Itemized Deduction Small Business Tax Deductions Worksheet Get Our Free Printable Small Business Tax Deduction Worksheet What Can Small Businesses Write Off Does Your Small Business Need Tax Help

Introduction This publication discusses common business expenses and explains what is and is not deductible The general rules for deducting business Information about Schedule A Form 1040 Itemized Deductions including recent updates related forms and instructions on how to file

Itemized Deduction Small Business Tax Deductions Worksheet

Itemized Deduction Small Business Tax Deductions Worksheet

Itemized Deduction Small Business Tax Deductions Worksheet

https://www.pdffiller.com/preview/391/382/391382225/large.png

DEDUCTIONS BY THE BROKER ARE ONLY DEDUCTIBLE IF THEY COME OUT OF THE AMOUNT REPORTED ON THE BROKER FORM 1099 PROFESSIONAL FEES TOTAL COMBINED BOARD FEES

Pre-crafted templates offer a time-saving solution for developing a varied variety of documents and files. These pre-designed formats and layouts can be used for various individual and expert projects, consisting of resumes, invites, flyers, newsletters, reports, discussions, and more, simplifying the material development procedure.

Itemized Deduction Small Business Tax Deductions Worksheet

Tax worksheet realtors: Fill out & sign online | DocHub

Truck Driver Tax Deductions Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller

Tax Deduction | Excel Templates

![Independent Contractor Expenses Spreadsheet [Free Template] independent-contractor-expenses-spreadsheet-free-template](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6349af5f4a6db36bd21473a4_1099-excel-template.png)

Independent Contractor Expenses Spreadsheet [Free Template]

Tax Deduction Worksheet for Police Officers - Fill and Sign Printable Template Online

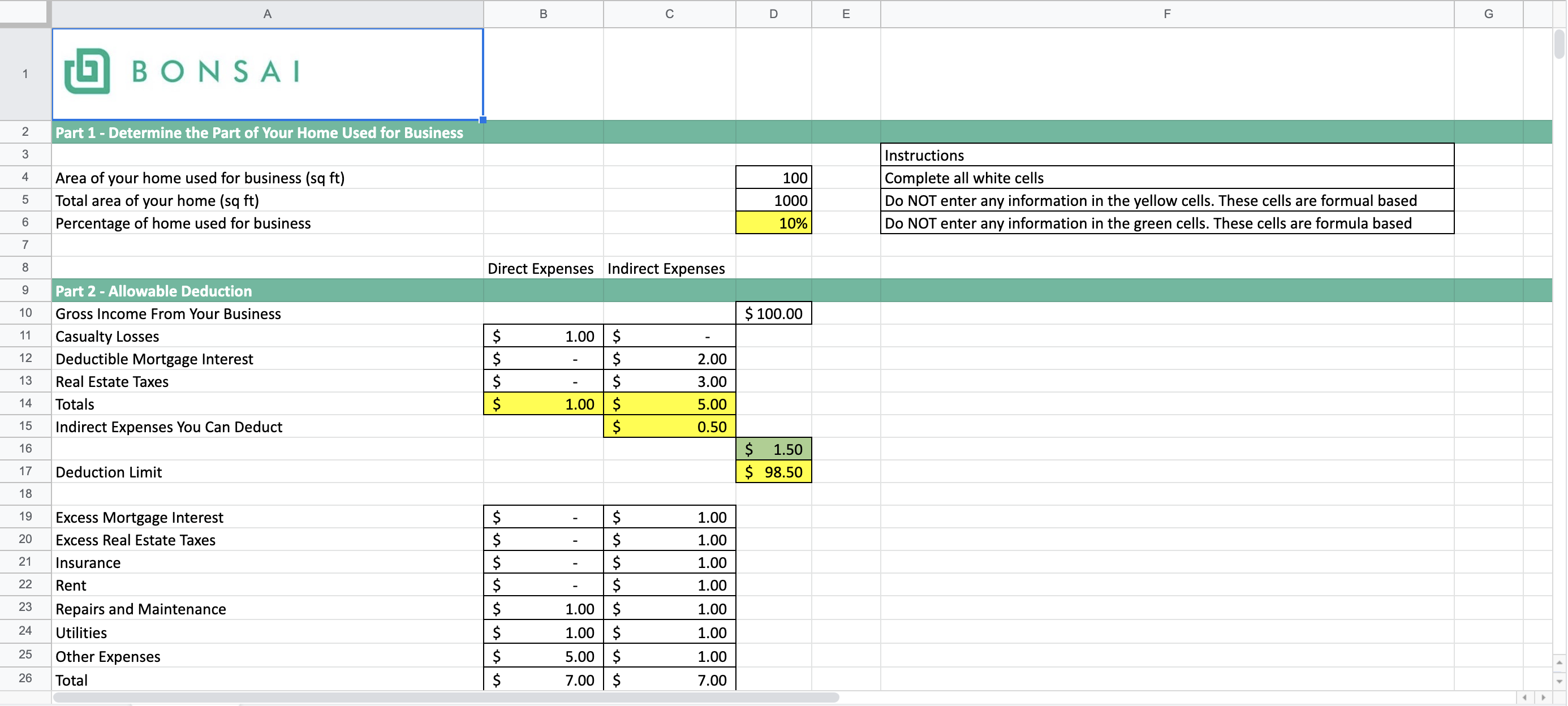

FREE Home Office Deduction Worksheet (Excel) For Taxes

https://diamondfinancial.com/wp-content/uploads/2016/01/Small-Business-Fillable-Worksheet.pdf

Small Business Self Employed 1099 Income Schedule C Worksheet Send last year s Schedule C or tax return if you operated the business previously and we

https://global.oup.com/us/companion.websites/fdscontent/uscompanion/us/static/companion.websites/9780190200824/Worksheets/07_Tax_Deduction_Worksheet.pdf

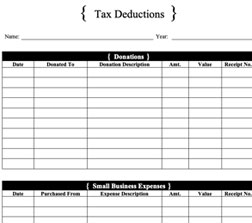

Tax Deduction Worksheet This worksheet allows you to itemize your tax deductions for a given year Tax deductions for calendar year 2 0 HIRED HELP

https://www.hellobonsai.com/blog/self-employed-tax-deductions-worksheet

The team at Bonsai organized this self employed tax deductions worksheet copy and download here to organize your deductible business expenses

https://www.cpapros.com/Worksheets/SmallBusiness_Deductions.pdf

Client ID TAX YEAR ORDINARY SUPPLIES The Purpose of this worksheet is to help you organize Advertising your tax deductible business expenses

https://www.fundingcircle.com/us/resources/small-business-tax-deductions/

For example you can deduct the social security Medicare and federal unemployment FUTA taxes you paid out to your employees Just remember

The home office deduction includes the cost of utilities such as heat electricity and Wi Fi so those expenses can t be deducted separately If you pay for advertising or marketing to promote your small business those costs are fully tax deductible As long as the expenses are

Employee salaries gross wages commissions bonuses and other types of compensation count as tax deductible expenses Compensation can even