Unrecaptured Section 1250 Gain Worksheet 2022 In 2022 I sold my interest in a partnership LLC which had unrecaptured section 1250 gain The partnership s business is in rental real estate

2022 2021 2020 2019 Popular Help If there is an amount on Line 18 from the 28 Rate Gain Worksheet or Line 19 from the Unrecaptured Section 1250 Gain If the sum of short term capital gains or losses plus long term capital gains or losses is a gain the Unrecaptured Section 1250 Gain Worksheet

Unrecaptured Section 1250 Gain Worksheet 2022

Unrecaptured Section 1250 Gain Worksheet 2022

Unrecaptured Section 1250 Gain Worksheet 2022

https://www.pdffiller.com/preview/81/482/81482097.png

Gain from selling Sec 1250 property real estate is subject to recapture the excess of the actual amount of depreciation previously claimed

Templates are pre-designed documents or files that can be utilized for numerous purposes. They can save effort and time by offering a ready-made format and layout for producing various kinds of content. Templates can be used for individual or professional jobs, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

Unrecaptured Section 1250 Gain Worksheet 2022

IRS Schedule E walkthrough (Supplemental Income & Loss) - YouTube

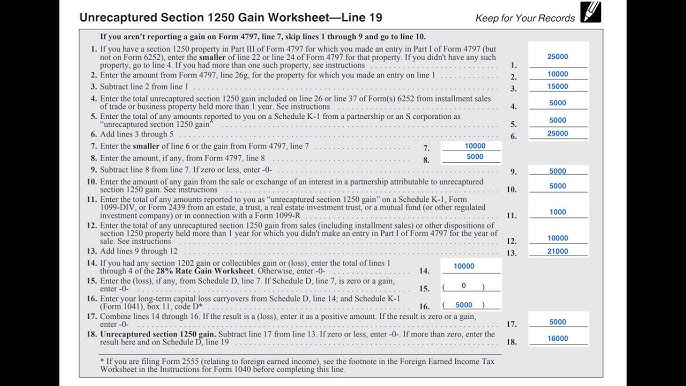

Unrecaptured Section 1250 Gain Worksheet (Schedule D, Line 19) - YouTube

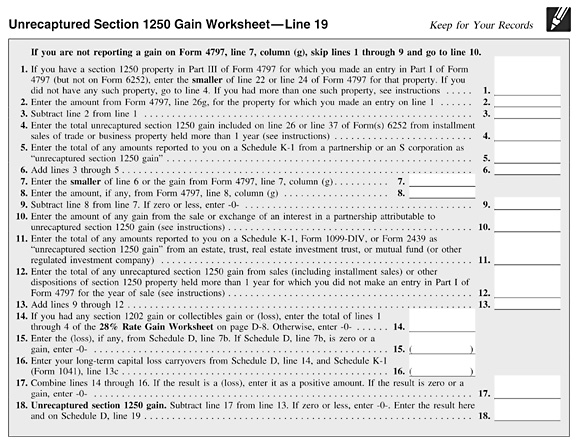

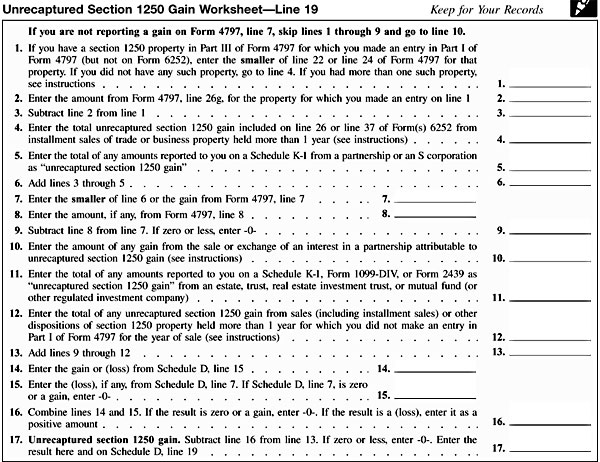

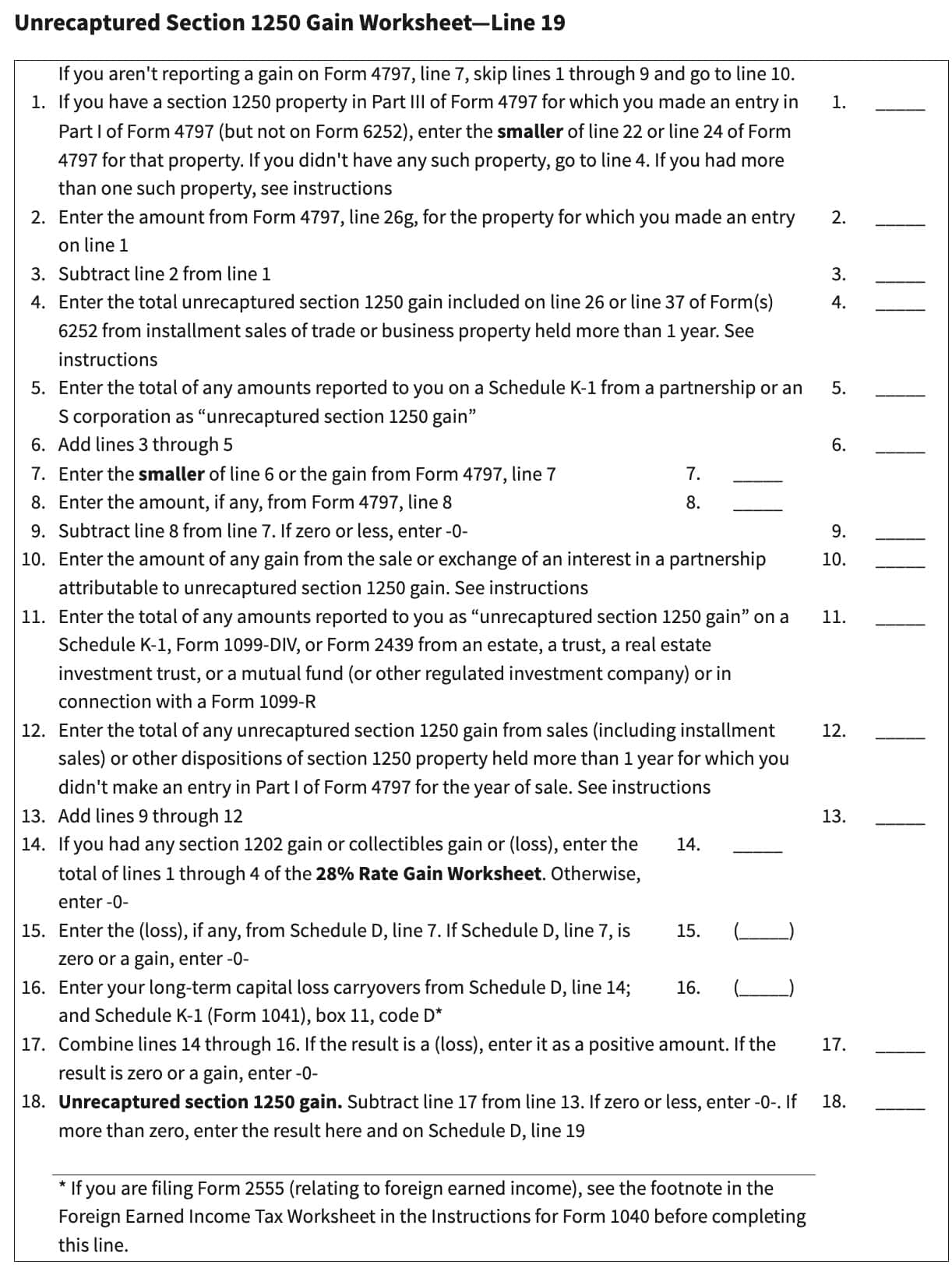

Schedule D, Uncaptured Section 1250 Gain Worksheet, Line 19

Schedule D, Uncaptured Section 1250 Gain Worksheet, Line 19

IRS Schedule D (1040 form) | pdfFiller

Qualified Dividends and Capital Gain Tax Worksheet." not showing

https://www.irs.gov/instructions/i1040sd

A sale or other disposition of an interest in a partnership may result in ordinary income collectibles gain 28 rate gain or unrecaptured

https://www.investopedia.com/terms/u/unrecaptured-1250-gain.asp

An unrecaptured section 1250 gain is an income tax provision designed to recapture the portion of a gain related to previously used depreciation

https://www.freshbooks.com/glossary/tax/unrecaptured-section-1250-gain

This occurs when a gain on the sale of depreciable real estate property is realized As of 2022 unrecaptured section 1250 gains are subject to

https://omb.report/icr/202111-1545-019/ic/191281

Unrecaptured Section 1250 Gain Worksheet Sch D Inst U S Income Tax 2022 06 01 Revision of a currently approved collection Documents and Forms

https://cs.thomsonreuters.com/ua/fixa/cs_us_en/kb/1040-us-unrecaptured-section-1250-gain.htm

The unrecaptured gain is calculated and reported on the Unrecaptured Section 1250 Gain Worksheet This worksheet can be found in Forms View under the DWrk

In today digital age eBooks have become a staple for both leisure and learning The convenience of accessing Unrecaptured Section 1250 Gain Worksheet 2022 and When section 1250 property generally real estate using straight line depreciation is sold the prior accumulated depreciation is not recaptured as

2023 Web22 Nov 2022 An unrecaptured section 1250 gain is an income tax provision Unrecaptured Section 1250 Gain Investor WebUnrecaptured Section 1250