Self Employed Tax Deduction Worksheet 15 Calculate the deduction using the Self Employed Health Insurance Deduction Worksheet in IRS Publication 535 self employment tax and contributions for

Want a handy worksheet to help you organize your self employment tax deductions Schedule C self employed business expenses worksheet for Small Business Self Employed 1099 Income Schedule C Worksheet Send last year s Schedule C or tax return if you operated the business previously and we

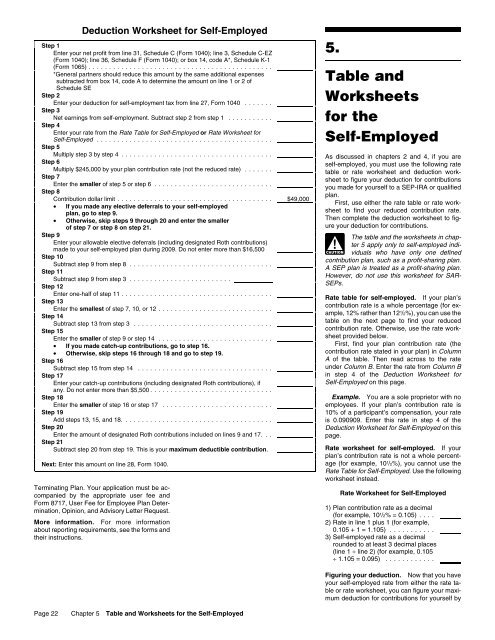

Self Employed Tax Deduction Worksheet

Self Employed Tax Deduction Worksheet

Self Employed Tax Deduction Worksheet

https://lacyitaliano.com/wp-content/uploads/2019/01/Self-Employed-Business-Deduction-Worksheet-pdf-232x300.jpg

Tax Year 2020 1 Schedule C Worksheet for Self Employed Filers and Contractors tax year 2020 This document will list and explain the information and

Pre-crafted templates use a time-saving service for producing a varied range of documents and files. These pre-designed formats and layouts can be utilized for different individual and professional tasks, consisting of resumes, invitations, flyers, newsletters, reports, presentations, and more, improving the content production procedure.

Self Employed Tax Deduction Worksheet

Independent contractor tax deduction worksheet

Tax worksheet realtors: Fill out & sign online | DocHub

Nurse Tax Deduction Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller

Small Business Tax Spreadsheet | Business worksheet, Small business tax deductions, Small business expenses

Hair stylist tax deduction worksheet: Fill out & sign online | DocHub

Self Employed Tax Deductions Worksheet Form - Fill Out and Sign Printable PDF Template | signNow

https://www.irs.gov/businesses/small-businesses-self-employed/self-employed-individuals-tax-center

If you estimated your earnings too low again complete another Form 1040 ES worksheet to recalculate your estimated taxes for the next quarter

https://www.demoretaxservice.com/files/109128408.pdf

Tax Worksheet for Self employed Independent contractors Sole proprietors Single LLC LLCs 1099 MISC with box 7 income listed

https://www.hellobonsai.com/blog/self-employed-tax-deductions-worksheet

The team at Bonsai organized this self employed tax deductions worksheet Here s a shortlist of business related expenses self employed

https://sharetheharvest.com/wp-content/uploads/2018/03/9-Schedule-C-Self-Employed-Single-LLC.pdf

Use a separate worksheet for each business owned operated Do not duplicate expenses Name type of business Owned Operated by Client Spouse Income

https://portal.clientwhys.com/sites/32975rose/selfemployedand1099worksheet.pdf

Tax Worksheet for self employed independent contractors sole proprietors single member LLCs people who received a 1099 NEC or 1099 K

The IRS Federal Income Tax Some common IRS deductions not allowed for these Personal non business Work Related Expenses INCOME 1 Gross Business Rent and utilities While tax rules can be complex self employed professionals can deduct many business related expenses These expenses

BUSINESS INCOME EXPENSE WORKSHEET FILL OUT ONE SHEET FOR EACH BUSINESS DO NOT COMBINE Business Name Profession INCOME 1099 MISC SELF EMPLOYMENT