What Is Unrecaptured Section 1250 Gain The Unrecaptured Section 1250 Gain refers to the taxable portion of any gain realized from the sale of depreciable real estate which is taxed as ordinary income This gain is unrecaptured

Jul 31 2022 0183 32 An unrecaptured Section 1250 gain effectively prevents you from taking a double dip tax break It changes the rate at which realized gains are taxed with the intention of But the amount of depreciation claimed on Sec 1250 property that is not recaptured as ordinary income under the Sec1250 recapture rules is unrecaptured section 1250 gain and is subject to

What Is Unrecaptured Section 1250 Gain

What Is Unrecaptured Section 1250 Gain

What Is Unrecaptured Section 1250 Gain

https://www.financereference.com/wp-content/uploads/2022/06/Unrecaptured-Section-1250-Gain-1024x576.jpg

Jun 8 2024 0183 32 Unrecaptured Section 1250 Gain is a tax provision that refers to the portion of a gain on the sale of depreciable real estate that has not been previously taxed as ordinary income

Templates are pre-designed files or files that can be used for numerous functions. They can conserve effort and time by offering a ready-made format and layout for developing different sort of content. Templates can be utilized for personal or professional projects, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

What Is Unrecaptured Section 1250 Gain

Depreciation Recapture Cost Segregation

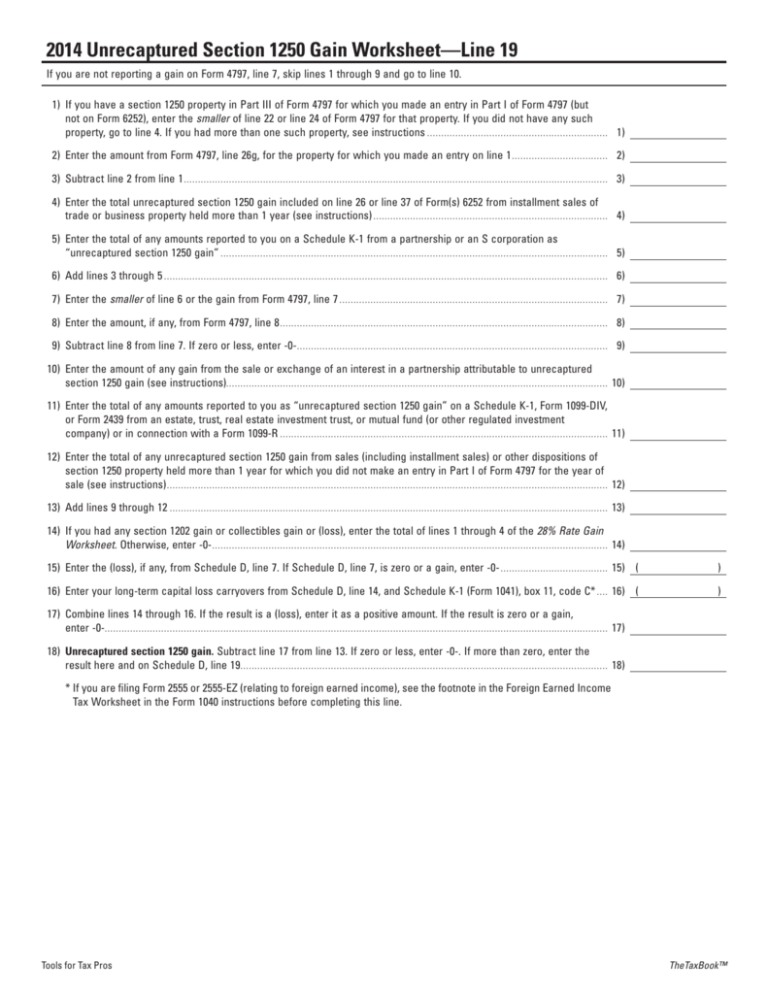

2014 Unrecaptured Section 1250 Gain Worksheet Line 19

10 Unrecaptured Section 1250 Gain Worksheet Worksheets Decoomo

Unrecaptured Section 1250 Gain Worksheet 2022 Printable Word Searches

Taxpayer Information Name Bryan Jones Capital Gains Bryan Had The

I Need Help With Schedule K 1 Form 1120 S For John Parsons And

https://investguiding.com › article

3 days ago 0183 32 An unrecaptured section 1250 gain is an income tax provision designed to recapture the portion of a gain related to previously used depreciation allowances It is only applicable to

https://ttlc.intuit.com › community › taxes › discussion

May 31 2019 0183 32 Unrecaptured Section 1250 Gain refers to the gain profit when you sell real estate Section 1250 and it was depreciated unrecaptured So let s say that you sell real

https://accountinginsights.org

Feb 18 2025 0183 32 Calculating unrecaptured Section 1250 gain involves understanding the property s depreciation history The unrecaptured gain is the portion of the sale gain taxed at the higher

https://fincent.com › glossary

Unrecaptured section 1250 gain is a tax provision under which previously recognised depreciation is recaptured into income when a gain on the sale of depreciable real estate property is

:max_bytes(150000):strip_icc()/GettyImages-1279111702-e9d0d62e1ab3458299f00ffc773d52f4.jpg?w=186)

https://www.freshbooks.com › glossary › tax

Aug 31 2023 0183 32 What Is an Unrecaptured Section 1250 Gain Unrecaptured section 1250 gain is a tax rule under which previously recognized depreciation is turned back into income This

The Unrecaptured Section 1250 Gain tax is a specific rate applied to the portion of gains from selling real property that is attributable to depreciation previously taken on the property This The Unrecaptured Section 1250 Gain essentially captures the depreciation benefits previously claimed on the property ensuring that the tax benefits of depreciation do not lead to an undue

What is unrecaptured section 1250 gain Unrecaptured section 1250 gain is the portion of a capital gain that is subject to a maximum tax rate of 25 This gain results from the sale of property