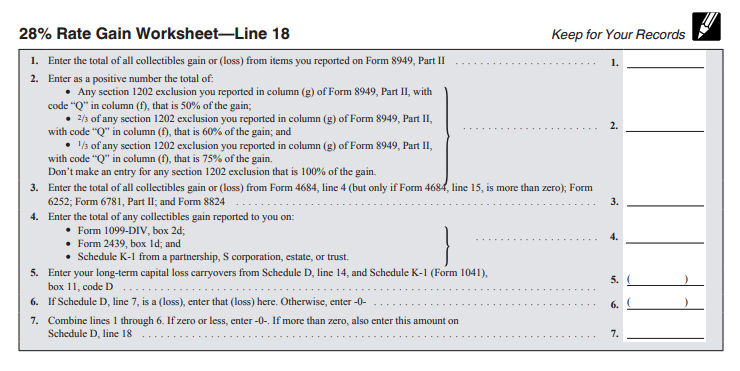

28 Rate Gain Worksheet If you are completing line 18c of Schedule D enter as a positive number the amount of your allowable exclusion on line 2 of the 28 Rate Gain Worksheet if

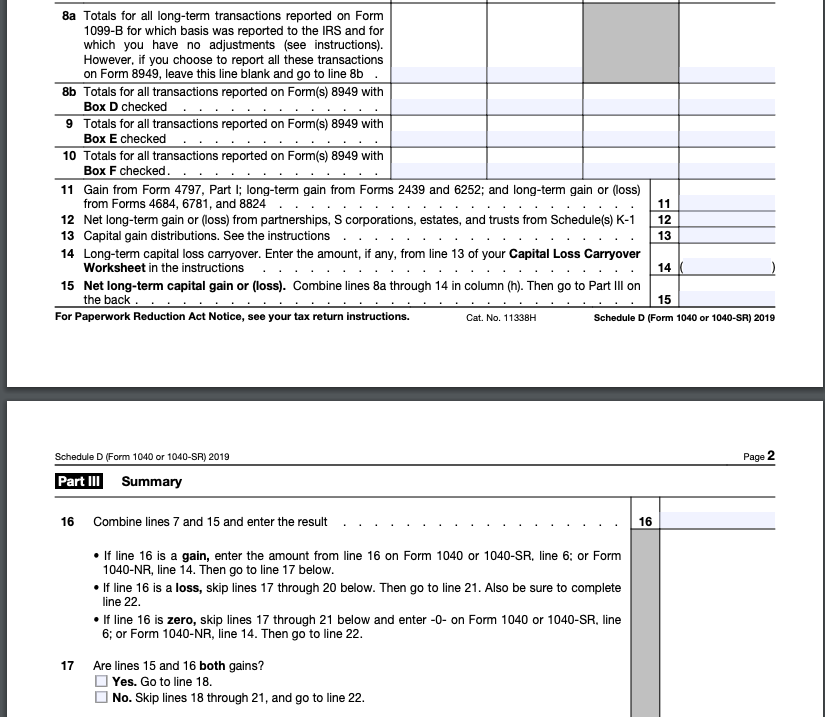

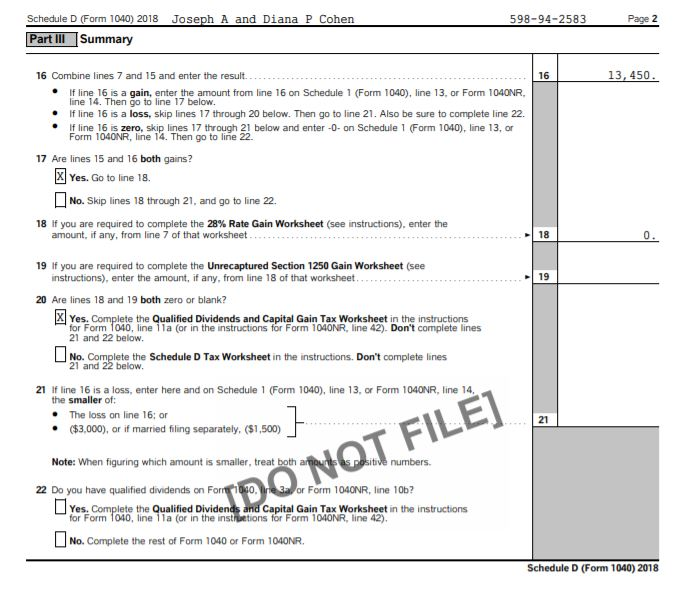

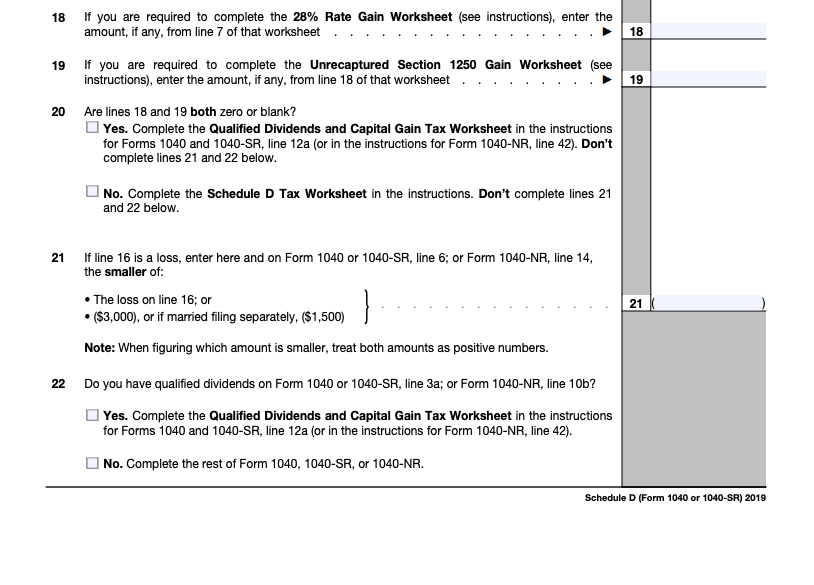

If there is an amount on Line 18 from the 28 Rate Gain Worksheet or Line 19 from the Unrecaptured Section 1250 Gain Worksheet of Schedule D Form 1040 Most taxpayers who file Schedule D do not have amounts on line 18 which contains capital gain taxed at the 28 rate or line 19 where

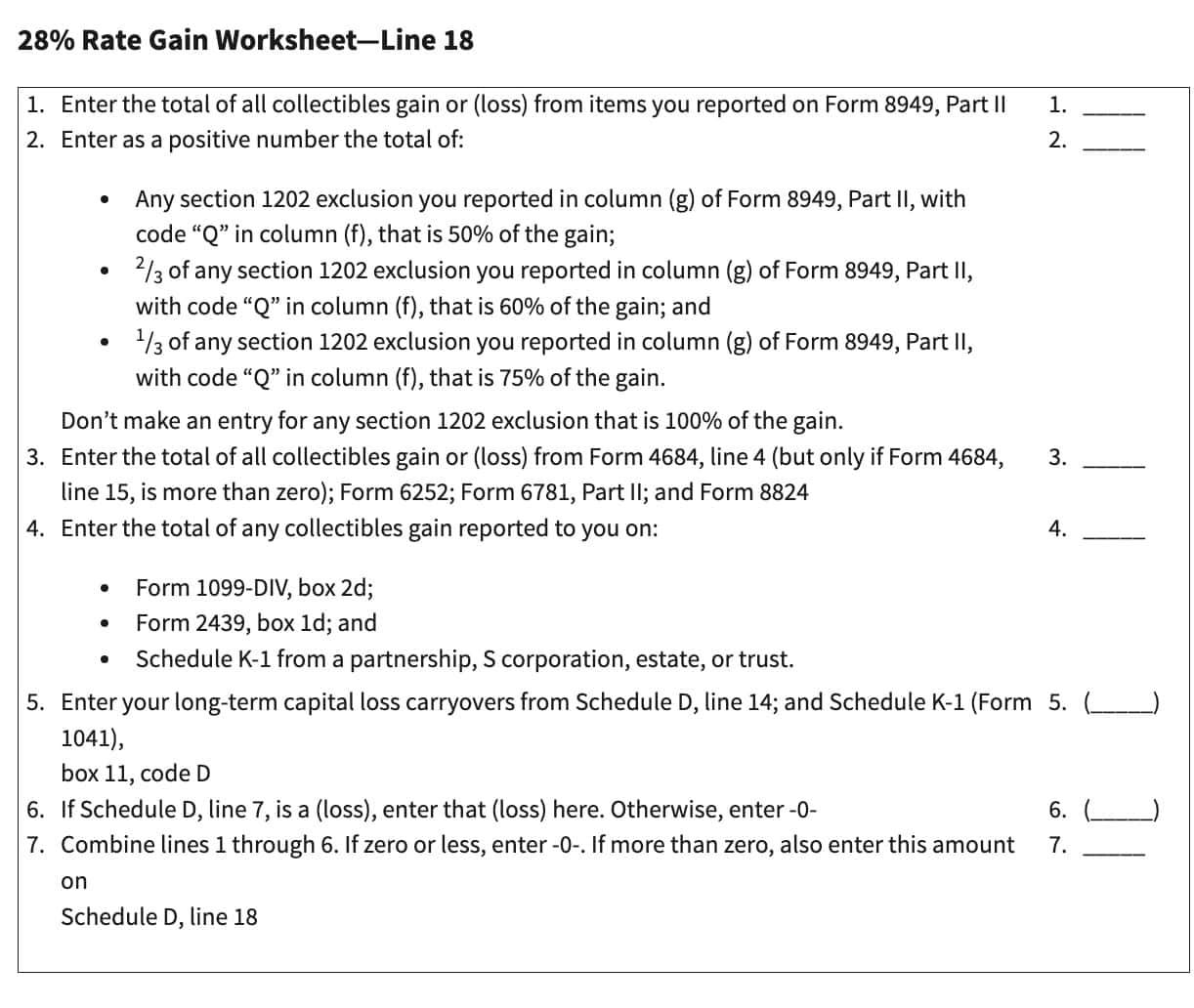

28 Rate Gain Worksheet

28 Rate Gain Worksheet

https://www.expatforum.com/attachments/rategainworksheet-jpg.16298/

If you are required to complete the 28 Rate Gain Worksheet see instructions enter the amount if any from line 7 of that worksheet If

Pre-crafted templates provide a time-saving service for developing a varied series of files and files. These pre-designed formats and layouts can be used for various individual and expert tasks, including resumes, invitations, leaflets, newsletters, reports, discussions, and more, simplifying the content development process.

28 Rate Gain Worksheet

28 Rate Gain Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller

Publication 929, Tax Rules for Children and Dependents; Tax for Children Under Age 14 Who Have Investment Income of More Than $1,500

IRS Schedule D Instructions - Capital Gains And Losses

Tax project. Can you help me fill out Schedule D for | Chegg.com

The images attached are what I need to put these | Chegg.com

Chapter 11, Part 3 - Tax Forms for Capital Gains & Losses - YouTube

https://www.irs.gov/instructions/i1040sd

28 Rate Gain Worksheet Line 18 1 Enter the total of all collectibles gain or loss from items you reported on Form 8949 Part II 1

https://support.taxslayerpro.com/hc/en-us/articles/360009170694-Schedule-D-Adjust-28-Rate-1250-Worksheet-Menu

In TaxSlayer Pro the 28 Rate Gain Worksheet and the Unrecaptured Section 1250 Gain Worksheet are produced automatically as needed but

https://proconnect.intuit.com/support/en-us/help-article/federal-taxes/calculating-capital-gains-28-rate-lacerte/L4kr0EUxp_US_en_US

Line 18 If you checked Yes on Line 17 complete the 28 Rate Gain worksheet in these instructions if either of the following applies for 20xx

https://omb.report/icr/201806-1545-014/doc/83919101

U S Income Tax Return for Estates and Trusts Sch D Inst 1041 28 Rate Gain Wrksht 28 Rate Gain Worksheet Sch D Inst OMB 1545 0092

http://www.a-ccpa.com/content/taxguide/text/c60s10d507.php

28 percent rate You will need to complete the 28 Rate Gain Worksheet in the Schedule D Instructions Then you take your short term gain or loss and net

The IRS posted updated instructions for 2018 Schedule D Form 1040 Capital Gains and Losses that include a corrected worksheet 28 rate 28 Rate Gain Worksheet in the instructions 18 19 Enter the amount if any from line 18 of the Unrecaptured Section 1250 Gain Worksheet in the

If you owned the asset for a year or less any gain would typically cost you more in taxes worksheet which are found in the Form 1040