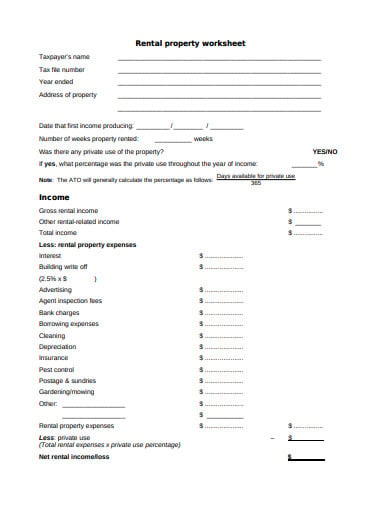

Rental Property Cost Basis Worksheet If you own property that you rent to another person or business fill out this form and bring the requested items to your tax appointment

Existing clients with no changes in their rentals need only complete the pertinent rental income and expense categories and any improvements Property Address Property lasting more than 1 year Property Description Cost Basis Land Value Date

Rental Property Cost Basis Worksheet

![2023 Rental Property Analysis Spreadsheet [Free Template] 2023-rental-property-analysis-spreadsheet-free-template](https://wp-assets.stessa.com/wp-content/uploads/2021/06/13170845/Property_Analysis_Spreadsheet__Stessa_.png) Rental Property Cost Basis Worksheet

Rental Property Cost Basis Worksheet

https://wp-assets.stessa.com/wp-content/uploads/2021/06/13170845/Property_Analysis_Spreadsheet__Stessa_.png

The original investment you made in the property minus the value of the land on which it sits Certain items like legal abstract or recording fees incurred in

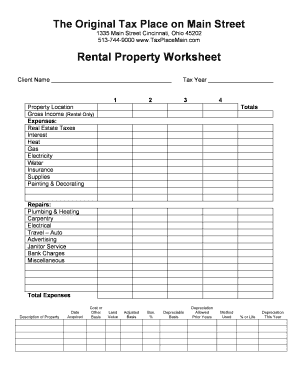

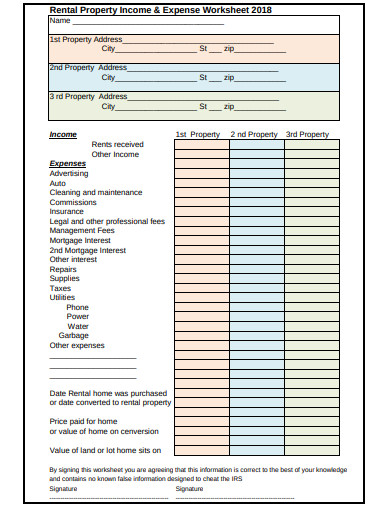

Templates are pre-designed documents or files that can be utilized for different functions. They can save effort and time by offering a ready-made format and layout for developing various kinds of content. Templates can be utilized for individual or professional tasks, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Rental Property Cost Basis Worksheet

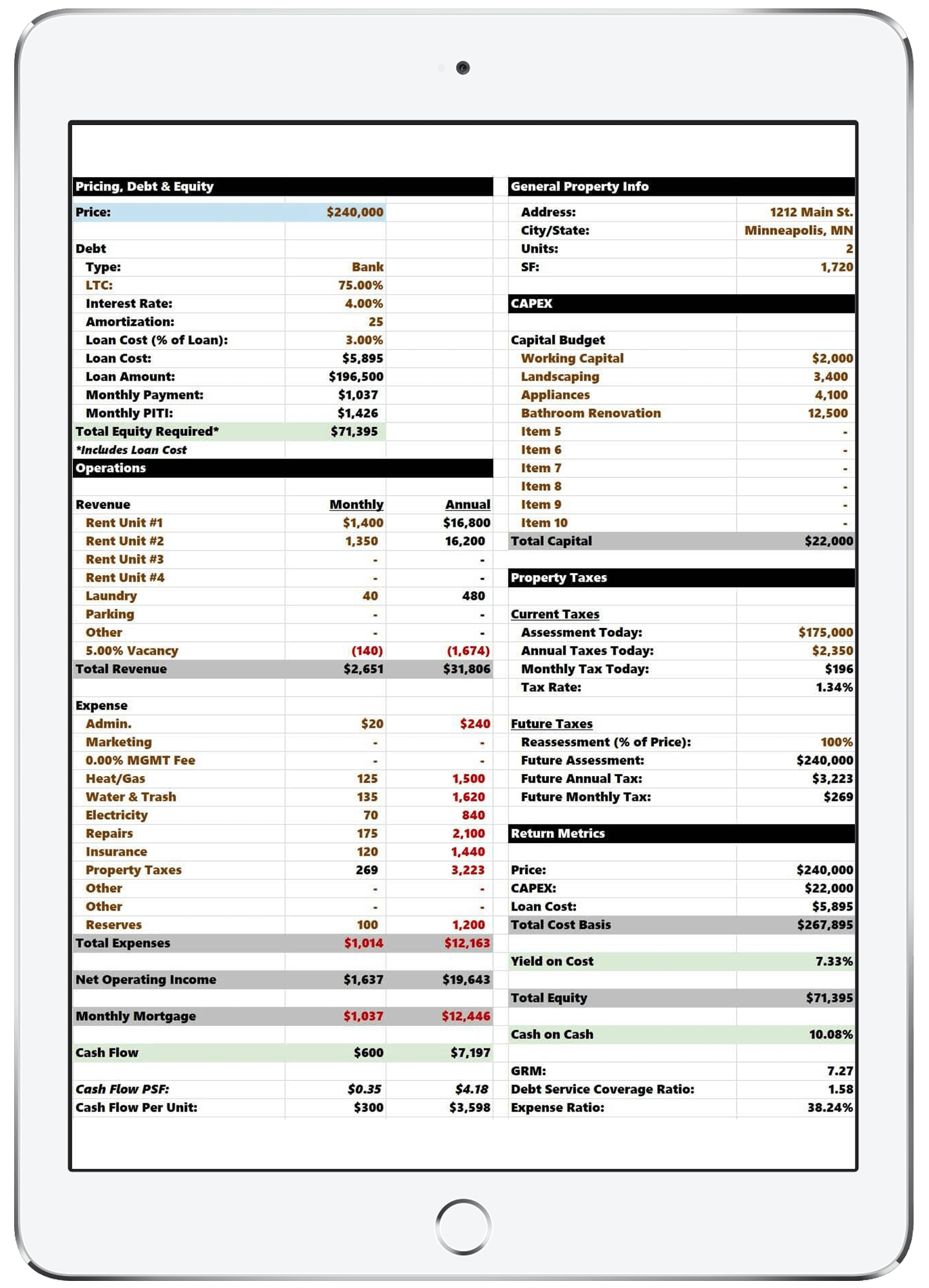

Rental Property Analysis Worksheet - Rent Marketplace | Tenant Screening

![The Best Rental Property Spreadsheet [+Free Rental Spreadsheet Template] the-best-rental-property-spreadsheet-free-rental-spreadsheet-template](https://uploads-ssl.webflow.com/637ac7502ecc7e25ee8a2510/64791c1152efed1e6bcb91fc_Screenshot%202023-06-02%20at%2010.29.28%20AM.png)

The Best Rental Property Spreadsheet [+Free Rental Spreadsheet Template]

18+ Rental Property Worksheet Templates in PDF

Rental Property Analysis Excel Template — Tactica Real Estate Solutions

Rental Property Worksheet PDF Form - Fill Out and Sign Printable PDF Template | signNow

Rental Property Cash Flow | Real estate investing rental property, Rental property investment, Real estate investing

![2023 Rental Property Analysis Spreadsheet [Free Template] 2023 Rental Property Analysis Spreadsheet [Free Template]](https://wp-assets.stessa.com/wp-content/uploads/2021/06/13170845/Property_Analysis_Spreadsheet__Stessa_.png?w=186)

https://www.rentbumper.com/rental-property-cost-basis/

1 Calculate Your Original Cost Basis Start with the full purchase price shown in the contract For example let s say you recently bought a rental property

https://www.realized1031.com/blog/how-to-calculate-cost-basis-for-rental-property

The cost basis for a rental property is actually the cost of acquiring the property considering not just the price but also expenses incurred

https://www.irs.gov/publications/p527

Figuring the basis Cooperatives Figuring the Depreciation Deduction Renting Part of Property How to divide expenses Duplex Not Rented for Profit

https://www.stessa.com/blog/cost-basis-for-rental-property/

Three types of cost basis for a rental property are original adjusted and depreciation cost basis Original cost basis is used to calculate tax on capital

https://www.nar.realtor/magazine/tools/client-education/handouts-for-sellers/worksheet-calculate-capital-gains

The adjusted cost basis figure from above Your capital gain A Special Real Estate Exemption for Capital Gains Up

Start with the original investment in the property Add the cost of major improvements Subtract the amount of allowable depreciation and casualty and theft If you are still entering the income and expenses on Schedule E for your rental property there will be a Depreciation and Amortization

This is the total investment in the rental property as it relates to taxes The cost basis of the rental property consists of the amount you