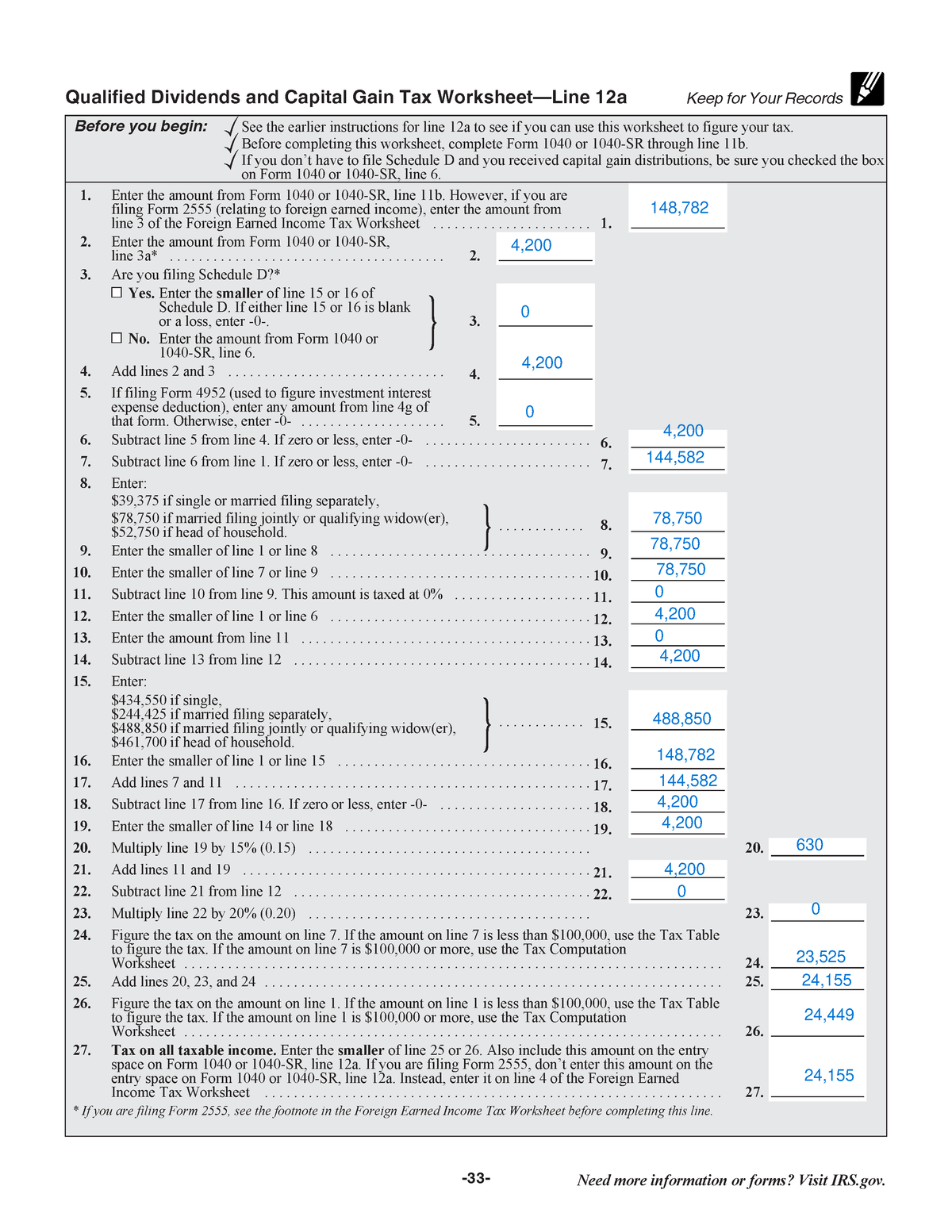

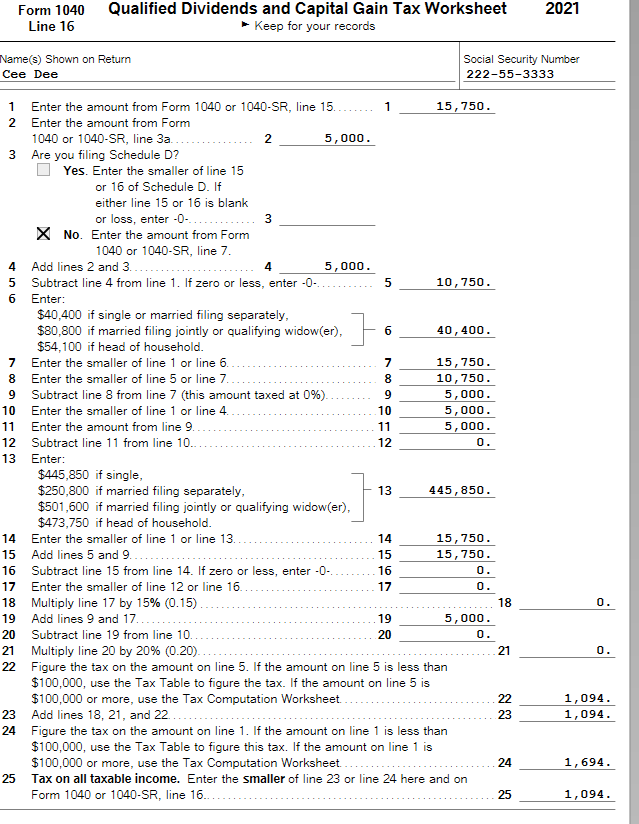

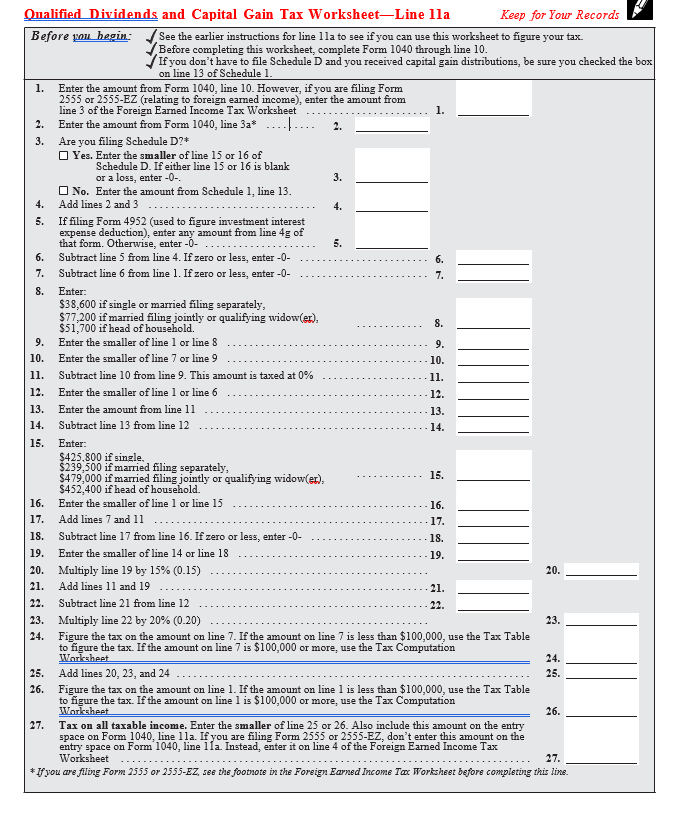

Capital Gain Tax Worksheet Before completing this worksheet complete Form 1040 or 1040 SR through line 15 If you don t have to file Schedule D and you received capital gain

Gains and Losses according to the IRS the tax is calculated on the Schedule D Tax Worksheet instead of the Qualified Dividends and Capital Gain Tax Worksheet Qualified dividends and capital gain tax worksheet 2021 pdf Qualified Dividends Tax Worksheet PDF Form FormsPal

Capital Gain Tax Worksheet

Capital Gain Tax Worksheet

Capital Gain Tax Worksheet

http://www.marottaonmoney.com/wp-content/uploads/2017/05/line44.jpg

Capital Gain Worksheet Sale of Depreciable Real Estate Calculation of Adjusted Basis Purchase price Total Capital Gains Tax lines 12 13 14

Pre-crafted templates offer a time-saving service for producing a varied series of documents and files. These pre-designed formats and layouts can be used for numerous personal and expert jobs, consisting of resumes, invitations, flyers, newsletters, reports, presentations, and more, simplifying the content production procedure.

Capital Gain Tax Worksheet

SOLUTION: Qualified Dividends and Capital Gain Tax Worksheet - Studypool

Qualified Dividends and Capital Gains Worksheet - Page 33 of 108 Fileid: - Studocu

Qualified dividends and capital gain tax worksheet | Chegg.com

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet – Marotta On Money

2018 Qualified Dividends and Capital Gain Tax Worksheet.pdf - Qualified Dividends and Capital Gain Tax Worksheet 2018 • See Form 1040 instructions for | Course Hero

Irs 1040 qualified dividends and capital gain tax worksheet

https://www.irs.gov/forms-pubs/about-schedule-d-form-1040

Information about Schedule D Form 1040 or 1040 SR Capital Gains and Losses including recent updates related forms and instructions on

https://www.nar.realtor/magazine/tools/client-education/handouts-for-sellers/worksheet-calculate-capital-gains

Download DOC When you sell a stock you owe taxes on the difference between what you paid for the stock and how much you got for the sale

https://pdfliner.com/qualified-dividends-and-capital-gain-tax-worksheet

This printable PDF blank is a part of the 1040 guide you on your way brochure s Tax and Credits section It is used only if you have dividend income or long

https://support.cch.com/kb/solution.aspx/000059538

Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax if you do not have to use the Schedule D Tax Worksheet and if any of the

https://www.marottaonmoney.com/how-your-tax-is-calculated-qualified-dividends-and-capital-gains-worksheet/

For this reason the first step of the Qualified Dividends and Capital Gain Tax Worksheet is to split those two separate types back out

The tax rate computed on your Form 1040 must consider any tax favored items such as Then complete the Qualified Dividends and Capital Gain Tax Worksheet on page 38 of the Instructions for Form 1040 or in the Instructions for Form 1040NR Do

Capital Gain Tax Worksheet or this worksheet to compute tax if WebQualified Dividends and Capital Gain Tax Worksheet 2022 See Form 1040