Capital Loss Carryover Worksheet Example Nov 22 2023 0183 32 Because you already have a 1 000 loss and there is a 3 000 limit on deductions you could apply up to 2 000 to offset ordinary income in the current tax year then carry the remaining 4 000 loss forward to a future tax year per IRS rules This is an example of tax loss carryforward

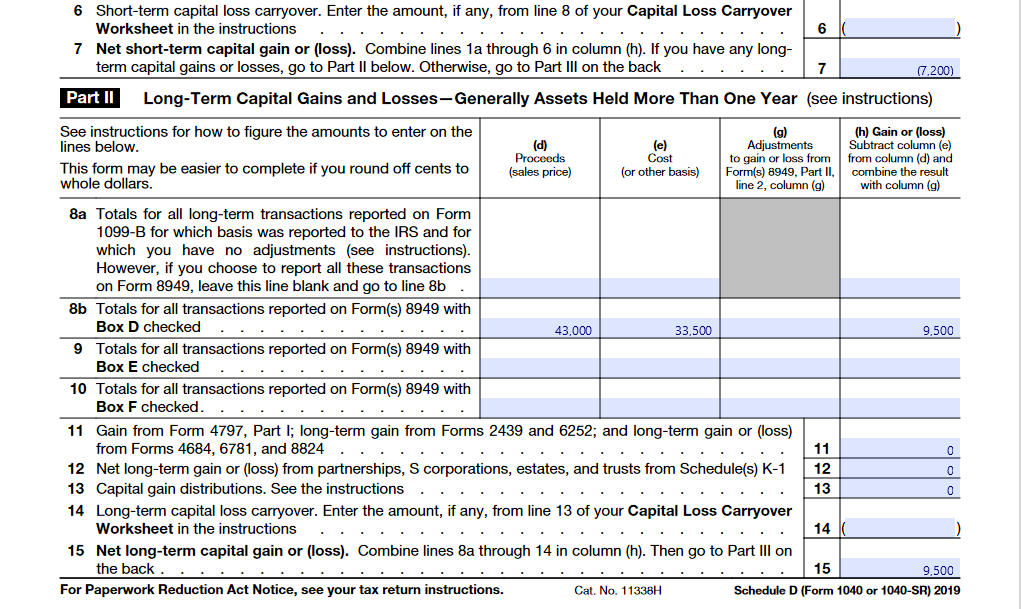

Oct 4 2023 0183 32 In this comprehensive guide we ll explore the definition rules and examples of capital loss carryover empowering you with the knowledge to make informed financial decisions Discover the advantages disadvantages and tax saving potential of this strategy and learn how to calculate and utilize capital loss carryovers to your advantage Jul 12 2022 0183 32 Capital Loss Carryover Worksheet in the 2020 and the 2021 instructions for Schedule D Form 1040 Capital Gains and Losses corrected the IRS provided late July 11 On page

Capital Loss Carryover Worksheet Example

Capital Loss Carryover Worksheet Example

Capital Loss Carryover Worksheet Example

https://www.pdffiller.com/preview/100/84/100084042/large.png

Apr 11 2022 0183 32 Lets look at an example You would have a 5 000 capital loss if you purchased an asset for 50 000 invested 10 000 into maintaining it then sold it for 55 000 If you sold it for 70 000 you would have a

Pre-crafted templates use a time-saving option for developing a diverse variety of documents and files. These pre-designed formats and layouts can be used for numerous individual and professional projects, including resumes, invites, flyers, newsletters, reports, discussions, and more, streamlining the material development process.

Capital Loss Carryover Worksheet Example

Where to find California capital loss carryover from a prior year

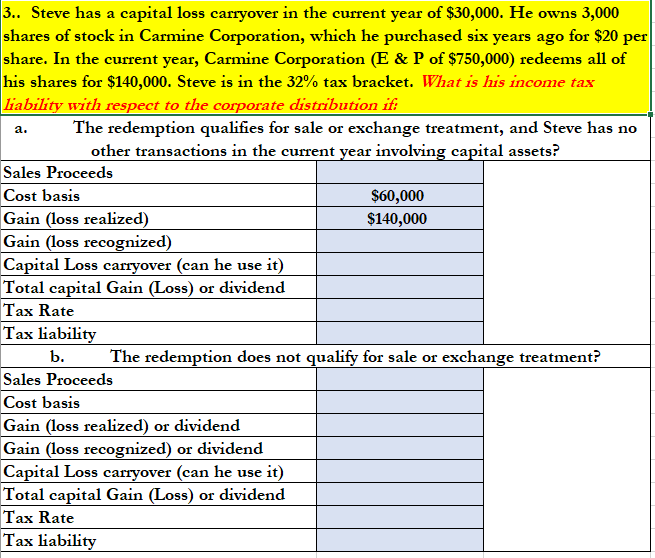

Solved 3.. Steve has a capital loss carryover in the current | Chegg.com

Capital Loss Carryover Worksheet PDF Form - FormsPal

Publication 17, Your Federal Income Tax; Chapter 17 - Reporting Gains and Losses, Comprehensive Example

Capital Loss Carryover - Fill Online, Printable, Fillable, Blank | pdfFiller

How to Minimize Portfolio Taxes

https://apps.irs.gov/app/vita/content/globalmedia/

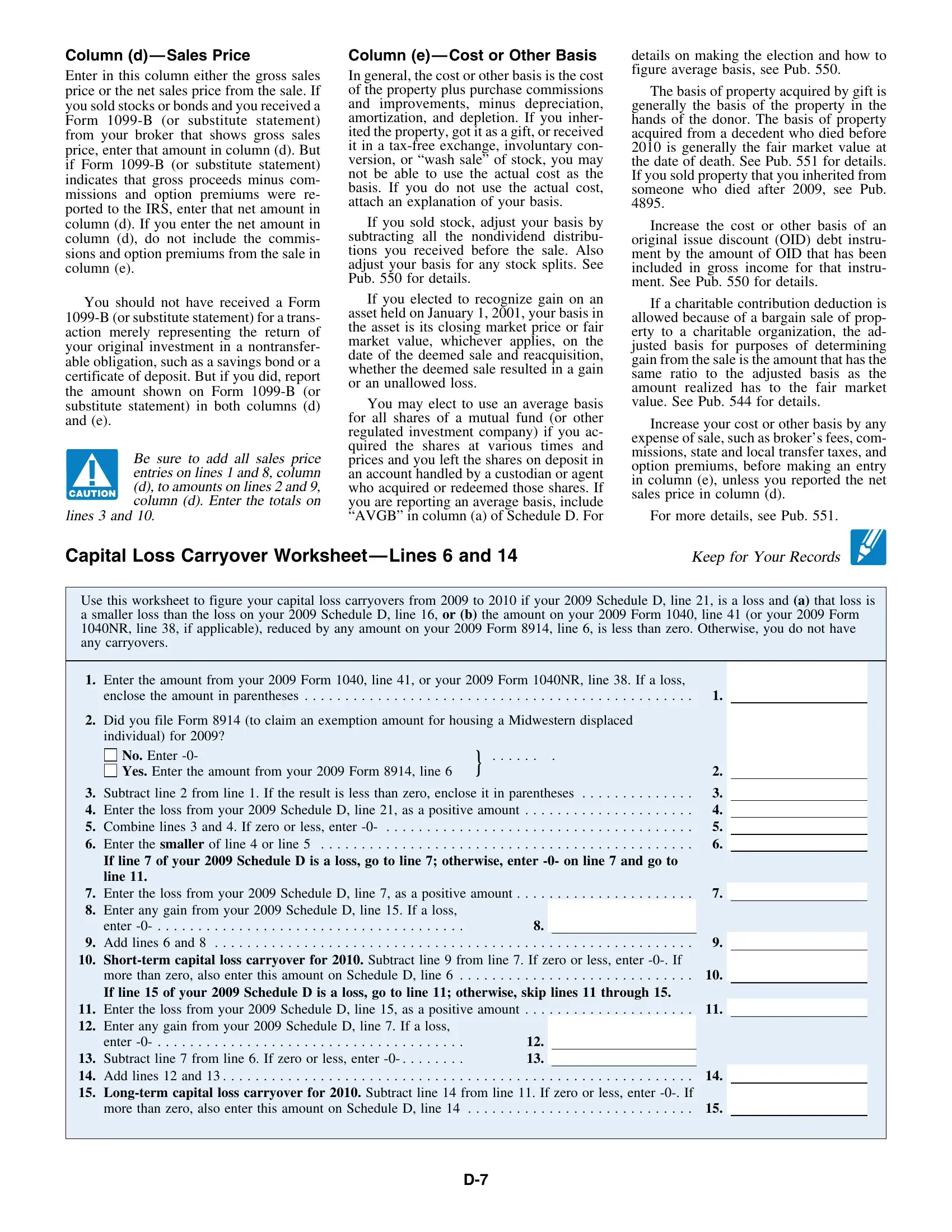

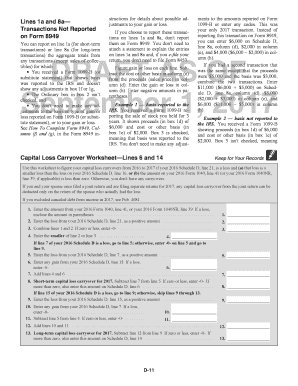

Use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss on your 2017 Schedule D line 16 or b the amount on your 2017 Form 1040 line 41 or your 2017 Form 1040NR line 39 if applicable is less than zero

https://smartasset.com/investing/what-is-a-capital-loss-carryover

May 23 2023 0183 32 Short term gains 250 Short term losses 400 First you deduct your long term losses from your long term gains leaving you with taxable long term capital gains of 500 for the year 1 000 500 The next thing to do is to deduct your short term losses from your short term gains

https://www.irs.gov/instructions/i1040sd

Use this worksheet to figure your capital loss carryovers from 2022 to 2023 if your 2022 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss on your 2022 Schedule D line 16 or b if the amount on your 2022 Form 1040 or 1040 SR line 15 or your 2022 Form 1040 NR line 15 if applicable would be less than zero

https://www.wallstreetmojo.com/capital-loss-carryover

Going per the law 100 000 can be offset against the 2016 capital gain of 45 000 with the residual loss being 55 000 As there is no capital gain in 2017 so the capital loss would be 55 000 Coming to the year 2018 55 000 loss can be set off against the gain of 35 000 leaving us with a loss of 20 000

https://www.fool.com/knowledge-center/how-to

Feb 20 2016 0183 32 Below you ll learn how to calculate the appropriate amount of capital loss carryovers Netting gains and losses You re allowed to use an unlimited amount of capital losses to offset

Capital Loss Carryover Worksheet Use this worksheet to figure the estate s or trust s capital loss carryovers from 2023 to 2024 if Schedule D line 20 is a loss and a the loss on Schedule D line 19 column 3 is more than 3 000 or b Form 1041 page 1 line 23 is a Carry over net losses of more than 3 000 to next year s return You can carry over capital losses indefinitely Figure your allowable capital loss on Schedule D and enter it on Form 1040 Line 13 If you have an unused prior year loss you can subtract it from this year s net capital gains

Nov 29 2023 0183 32 Losses beyond that amount can be deducted on future returns as a capital loss carryover until the loss is all used up For example if your net capital loss in 2023 was 7 000 and you re filing as single You could have a deduction of 3 000 of the loss on your 2023 return 3 000 on your 2024 return and the remaining 1 000 on your 2025