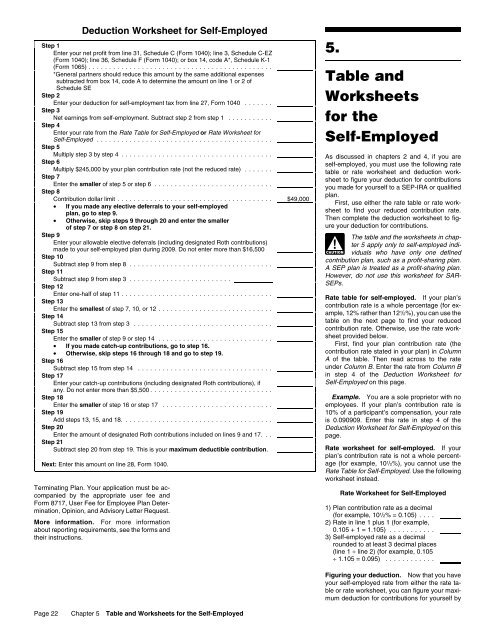

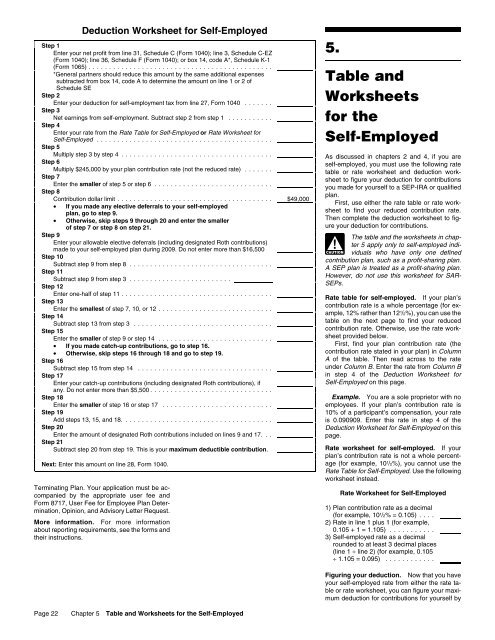

Deduction Worksheet For Self Employed The TaxAct program offers the Publication 560 Worksheet in order for qualified self employed individuals to calculate their maximum deductible contribution

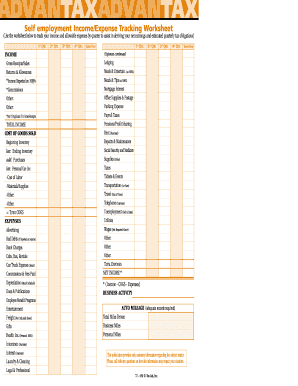

Taking the deduction is not as straightforward for a self employed taxpayer The IRS publishes a worksheet for this deduction Deductible Expense Advertising Car Truck Expenses Commissions Fees Contract Labor Depletion Depreciation Employee Benefit Programs Insurance

Deduction Worksheet For Self Employed

Deduction Worksheet For Self Employed

Deduction Worksheet For Self Employed

https://img.yumpu.com/3778650/1/500x640/table-and-worksheets-for-the-self-employed-completetax.jpg

Are you eligible for self employment tax deductions Learn how to deduct health insurance and other expenses and get tax answers at H R Block

Pre-crafted templates use a time-saving service for producing a varied range of files and files. These pre-designed formats and designs can be utilized for different personal and professional jobs, including resumes, invites, leaflets, newsletters, reports, discussions, and more, streamlining the material production process.

Deduction Worksheet For Self Employed

Nurse Tax Deduction Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller

Hairstylist Tax Write Offs Checklist for 2023 | zolmi.com

FormalBest Of Self Employed Tax Deductions Worksheet Check more at https://www.kuprik… | Business tax deductions, Small business tax deductions, Small business tax

Real Estate Agent Tax Deductions Worksheet Pdf - Fill Online, Printable, Fillable, Blank | pdfFiller

Small Business Tax Spreadsheet | Business worksheet, Small business tax deductions, Small business expenses

The Ultimate Self Employed Deduction Cheat Sheet! - Exceptional Tax Services

https://www.irs.gov/pub/irs-pdf/p560.pdf

Then fig ure your maximum deduction by using the Deduction Worksheet for Self Employed in chapter 5 Where To Deduct Contributions Deduct the contributions

https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/SEP-cntrb-wksht.pdf

Deduction for Self Employment Tax 2 3 532 From IRS Form 1040 Step 3 This worksheet will assist you with calculating your contri bution and can help

https://www.hellobonsai.com/blog/self-employed-tax-deductions-worksheet

Looking to lower your tax liability for the year Well you are in the right place User our free self employed tax deductions worksheet to

http://www.jdunman.com/ww/business/sbrg/publications/p560ch05.htm

Enter this rate in step 1 of the Deduction Worksheet for Self Employed Rate worksheet for self employed If your plan s contribution rate is not a whole

https://sharetheharvest.com/wp-content/uploads/2018/03/9-Schedule-C-Self-Employed-Single-LLC.pdf

Use a separate worksheet for each business owned operated Do not duplicate expenses Name type of business Owned Operated by Client Spouse Income

To generate the Self Employed Pensions SEP Worksheet Wks SEP in the View Print mode of a 1040 return enter the plan contribution rate on the SEP screen Tax Worksheet for Self employed Independent contractors Sole proprietors Single LLC LLCs 1099 MISC with box 7 income listed

Tax Worksheet for self employed independent contractors sole proprietors mileage deduction without this number Interest paid on auto loan this year