Deduction Worksheet For Self Employed 2023 Step 1 Using Schedule SE Form 1040 calculate your self employment tax deduction This form is available online at http www irs gov pub irs pdf f1040sse pdf Step 2 Calculate your

If you checked none of these above please continue by completing the worksheet below for each business All Forms 1099 AND the detail provided by the company Door Dash Lyft Aug 2 2024 0183 32 These days plenty of people WFH but only self employed get a tax break out of it If you re a freelancer independent contractor or small business owner who uses your home for business purposes the home office tax

Deduction Worksheet For Self Employed 2023

Deduction Worksheet For Self Employed 2023

Deduction Worksheet For Self Employed 2023

https://www.pdffiller.com/preview/391/382/391382225/large.png

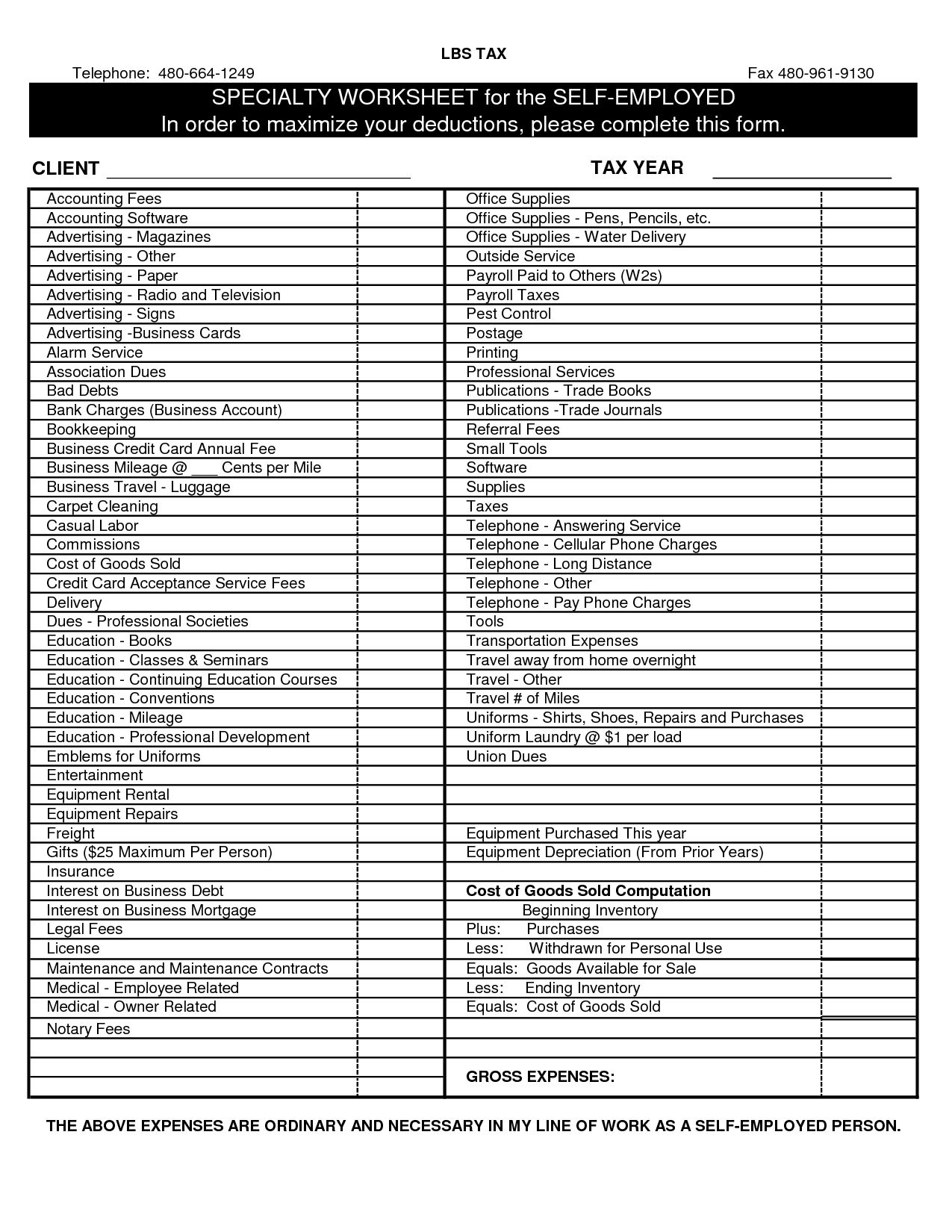

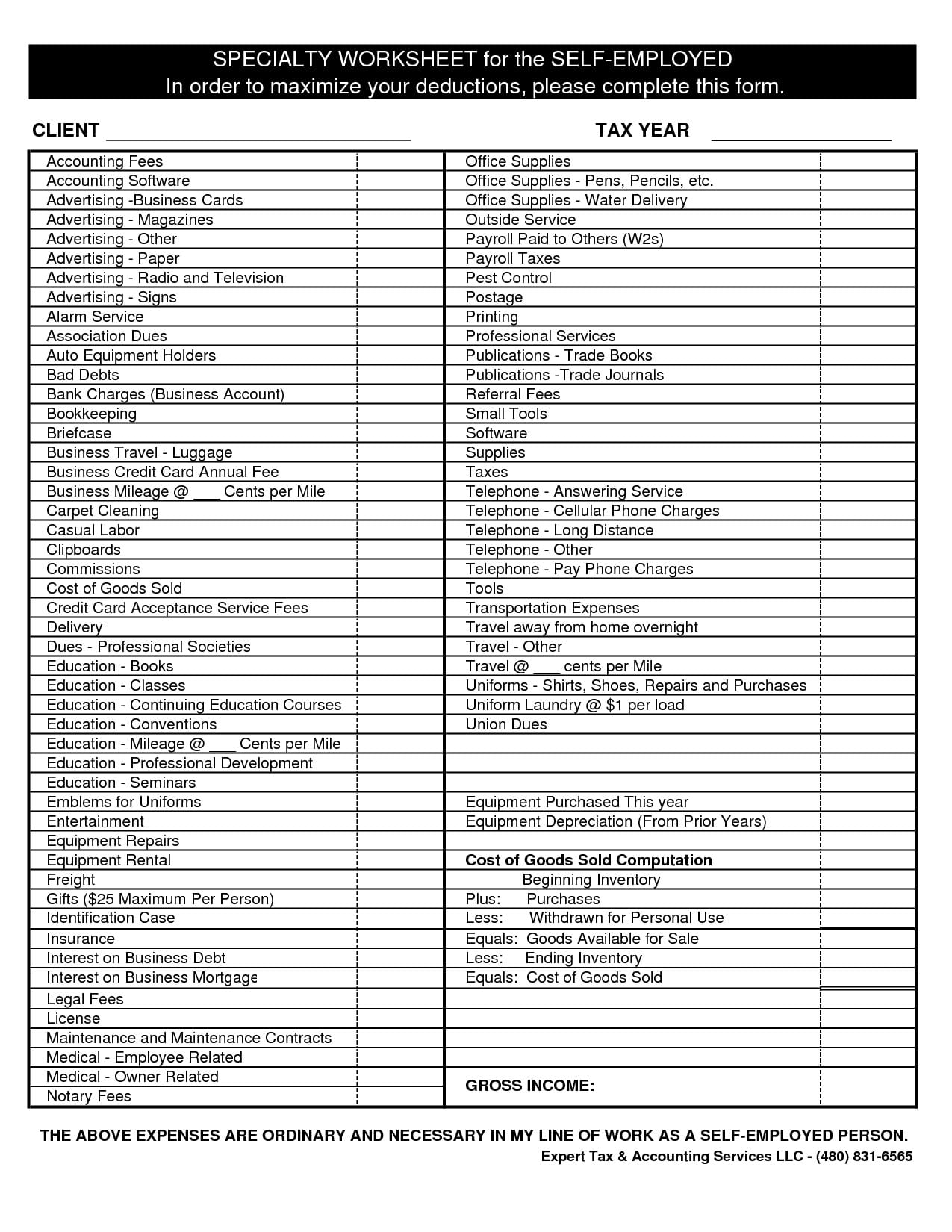

Self Employment Worksheet Tax Year 2023 Business Name Type of Business Federal I D IRS holds you responsible for keeping track of ALL income from this

Templates are pre-designed files or files that can be used for different functions. They can conserve time and effort by supplying a ready-made format and layout for producing various kinds of material. Templates can be utilized for individual or expert projects, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

Deduction Worksheet For Self Employed 2023

Self Employed Tax Deductions Worksheet Worksheet Resume Examples

Self Employed Deductions Worksheet

Tax Deduction Worksheet For Self Employed

Printable Tax Organizer Template

Self Employed Tax Prep Checklist Download 2022 TurboTax Canada Tips

Tax Deduction Worksheet 2023

https://www.irs.gov › businesses › small-businesses

Jun 28 2024 0183 32 A collection of relevant forms and publications related to understanding and fulfilling your filing requirements

https://www.hellobonsai.com › blog › self-e…

Dec 27 2024 0183 32 The team at Bonsai organized this self employed tax deductions worksheet copy and download here to organize your deductible business expenses for free Simply follow the instructions on this sheet and start

https://gusto.com › › self-employment-ta…

Jul 1 2024 0183 32 Wondering what you can write off as a self employed business owner Use this list of 2023 tax deductions designed for the self employed

https://filetax.com › organizer.html

Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions The source information that is required for each tax return is

https://static1.squarespace.com ›

Itemized Deductions need to be more than your standard deduction 13 850 for singles 20 800 for heads of household and 27 700 for married couples These deductions will not help you if

Dec 14 2023 0183 32 Our calculator allows you to select your specific self employed industry over 30 and discover what self employed business tax write offs and expenses you can deduct as a If you are self employed or own your own unincorporated business simply move step by step through this worksheet to calculate your SEP IRA contribution You will need to have your

Self employed If you expect to have income from self employment use Worksheet 2 3 to figure your expected self employment tax and your allowable deduction for self employment tax