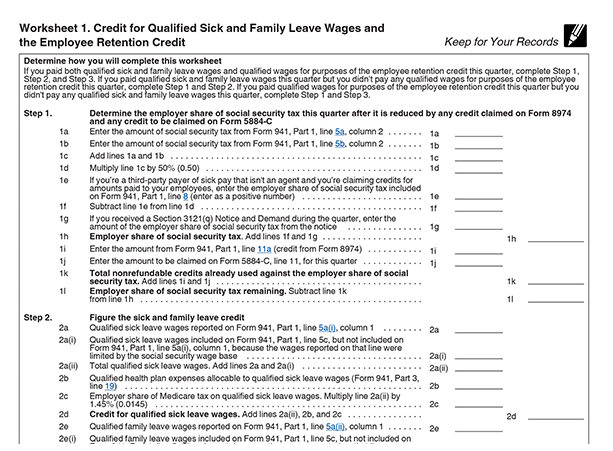

941 Worksheet 1 2021 Worksheet 1 is used to calculate the amounts of the credits for qualified sick and family leave wages and the employee retention credit Among

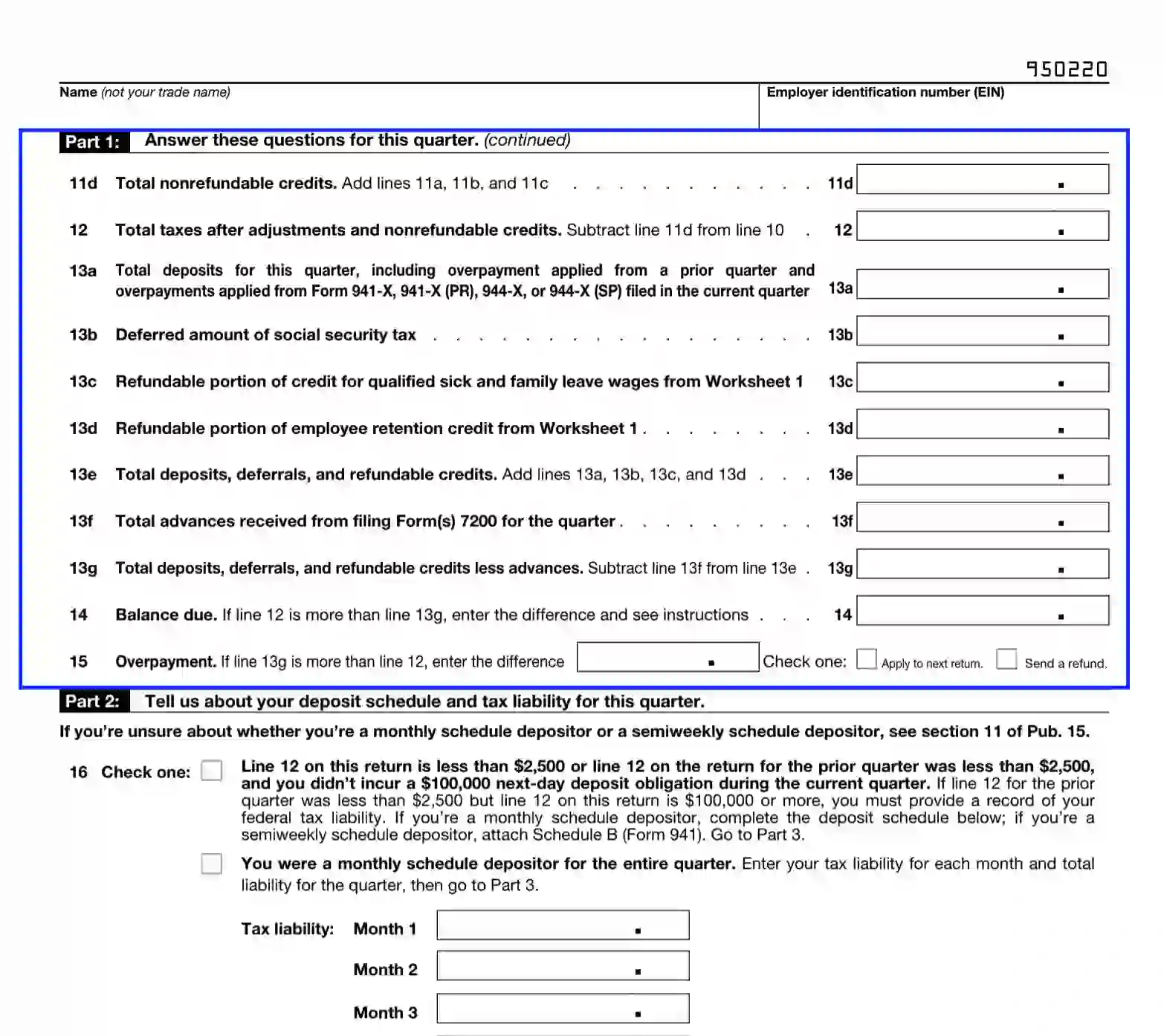

Complete updated Form 941 Worksheet 1 for 2023 2022 to report qualified sick and family leave wages and employee retention credits with These businesses can take the credit for wages through the end of 2021 The ERTC is 50 of qualifying wages for 2020 and 70 for 2021 The two

941 Worksheet 1 2021

941 Worksheet 1 2021

941 Worksheet 1 2021

https://blog.taxbandits.com/wp-content/uploads/2020/10/Screen-Shot-2020-10-13-at-1.17.45-PM-1024x518.png

The IRS introduced 941 Worksheet 1 to help businesses to calculate tax credits To be precise it should be used to calculate the refundable and nonrefundable

Pre-crafted templates provide a time-saving service for developing a diverse variety of files and files. These pre-designed formats and designs can be utilized for different individual and expert tasks, including resumes, invites, leaflets, newsletters, reports, discussions, and more, streamlining the material creation process.

941 Worksheet 1 2021

A Complete Guide to Filing Out Form 941 Worksheet 1 for 2021 | by TaxBandits - Payroll & Employment Tax Filings | Modern Payroll | Medium

IRS Form 941 ≡ Fill Out Printable PDF Forms Online

.jpg)

Updated Form 941 Worksheet 1, 2, 3 and 5 for 2023 | Revised 941

.jpg)

Updated Form 941 Worksheet 1, 2, 3 and 5 for 2023 | Revised 941

A No-Worries Guide to Complete Form 941 Worksheet 1 for 2020 | by TaxBandits - Payroll & Employment Tax Filings | Modern Payroll | Medium

Employee Retention Tax Credit

https://www.irs.gov/pub/irs-pdf/i941.pdf

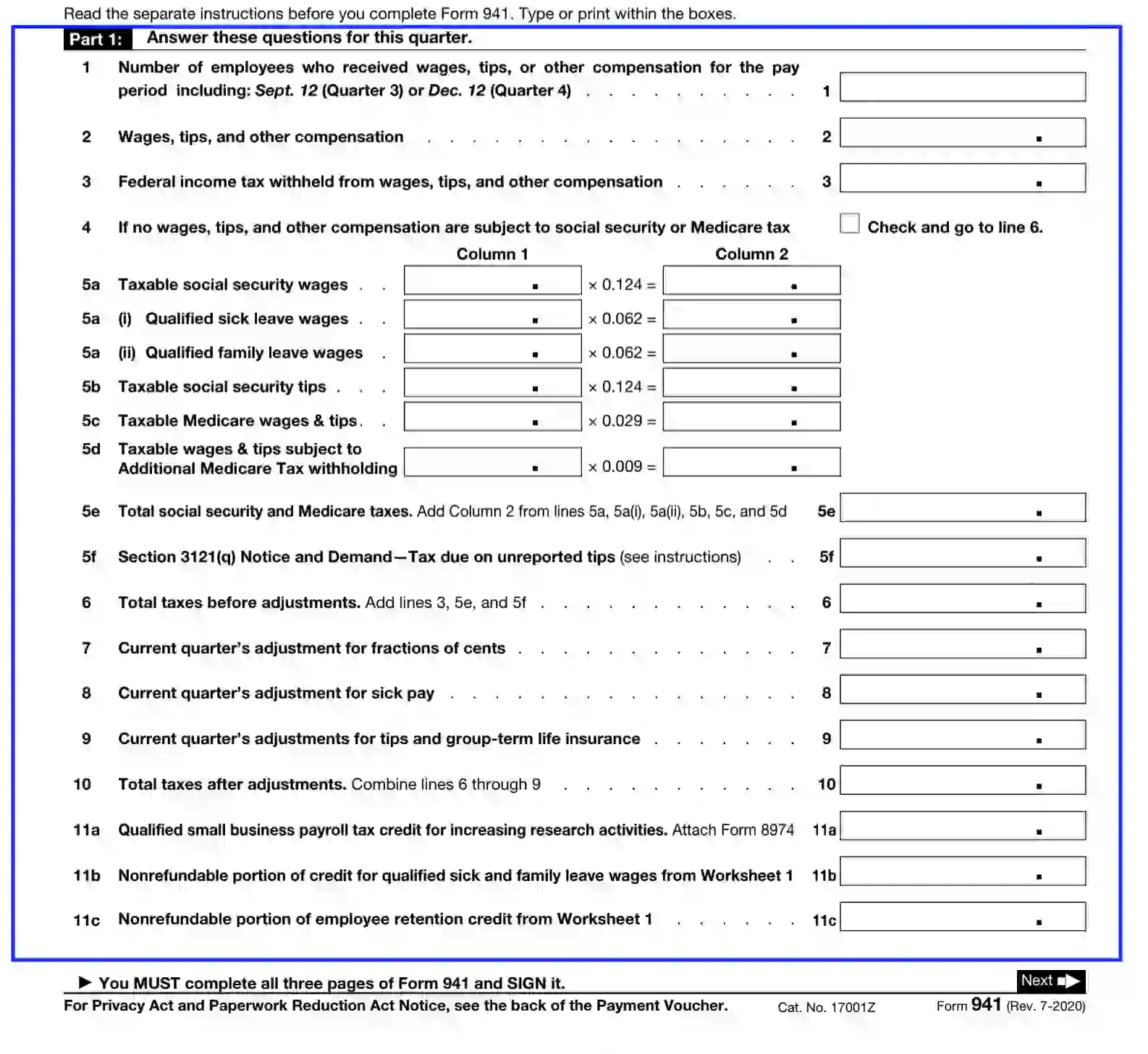

Use Worksheet 2 to figure the credit for leave taken after March 31 2021 and before October 1 2021 For more information about the credit

.jpg?w=186)

https://www.dhscott.com/wp-content/uploads/2021/01/Form-941-Worksheet.pdf

Worksheet 1 Credit for Qualified Sick and Family Leave Wages and the Employee Enter the amount from Form 941 Part 1 line 11a credit from Form 8974

https://qbkaccounting.com/941-worksheets-erc/

Here is a downloadable Worksheets 1 to 5 for preparing or amending your 941 X forms to claim ERC Employee Retention Credit and FFCRA

https://cpadept.com/wp-content/uploads/2020/07/2020-1st-Qtr-2021-Form-941-Worksheet1.pdf

You must use this worksheet if you claimed the employee retention credit for wages paid after March 12 2020 and before July 1 2021 on

https://www.taxbandits.com/payroll-forms/features/form-941-worksheet-1/

IRS Form 941 Worksheet 1 has changed for the Q2 of 2021 Calculate sick and family leave wages in fillable 941 Worksheet 1 and others in new Worksheet of 2021

According to the American Rescue Plan Act of 2021 ARP enacted March 11 2021 employers are required to provide paid time off to employees Check here 19 Qualified health plan expenses allocable to qualified sick leave wages for leave taken before April 1 2021 19 20 Qualified

Revised Form 941 Worksheet 1 for 2021 to apply for the COVID 19 Credits IRS has released the new 941 Worksheet 2 3 5 for COBRA premium