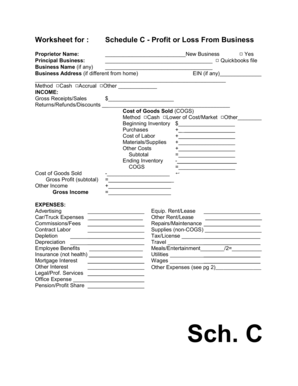

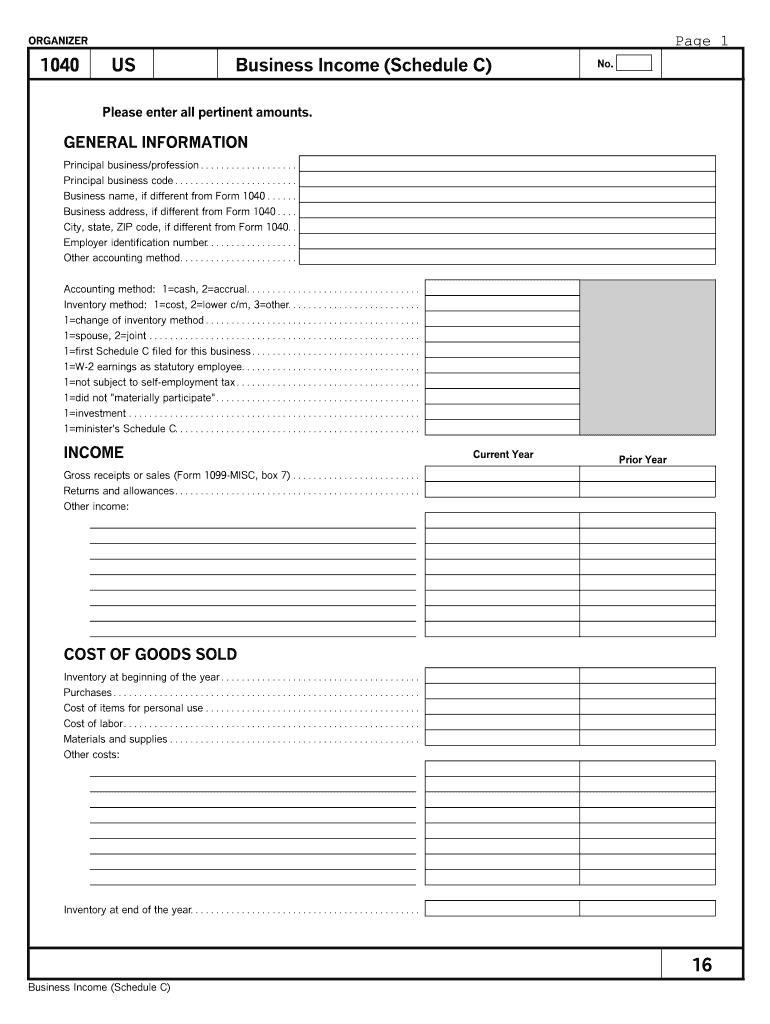

Schedule C Worksheet Misc Exp Other The IRS divides the Schedule C into five parts Each section reports important information about your income and deductions

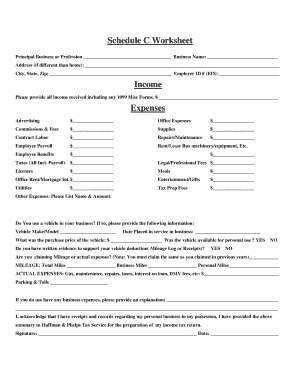

Step 4 Complete 1040 Schedule C Part II Expenses Section and Part V Other Expenses Section MISC for your services The self employment tax Handy tips for filling out Schedule c expenses worksheet online Printing and scanning is no longer the best way to manage documents

Schedule C Worksheet Misc Exp Other

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/a16bc764-2575-4107-9c18-7454b86b0b5c.default.JPG

SCHEDULE C BUSINESS INCOME Small Business Self Employed 1099 Misc Income GENERAL EXPENSES Advertising Accounting Tax Preparation Fee Bank

Templates are pre-designed files or files that can be utilized for different purposes. They can conserve effort and time by supplying a ready-made format and layout for creating different kinds of material. Templates can be used for individual or professional jobs, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

Schedule C Worksheet Misc Exp Other

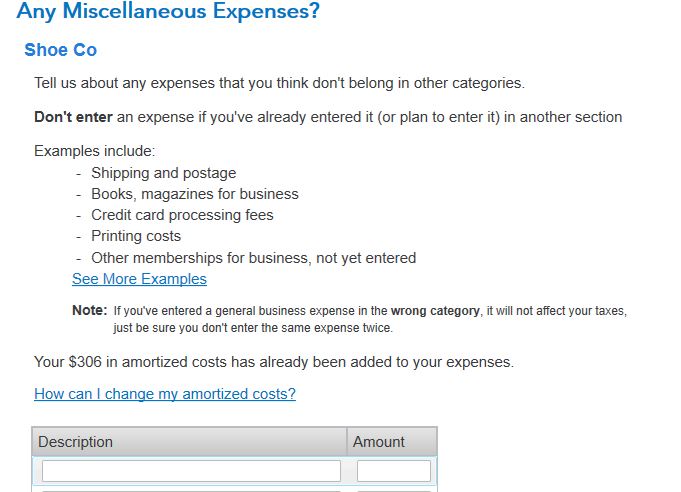

Solved: How do I fill the following Entry: Schedule C (consulting) -- Schedule C Worksheet: Amount - Misc Exp Other must be entered. Amount - Misc Exp Other??

Solved: How do I fill the following Entry: Schedule C (consulting) -- Schedule C Worksheet: Amount - Misc Exp Other must be entered. Amount - Misc Exp Other??

How to fill out Schedule C : Stripe: Help & Support

Schedule C Worksheet - Fill and Sign Printable Template Online

Schedule C Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller

How to Fill Out Your Schedule C Perfectly (With Examples!)

https://ttlc.intuit.com/community/business-taxes/discussion/how-do-i-fill-the-following-entry-schedule-c-consulting-schedule-c-worksheet-amount-misc-exp-other/00/1056922

Please go into your Schedule C and check the Other miscellaneous expenses You may remember those expenses for 2022 but if they are not valid

https://www.irs.gov/instructions/i1040sc

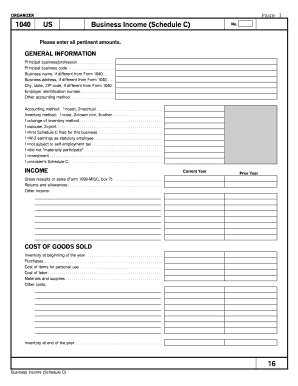

Introduction Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole

https://www.keepertax.com/posts/schedule-c

Step 1 Input your information Step 2 Fill out your income and cost of goods sold Step 3 Fill out your business expenses Step 4

https://www.thebalancemoney.com/deductible-miscellaneous-business-expenses-examples-5197415

Miscellaneous expenses are defined as other expenses These expenses are not specific but are still considered ordinary and necessary

https://www.irs.gov/pub/irs-dft/i1040sc--dft.pdf

To report income from a nonbusiness activity see the instructions for Schedule 1 Form 1040 line 8j Also use Schedule C to report a wages

Use Schedule C Form 1040 or 1040 SR to report income or loss from a business you operated or a profession you practiced as a sole proprietor You may be Yes Attach a copy of the 1099 MISC s filed Depreciation usually buildings Employee Other business related expenses please itemize

Schedule C Worksheet Misc Exp Other ebook download or read online In today digital age eBooks have become a staple for both leisure and learning