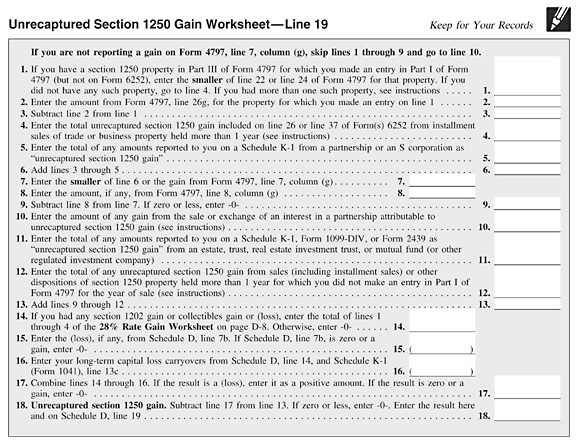

Unrecaptured Section 1250 Gain Worksheet Go to Schedule D Select the Ln 19 Unrec 1250 Gain tab Above the worksheet enter an amount in the Enter any Unrecaptured section 1250 gain for line

Report your share of this unrecaptured gain on the Unrecaptured Section 1250 Gain Worksheet Line 19 in the Instructions for Schedule D Form 1040 as follows Unrecaptured Section 1250 Gain Worksheet If the sum of short term capital gains or losses plus long term capital gains or losses is a gain

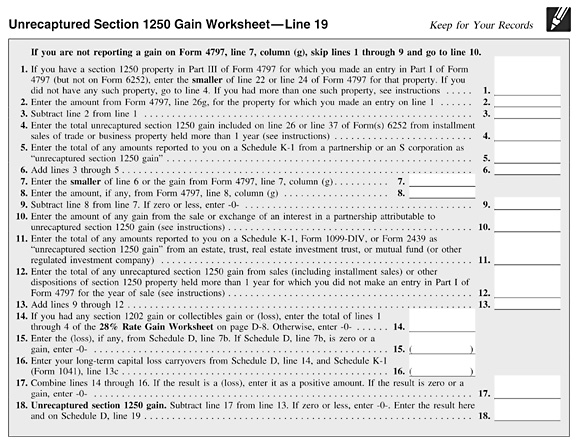

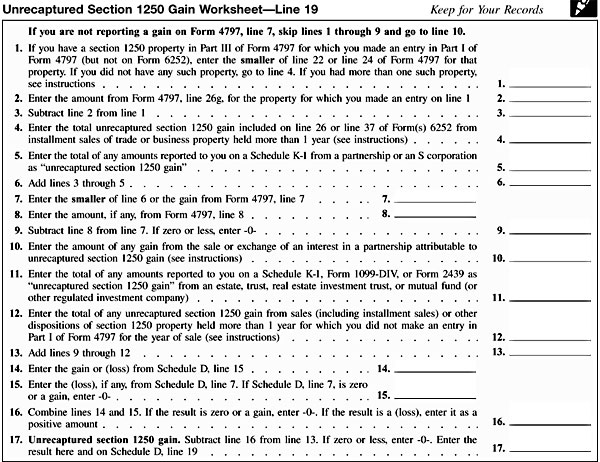

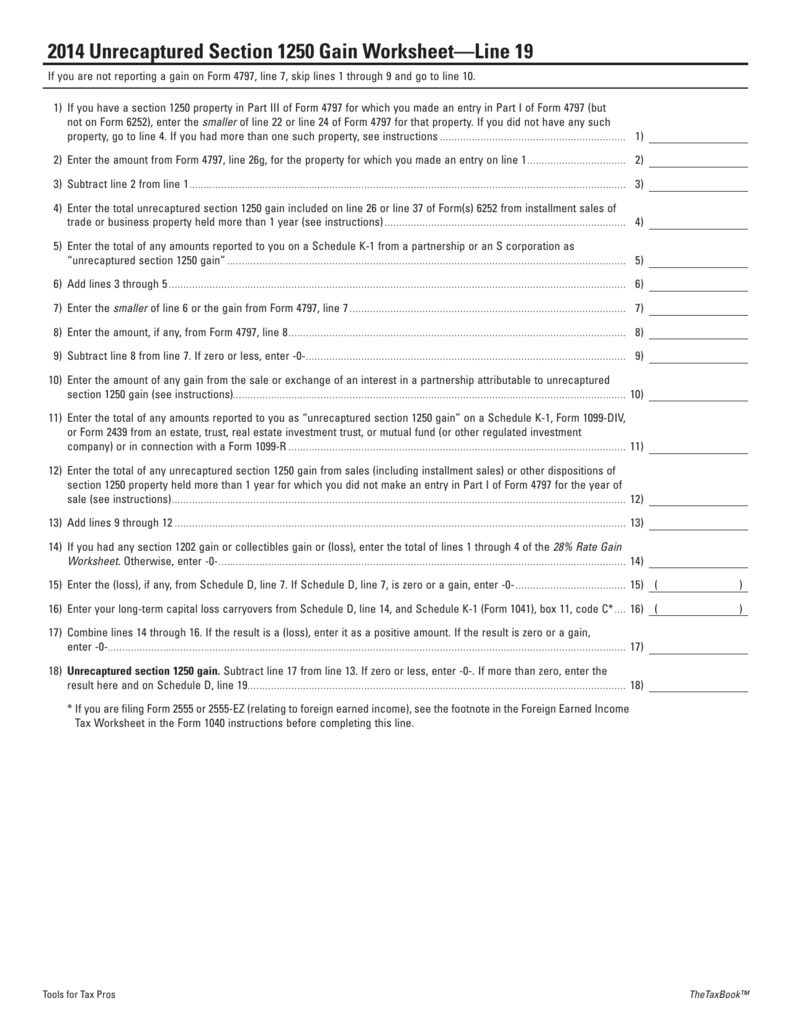

Unrecaptured Section 1250 Gain Worksheet

Unrecaptured Section 1250 Gain Worksheet

Unrecaptured Section 1250 Gain Worksheet

https://www.unclefed.com/TaxHelpArchives/2003/1040Instrs/ScheduleD_UncapturedSection1250GainWorksheet_Line19.jpg

Subscribe to our YouTube channel https www youtube channel

Templates are pre-designed documents or files that can be utilized for various purposes. They can save effort and time by providing a ready-made format and layout for developing different sort of material. Templates can be used for personal or professional projects, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

Unrecaptured Section 1250 Gain Worksheet

Schedule D, Uncaptured Section 1250 Gain Worksheet, Line 19

Unrecaptured Section 1250 Gain Worksheet (Schedule D, Line 19) - YouTube

What Is Unrecaptured Section 1250 Gain - The Expert Opinion

2014 Unrecaptured Section 1250 Gain Worksheet—Line 19

SECTION 1250 GAIN Basically, for most of us, there is NO 1250

Publication 929, Tax Rules for Children and Dependents; Tax for Children Under Age 14 Who Have Investment Income of More Than $1,500

https://www.irs.gov/instructions/i1040sd

Step 3 Unrecaptured Section 1250 Gain Worksheet Line 19 Line 10 Line 12 Installment sales Other sales or dispositions of section

https://www.investopedia.com/terms/u/unrecaptured-1250-gain.asp

An unrecaptured section 1250 gain is an income tax provision designed to recapture the portion of a gain related to previously used depreciation

https://cs.thomsonreuters.com/ua/fixa/cs_us_en/kb/1040-us-unrecaptured-section-1250-gain.htm

The unrecaptured gain is calculated and reported on the Unrecaptured Section 1250 Gain Worksheet This worksheet can be found in Forms View under the DWrk

https://omb.report/icr/202111-1545-019/ic/191281

Unrecaptured Section 1250 Gain Worksheet Sch D Inst U S Income Tax Return for Estates and Trusts OMB 1545 0092 IC ID 191281 OMB report TREAS IRS

https://www.freshbooks.com/glossary/tax/unrecaptured-section-1250-gain

Unrecaptured section 1250 gain is an income tax provision It applies to the sale of depreciable real estate Read on to find out more

Gain from selling Sec 1250 property real estate is subject to recapture the excess of the actual amount of depreciation previously claimed An unrecaptured section 1250 gain is an income tax provision designed to recapture the portion of a gain related to previously used depreciation allowances It

Use screen 1250 Unrecaptured Section 1250 Gain on the Assets Sales Recapture tab It is available in both 1065 and 1120S packages