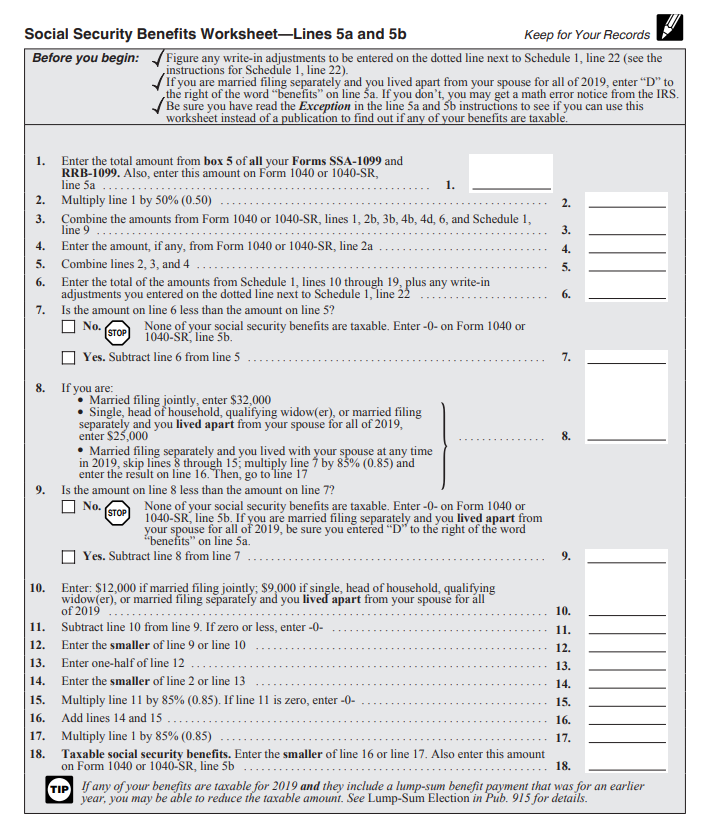

Form 1040 Line 6: Social Security Benefits — The Law Offices of O'Connor & Lyon

Social Security Benefits Worksheet 2022 Pdf - Fill Online, Printable, Fillable, Blank | pdfFiller

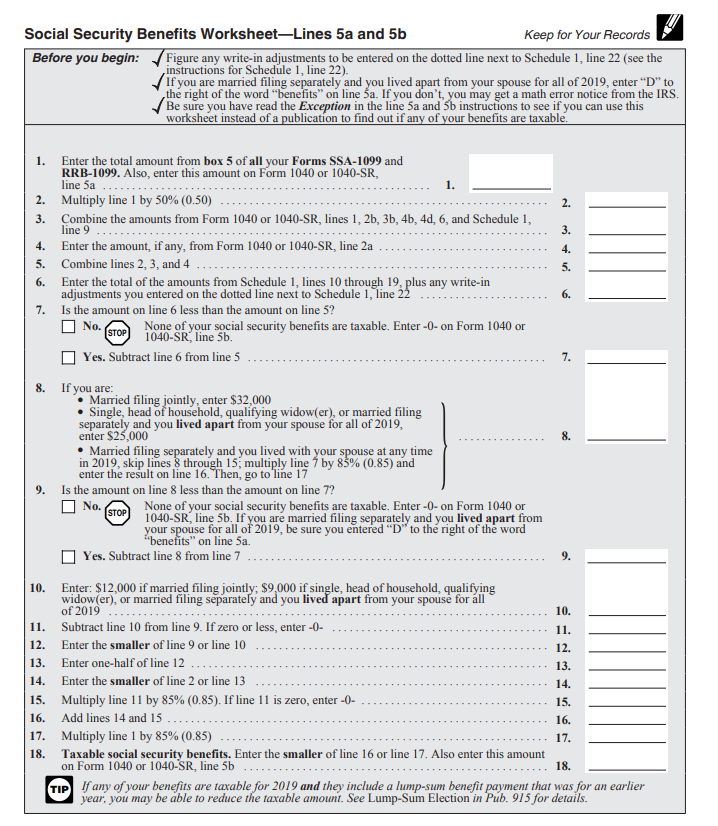

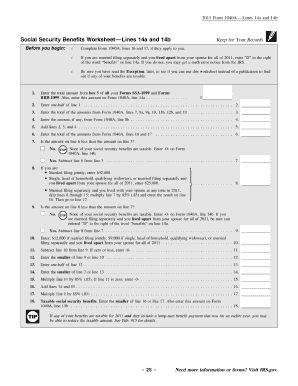

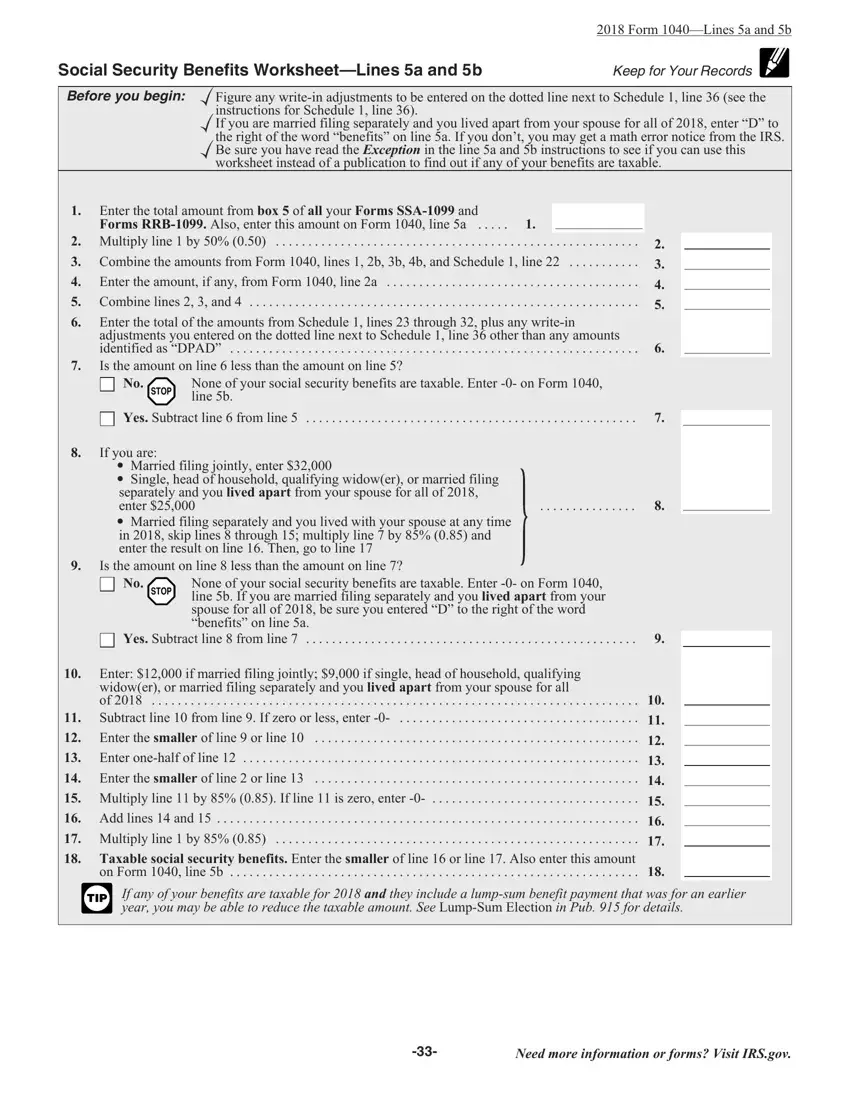

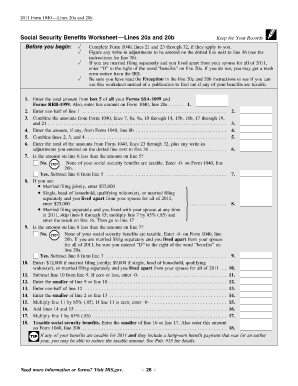

Social Security Benefits Worksheet - Lines 20a and 20b

2021-2023 Form IRS Publication 915Fill Online, Printable, Fillable, Blank - pdfFiller

Publication 915 (2022), Social Security and Equivalent Railroad Retirement Benefits | Internal Revenue Service

Lines 20A 20B ≡ Fill Out Printable PDF Forms Online

https://www.irs.gov/pub/irs-pdf/n703.pdf

Read This To See if Your Social Security Benefits May Be Taxable If your Form SSA 1042S or Form RRB 1042S You exclude income from sources outside the

https://www.taxact.com/support/1375/2022/social-security-benefits-worksheet-taxable-amount

If your income is modest it is likely that none of your Social Security benefits are taxable As your gross income increases a higher percentage of your

https://www.cchwebsites.com/content/taxguide/tools/ssbenefits_m.php

Many of those who receive Social Security retirement benefits will have to pay income tax on some or all of those payments More specifically if your total

https://www.ssa.gov/benefits/retirement/planner/taxes.html

Each January you will receive a Social Security Benefit Statement Form SSA 1099 showing the amount of benefits you received in the previous year You can

https://tax.ri.gov/sites/g/files/xkgbur541/files/2022-12/Social%20Security%20Worksheet_w.pdf

2022 Modification Worksheet Taxable Social Security Income Worksheet Enter Amount of social security benefits from Federal Form 1040 or 1040 SR line

2022 45 Filing status Choose your filing status The Filing Status table Employer provided adoption benefits excluded from your income form 8839 Social Security and Equivalent Jan 13 2022 Your benefits aren t taxable for 2021 because your income as figured in Worksheet A isn t more than your

So the taxable amount that you would enter on your federal income tax form is 5 000 because it is lower than half of your annual Social