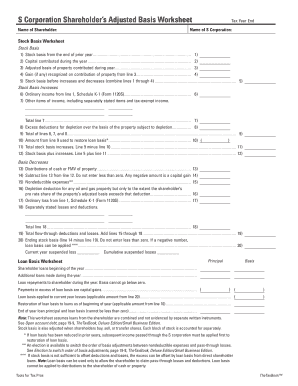

S Corp Basis Worksheet Under the normal computation rules basis is computed by taking beginning basis and adding the items of income reducing that by nondividend

Please see the last page of this article for a sample of a Shareholder s Basis Worksheet Suspended Losses Normally a shareholder that has basis in the company First you d increase the your initial contribution of 20 000 the starting stock basis by the 3 000 from ordinary dividends You d then take

S Corp Basis Worksheet

S Corp Basis Worksheet

x-raw-image:///85c402415501ac05b5b2917ba77518f41397d57a57348829af765f11be5d3328

Must reduce the basis by the total loss if the shareholder receives full benefit of the loss Shareholder Tax Basis in PA S Corporation Stock Worksheet

Templates are pre-designed files or files that can be utilized for various functions. They can save effort and time by supplying a ready-made format and design for creating different type of content. Templates can be used for individual or expert projects, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

S Corp Basis Worksheet

S Corporation Shareholder Basis Losses Claimed in Excess of Basis

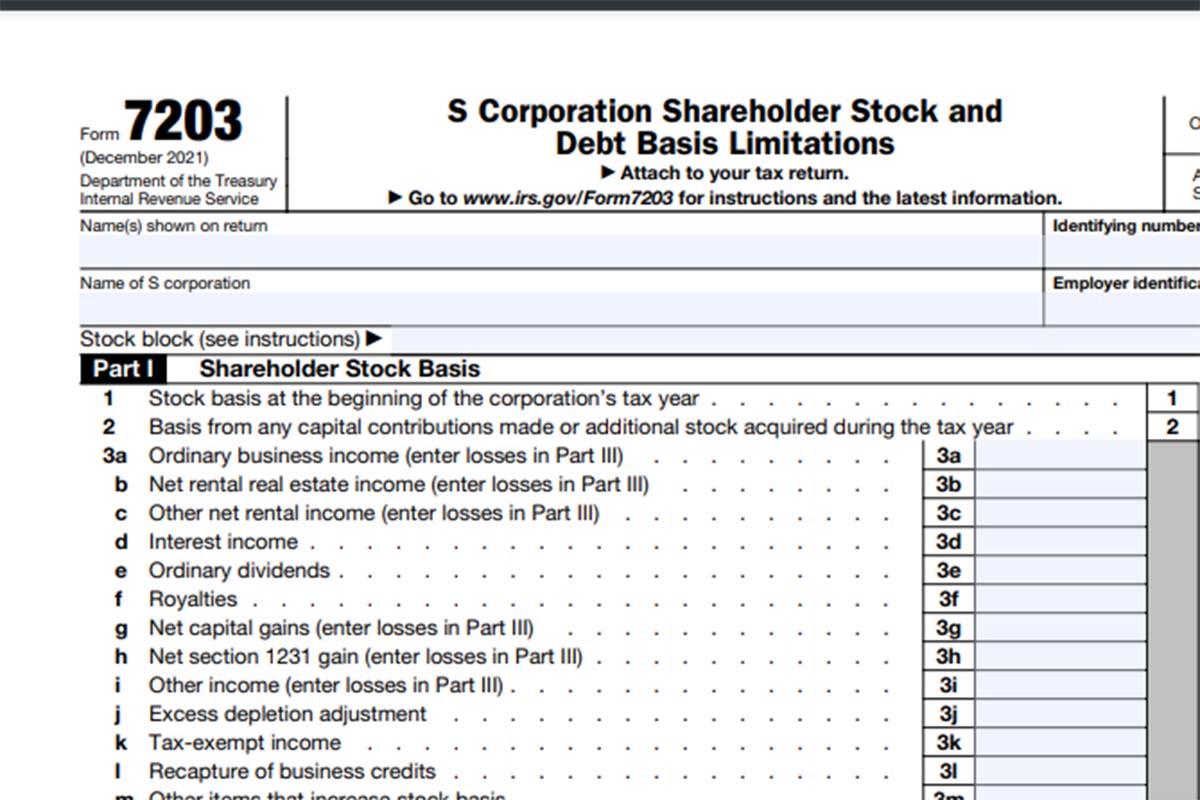

More Basis Disclosures This Year for S corporation Shareholders - Need to Complete New Form 7203 (to be Attached to 1040 Return) - Wegner CPAs

LB&I Process Unit Knowledge Base – S Corporations

When, why and how … Basis reporting by partners, members and S Corp. shareholders

IRS Expands Cases Where S Shareholder Must Attach Basis Computation and Adds Check Box to Schedule E — Current Federal Tax Developments

LB&I Process Unit Knowledge Base – S Corporations

https://www.irs.gov/pub/irs-utl/2018ntf-s-corporation-shareholder-basis.pdf

S corporation shareholders must track adjustments to their basis in S corporation Basis Worksheet to the Return Page 11 To compute basis you need to know

https://www.upcounsel.com/s-corp-basis-worksheet

An S corp basis worksheet is used to compute a shareholder s basis in an S corporation Shareholders who have ownership in an S corporation must make a point to

https://www.aicpa-cima.com/resources/download/s-corporation-shareholder-basis-schedule

Calculate an S corporation s shareholder s basis using this customizable template and keep track of your client s ownership in their S corporation stock

https://kb.drakesoftware.com/Site/Browse/10919/1120S-Shareholders-Adjusted-Basis-Worksheet-Basis-Wks

This article refers to screen Shareholder s Adjusted Basis Worksheet in the 1120 S S corporation package The inside basis is calculated at the S corp

https://irp.cdn-website.com/8c5b6e72/files/uploaded/1041420-Shareholder_Basis_in_SCorp_Worksheet.pdf

Payments made on reduced basis loans result in taxable income See worksheet below Enter the full loan repayment amount in the Loan Face Amount column

Beginning in tax year 2021 Form 7203 replaced the 3 part Worksheet for Figuring a Shareholder s Stock and Debt Basis and its Calculate the return To enter S Corporation basis limitation Select the Income Deductions category Select the S Corporation Passthrough worksheets Select

But in the S corporation context basis can become a moving target as a shareholder s investment in the company changes Unlike with C