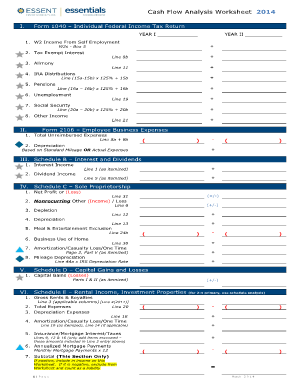

Essent Rental Income Worksheet This Cash Flow Analysis Calculator has been designed to assist in determining qualifying income for situations in which tax return analysis is typically

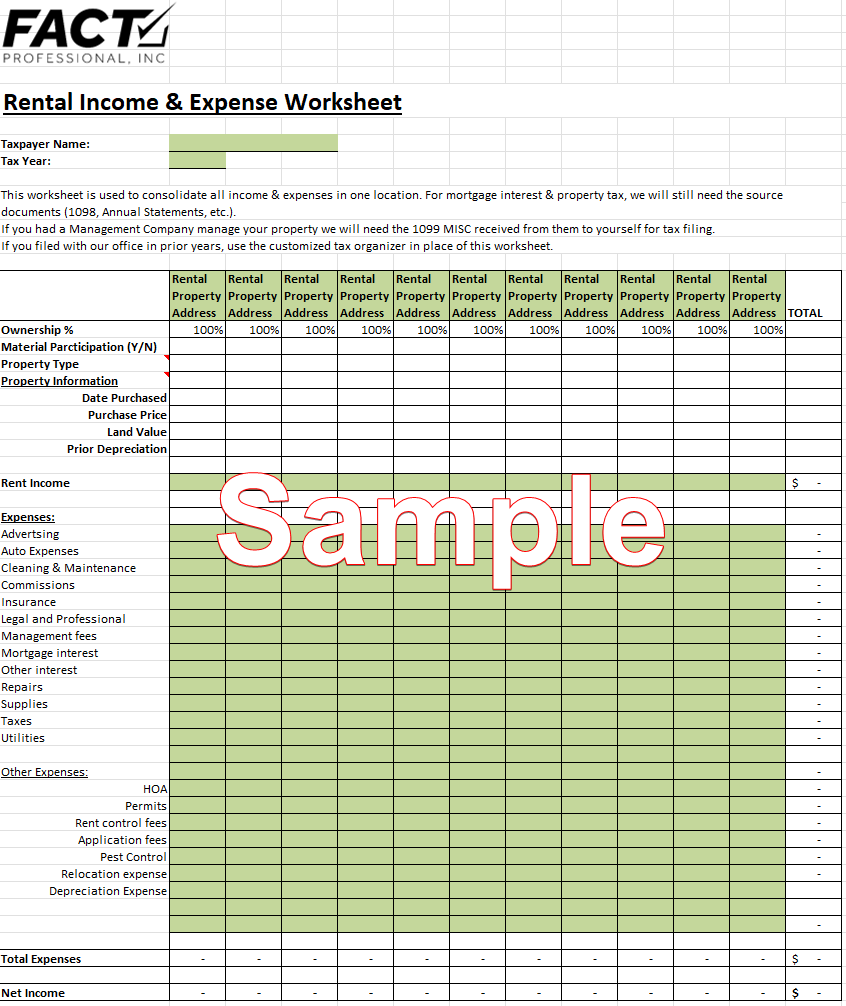

2022 SCHEDULE E INCOME WORKSHEET FOR 2 4 UNIT OWNER OCCUPIED PROPERTIES Assume 12 months of rental income expenses for each tax year unless other SCHEDULE E ROYALTIES use separate worksheet for rental income analysis 1 Gross Royalties Received Line 4 applicable columns 2 Total Expenses Line 20

Essent Rental Income Worksheet

Essent Rental Income Worksheet

Essent Rental Income Worksheet

https://www.pdffiller.com/preview/100/413/100413777/large.png

Rental Income Schedule E asy Available Times There are currently no property and receive hands on practice using our Cash Flow Analysis Worksheet

Templates are pre-designed files or files that can be utilized for various purposes. They can conserve effort and time by supplying a ready-made format and layout for developing various sort of content. Templates can be used for individual or expert projects, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

Essent Rental Income Worksheet

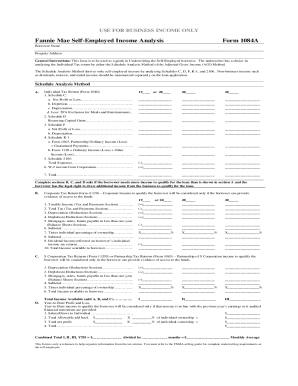

Essent Cash Flow Analysis Form - Fill Out and Sign Printable PDF Template | signNow

2022 Cash Flow Worksheet

Essent Income Worksheet - Printable Word Searches

2022 Schedule E - Investment Property Worksheet

2021 Cash Flow Worksheet

CASH FLOW ANALYSIS WORKSHEET | 2023

https://www.essent.us/sites/default/files/2023-01/2023-rental-property-investment-schedule-e-calculator-v01.2023_0.xls

For complete Essent underwriting guidelines go to essent us Consult your program product guidelines to determine qualifying income eligibility 4 5

https://www.essent.us/sites/default/files/2021-01/2021-rental-property-investment-calculator-v01.2021.xls

For complete Essent underwriting guidelines go to essent us Consult your program product guidelines to determine qualifying income eligibility 5 6

https://www.essent.us/sites/default/files/2022-02/2022-rental-property-primary-schedule-e-calculator.xls

For complete Essent underwriting guidelines go to essent us Consult your program product guidelines to determine qualifying income eligibility 5 6

https://www.essent.us/documents/rental-property-investment

Determine the average monthly income loss for a non owner occupied investment property

https://www.essent.us/sites/default/files/2022-02/2022-rental-property-investment-schedule-e-worksheet.pdf

2022 SCHEDULE E INCOME WORKSHEET FOR NON OWNER OCCUPIED PROPERTIES Mortgage Assume 12 months of rental income expenses for each tax year unless other

A value must be entered in each cell to correctly calculate income If there is no value related to a specific cell enter 0 For complete Essent underwriting OF MONTHS RENTAL INCOME EXPENSES REVIEWED Months of information in tax returns 11 TOTAL AVERAGE INCOME LOSS FOR THIS PROPERTY Divide line 9 by line 10

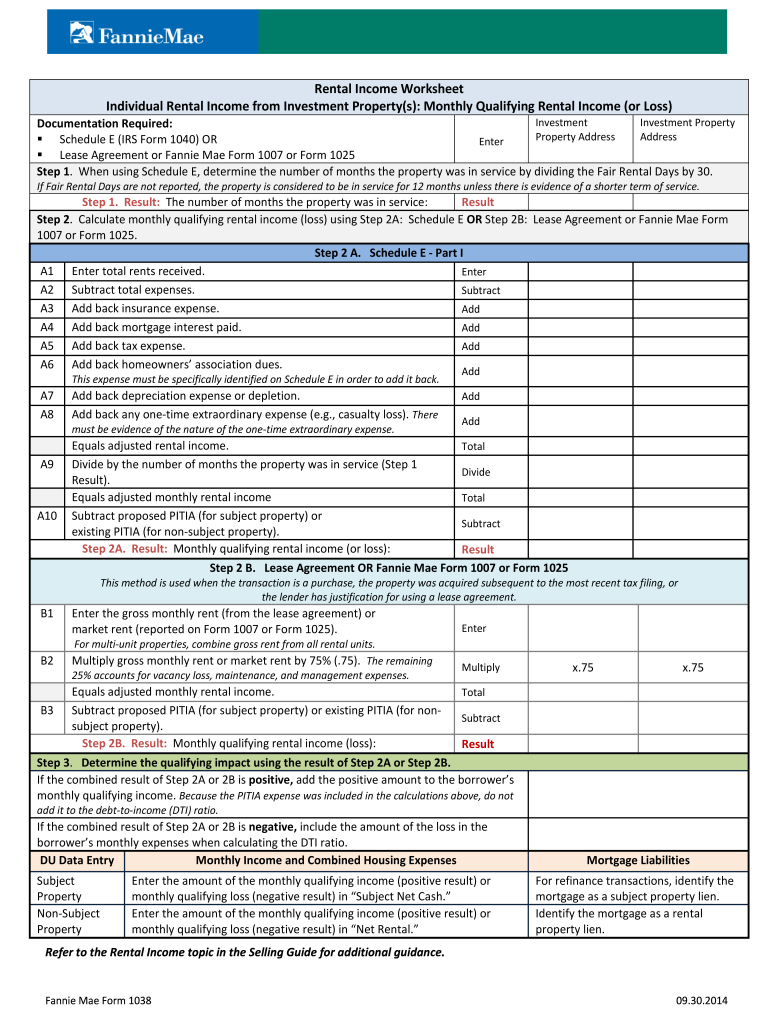

Use this worksheet to calculate qualifying rental income for Fannie Mae Form 1038 Individual Rental Income from Investment Property s up to 4 properties